Picture supply: Getty Photographs

Seeking to make investments on the London Inventory Alternate this month? Right here’s a dust low cost dividend share and a hovering exchange-traded fund (ETF) I believe are value contemplating.

Financial institution of Georgia Group

Financial institution of Georgia‘s (LSE:BGEO) share value has plummeted by double-digit percentages in current weeks. I believe this represents an amazing dip-buying alternative for buyers searching for worth shares with enormous dividend yields.

For 2024, the FTSE 250 financial institution trades on a ahead price-to-earnings (P/E) ratio of three.1 instances. As for dividend yields, these ring in at 7.6% and eight.1% for this yr and subsequent yr respectively. To place that in context, each figures are greater than double the typical for FTSE 250 shares.

Financial institution of Georgia’s stoop displays rising issues over rising political uncertainty within the nation and, extra particularly, its future relationships with Russia and the European Union. These points will naturally have important implications for Georgia’s financial system and the businesses that function there.

Nonetheless, I’d argue that Financial institution of Georgia’s rock-bottom P/E ratio of three instances greater than displays any risks to its income.

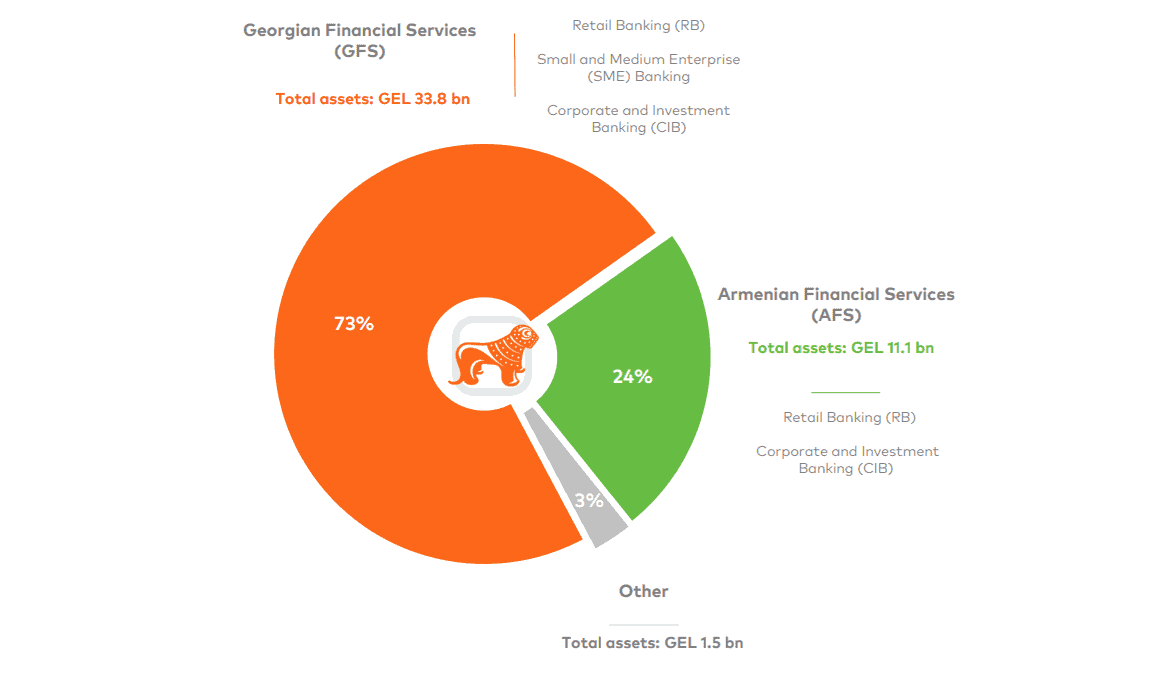

On stability, I believe the financial institution stays an effective way to capitalise on booming monetary merchandise demand in its rising market. Income rose 16% within the first half of 2024 as mortgage ranges rocketed, newest financials confirmed.

I’m additionally inspired by its acquisition of Ameriabank this yr. This provides it important publicity to Armenia, one other of the area’s fastest-growing economies.

Whereas it’s not with out threat, I believe the agency might show to be a superb long-term prospect.

iShares Gold Producers ETF

Treasured metals costs have boomed in 2024. Gold, as an example, has soared to document highs throughout a number of currencies, and in sterling phrases broke via £2,000 per ounce late final month for the primary time.

Silver’s additionally tearing it up, and on a greenback foundation has struck its highest since 2012 in current days.

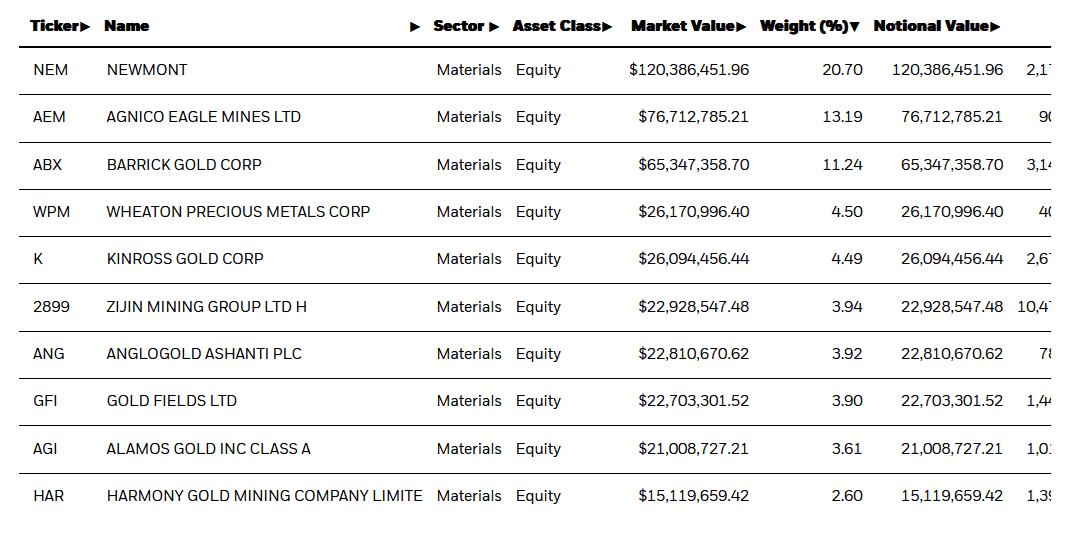

I believe investing in a gold-based exchange-traded fund (ETF) could possibly be a good suggestion on this local weather. One which’s caught my eye is the iShares Gold Producers ETF (LSE:SPGP), which has a comparatively low annual price of 0.55%.

Because the identify suggests, it invests in gold mining corporations somewhat than monitoring the bullion value itself. This has an enormous benefit for me as an investor, as lots of the miners it owns pay a dividend which the fund routinely reinvests.

On the draw back, buying this mining-focused gold ETF exposes me to the problematic nature of metals manufacturing. Nonetheless, as a result of the fund invests in a variety of various corporations, the chance of such troubles on my total returns are lowered, however not eradicated.

In fact, there’s no assure that gold costs will maintain rallying. Nonetheless, a mix of central financial institution price cuts, ongoing worries over the US and Chinese language economies, and escalating hassle within the Center East all imply the dear steel might proceed hovering in October and past.