- Altcoin sector could also be primed for a robust restoration on the charts

- BTC and USDT dominance gave the impression to be at pivotal factors

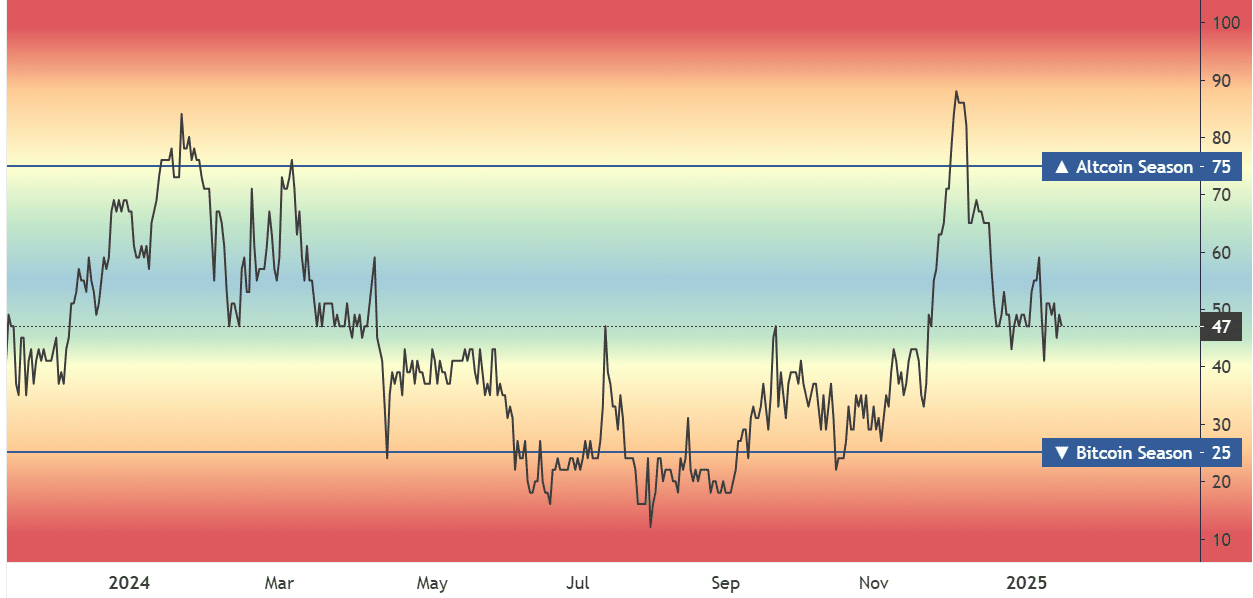

After the newest bout of sell-offs in January, altcoins might be primed for a robust rebound, whereas additionally outshining Bitcoin [BTC]. In actual fact, according to the analytics platform, Alphractal, the Altcoin Season Index has retreated to a pivotal level. This might gasoline the sector’s short-term restoration.

A part of the agency’s X’s submit learn,

“With Bitcoin rising from 89k to 97k in the last 24 hours, the Altcoin Season Index suggests that we are entering a phase where altcoins could start to recover.”

Supply: Alphractal

The hooked up chart revealed that the Altcoin Season Index has traditionally recovered each time it hit the decrease vary. Apparently, the restoration all the time adopted BTC’s lead. Therefore, the latest upswing from below $90k to $97k might raise the sector once more.

What’s subsequent for altcoins?

Price declaring, nonetheless, that one other fashionable altcoin traction indicator from Blockchain Middle lay at a impartial stage at press time. This implied that it was neither an altcoin season nor a Bitcoin season. Merely put, the market might go in both route from right here.

Supply: Blockchain Middle

Even so, BTC has the higher hand proper now, particularly within the face of doubtless pro-crypto updates that may comply with Donald Trump’s inauguration on the twentieth.

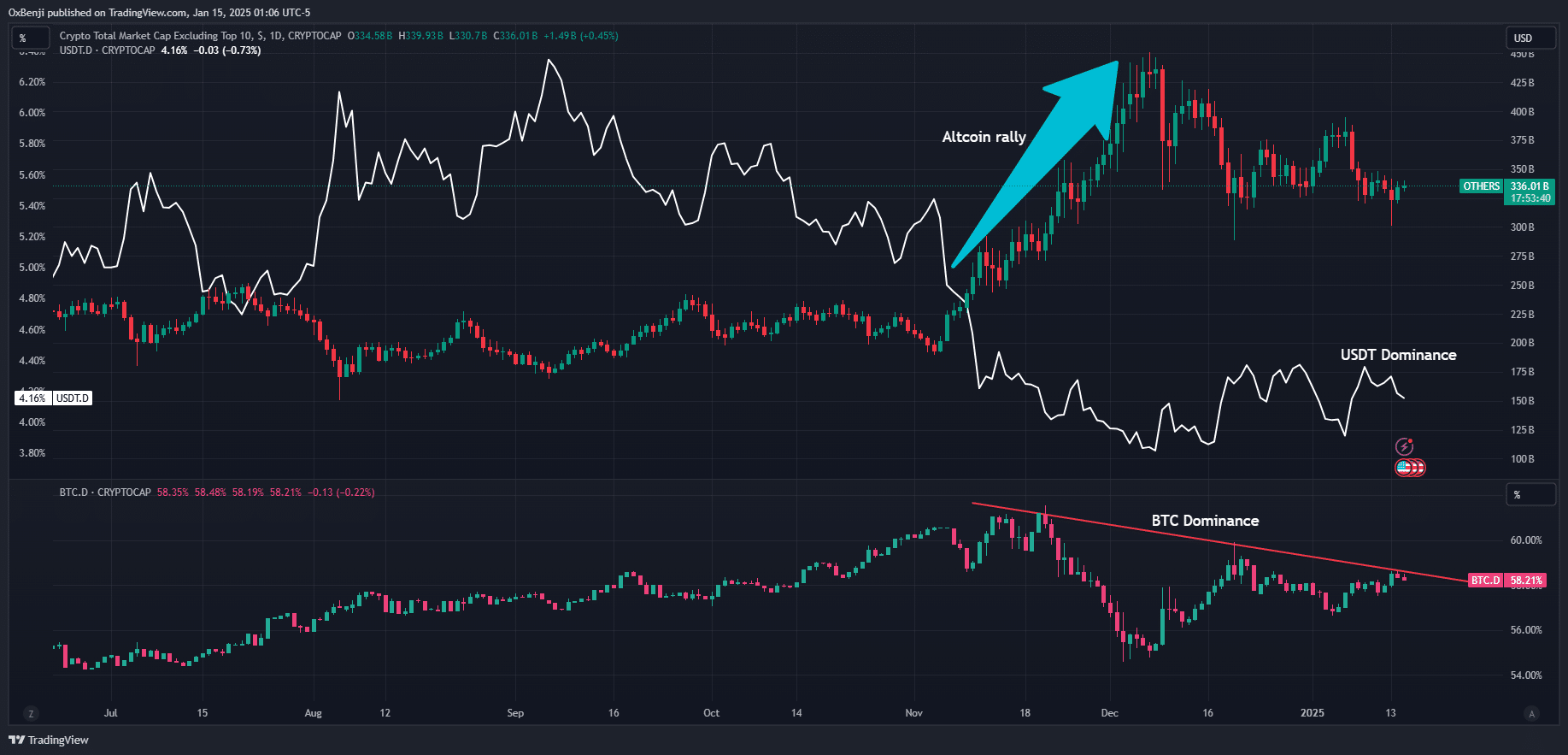

So, what’s subsequent for the remainder of the altcoin sector? Nicely, we explored BTC and Tether’s USDT dominance for further clues.

For context, each indicators are inversely correlated to altcoin momentum. A drop in BTC and USDT dominance means possible capital rotation from BTC to altcoins and larger shopping for strain.

Supply: TradingView

This was evident throughout November’s altcoin pump too. It coincided with a decline in BTC and USDT market dominance.

At press time, BTC.D had hit a trendline resistance, whereas USDT.D confirmed indicators of retreating decrease. If each indicators retreat over the following few days, the Alphractal projection might be validated.

That being mentioned, some high altcoins, like XRP and Hedera [HBAR], have outperformed the king coin up to now. For a 90-day interval, XRP and HBAR’s values have been up 450% and 600%, respectively. Over the identical interval, BTC noticed simply 52% positive aspects.