- Bitcoin has had a bearish construction on the weekly and 3-day value charts.

- Technical indicators had been combined, however general, costs usually tend to fall than pattern larger.

Bitcoin [BTC] roared again to life after visiting the liquidity pool on the $64k zone. The value hunch reversed inside a number of hours, and the $69k liquidity zone was the subsequent short-term goal.

Up to now, BTC is on observe to attain this.

In a publish on X (previously Twitter), IntoTheBlock famous that there was a powerful netflow of BTC into exchanges. This might see a wave of promoting and hints at a value reversal within the coming days.

Bearish market construction highlights dealer bias

Supply: BTC/USDT on TradingView

The three-day value chart noticed a session shut beneath $56.5k on the fifth of July, forming a bearish construction break. The earlier decrease excessive at $72k remained unbeaten.

Primarily based on an earlier evaluation, the $69k liquidity pool is a spot the place a bearish reversal might happen quickly.

The RSI on the 3-day chart was at 56 however didn’t present robust bullish momentum. It hinted that momentum could be shifting bullishly. Nevertheless, the CMF was at +0.01 and doesn’t mirror robust capital inflows.

General, the bias was bearish on the 3-day chart, however this may change if the $72k stage is damaged.

BTC speculators had been desperate to go lengthy

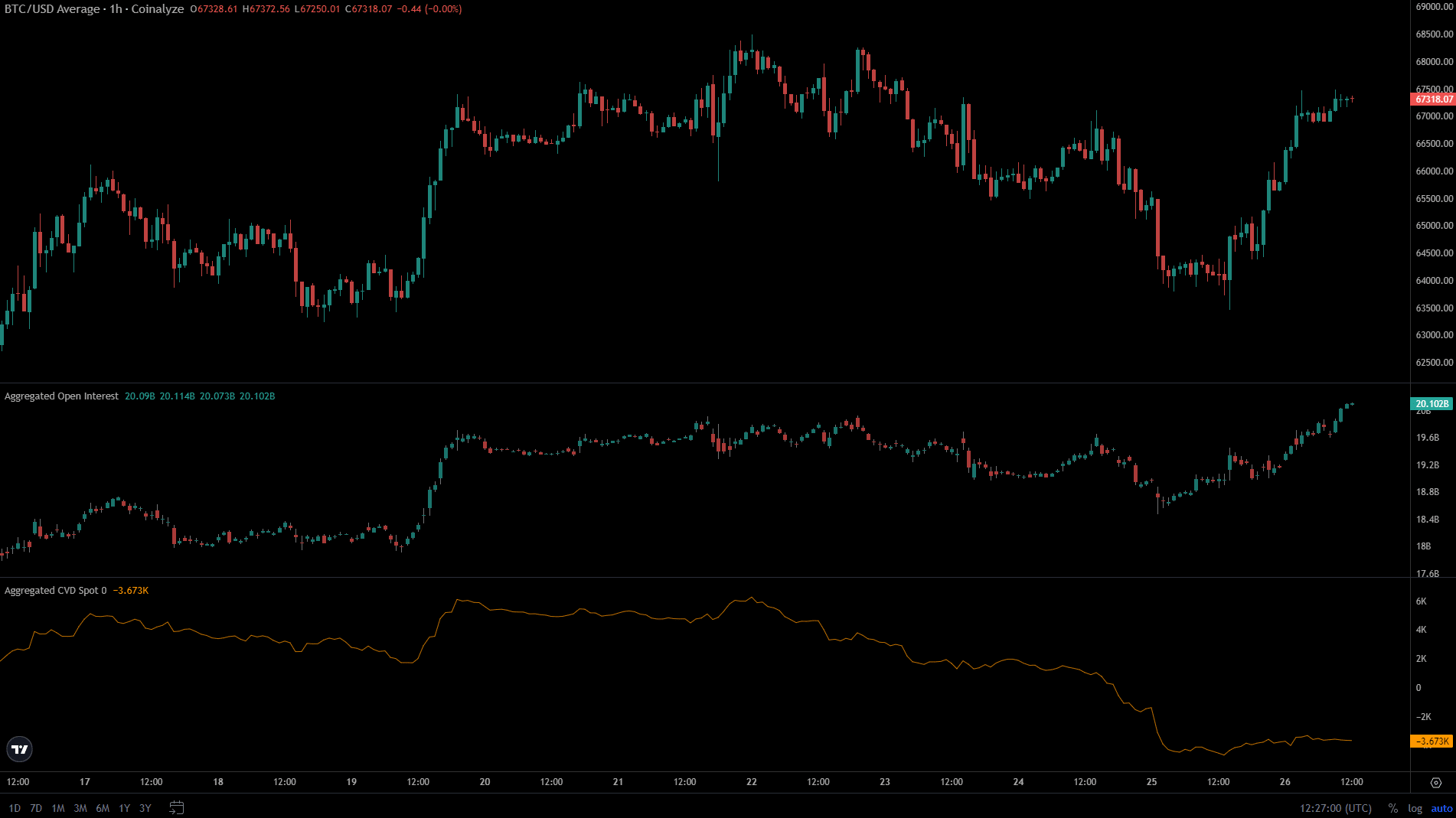

Supply: Coinalyze

Previously 24 hours, the worth reversal from $64k was accompanied by a pointy rise in Open Curiosity. It indicated robust bullish sentiment within the short-term and an indication of conviction amongst speculators of extra good points.

However, the spot CVD was unable to ascertain an uptrend. This indicated an absence of shopping for stress regardless of the worth bounce and bolstered the concept of a bearish reversal.

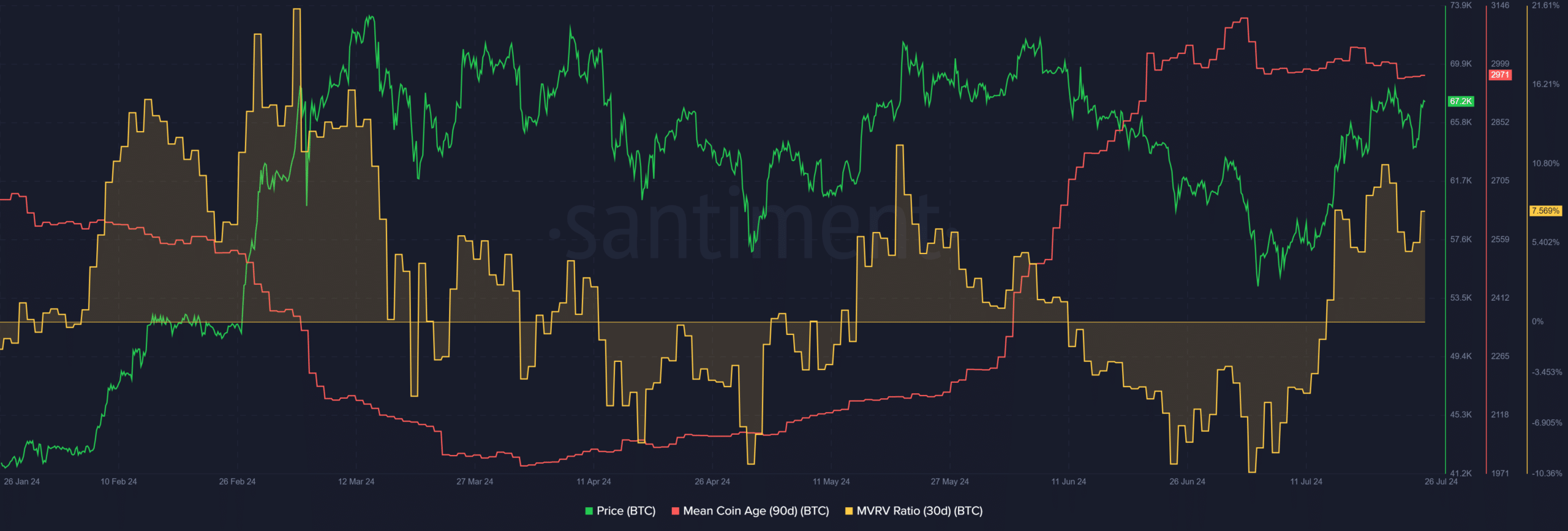

Supply: Santiment

The 30-day MVRV was at 7.6%, exhibiting short-term holders had been at a modest revenue. A continued improve within the MVRV would sign potential promoting stress within the type of profit-taking by the short-term holders.

The 90-day imply coin age (MCA) has not trended downward regardless of the worth drop. It was an indication that holders weren’t prepared to half with their BTC, which hinted at a continued bullish pattern.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Placing all of the clues collectively, it appeared possible that Bitcoin would see a reversal across the $69k zone. If the MCA begins to fall, it will reinforce this concept.

As a substitute, if the MCA and the spot CVD pattern upward once more, it will be a clue that BTC bulls had been robust sufficient to drive costs previous the $69k liquidity pool.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.