- Bitcoin’s mining sector is struggling, with income declining sharply

- Transitioning to AI information facilities would possibly current important price and logistical challenges for Bitcoin miners

In August, Bitcoin [BTC] noticed some important volatility, buying and selling between $64,000 and $57,000. The cryptocurrency continued its downward pattern into September, with BTC priced at $56,816.75 at press time.

Regardless of a modest 0.38% hike over the previous 24 hours in accordance with CoinMarketCap, technical indicators appeared to recommend a persistent bearish pattern.

Bitcoin mining’s AI wager

That’s not all although. Amidst this uncertainty, BTC mining corporations are exploring diversification into high-performance computing information facilities to spice up income.

Nevertheless, Phil Harvey, CEO of Sabre56, a blockchain information middle consulting agency, believes that such a transition is fraught with challenges and will not be as possible because it seems.

Talking to a media outlet, the exec claimed that remodeling a crypto mining facility into an AI or high-performance computing information middle is considerably costlier.

He identified that whereas operating a typical mining operation prices between $300,000 and $350,000 per megawatt, AI information facilities demand a a lot increased funding. Someplace alongside the strains of $3 million to $5 million per megawatt— A rise of 10 to fifteen occasions.

Harvey additionally famous that even with a gigawatt of energy, solely about 200 megawatts might feasibly be redirected to high-performance computing duties.

He stated,

“There’s probably around 20%, I would imagine, of each miner’s portfolio that is actually capable of delivering key attributes like power, data, and land in order to facilitate AI.”

Bitcoin’s income hunch

The latest push for Bitcoin miners to pivot in the direction of AI information facilities might stem from their important income struggles.

For context, August marked the worst earnings month for BTC miners in practically a 12 months, with income hitting their lowest since September 2023. Particularly in gentle of mined coin portions dwindling.

The numerous operational prices of mining additional exacerbated the state of affairs. If these bills outweigh the rewards, miners could possibly be pressured to capitulate.

This monetary stress has prompted many to discover various income streams, akin to high-performance computing, to stabilize their operations.

The truth is, a latest evaluation by AMBCrypto revealed a big drop in miner income, with the identical falling to $820 million in August.

Supply: BitBo

This represented a decline of over 10% from July’s $927 million and marked a staggering 57% fall from its peak of practically $1.93 billion in March.

March was notable, not just for its excessive revenues but in addition for Bitcoin’s all-time excessive (ATH) surpassing $73,000.

VanEck has a distinct perspective to share

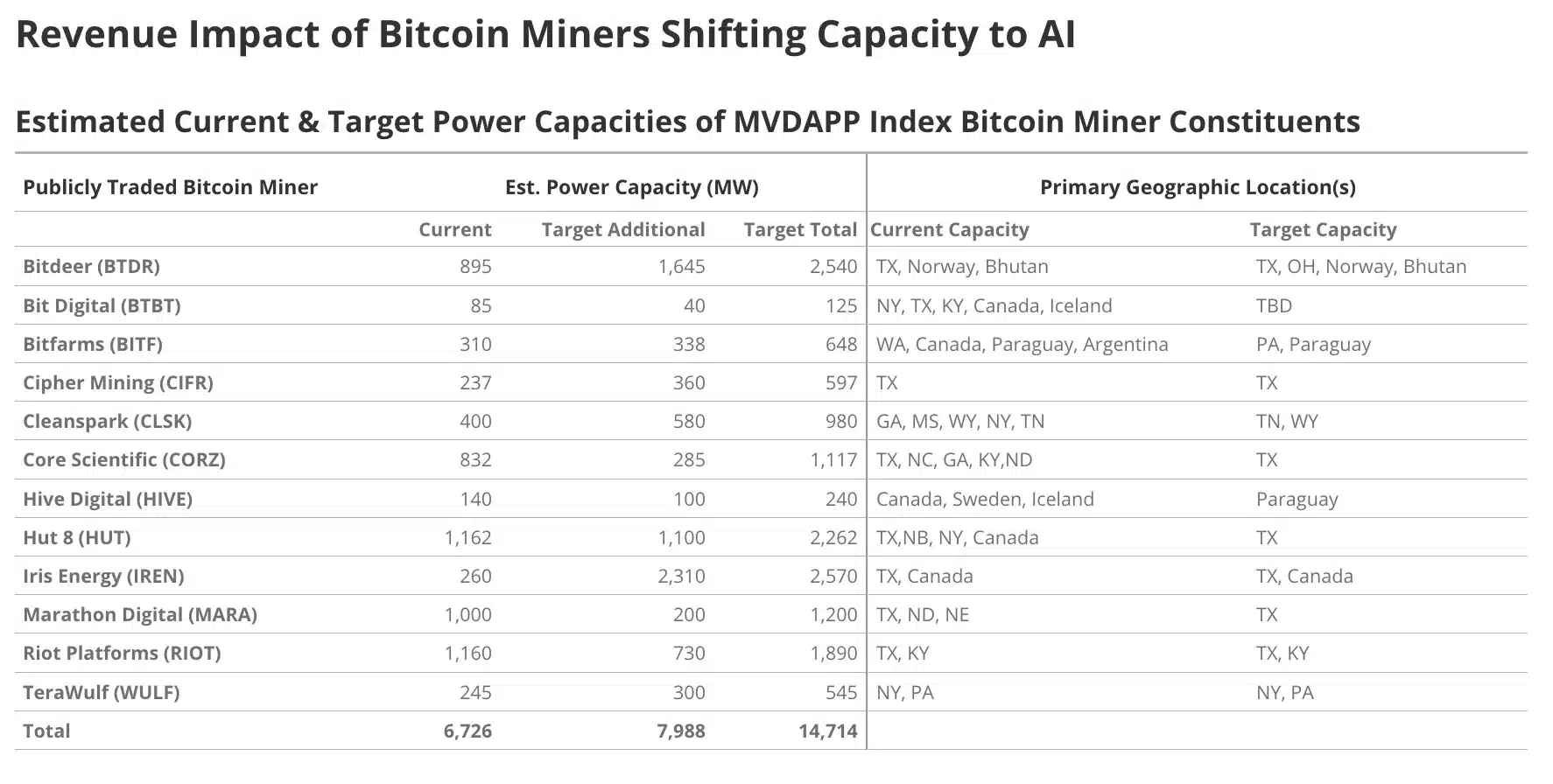

Right here, it’s value noting that in accordance with VanEck’s projections, publicly traded BTC mining corporations might generate substantial revenues by reallocating 20% of their power capability to AI and high-performance computing by 2027.

“Total additional yearly profits could exceed an average of $13.9 billion per year over 13 years.”

The report added,

“AI companies need energy, and Bitcoin miners have it.”

Supply: VanEck

Thus, because the Bitcoin mining trade explores the shift to high-performance computing and AI information facilities, the trail ahead stays unsure.

However, how this transition unfolds shall be essential in figuring out whether or not it will possibly efficiently stabilize and improve mining revenues. Particularly within the face of present monetary pressures.