Picture supply: Getty Pictures

There are many ways in which folks attempt to construct generational wealth. Some purchase property that they go down the road after they die. Others purchase superb artwork, gold cash or different high-worth collectibles. However for my part, one of the simplest ways to make long-term wealth is to purchase FTSE 100 and FTSE 250 shares.

A fast look on the long-term returns of those two London share indices exhibits why. The Footsie has delivered an 8% common annual return because it started in 1984. The FTSE 250, in the meantime, has produced a good higher 11% common return because it began up within the early Nineties.

Do not forget that previous efficiency is not any assure of future income. Nevertheless, a median 9.5% yearly return for the 2 mixed illustrates the potential returns that may be achieved by investing in UK shares.

With this in thoughts, here’s a FTSE 100 share I believe assist might generate gorgeous generational returns.

Banking large

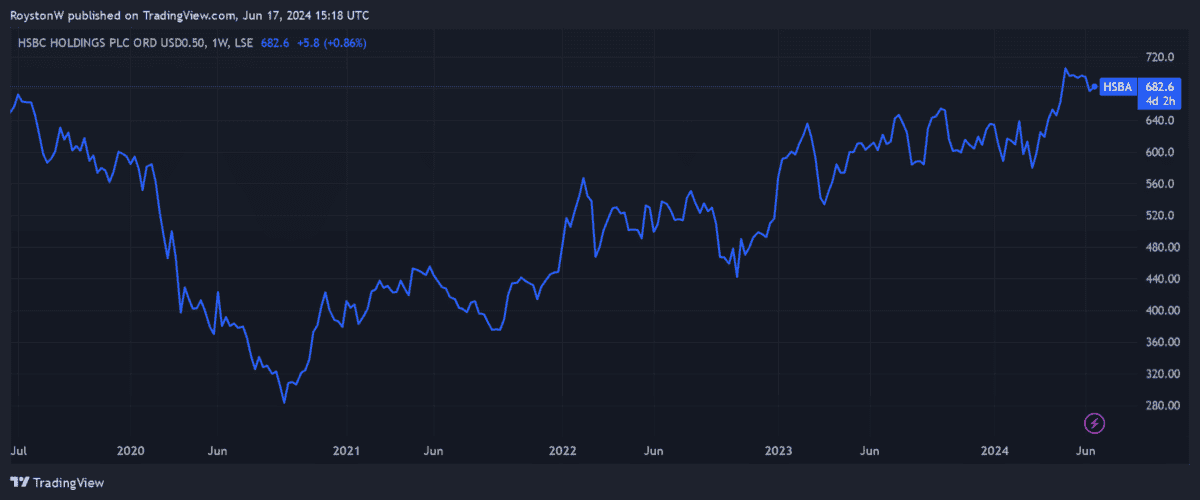

HSBC Holdings (LSE:HSBA) is without doubt one of the world’s greatest banking teams. It’s additionally the most important financial institution on the London Inventory Alternate by market cap (its shares are price a whopping £126bn).

The Footsie financial institution is wanting more and more to Asia to drive long-term income. And who can blame it? A mixture of explosive inhabitants development and growing private incomes imply banking product penetration demand seems set to soar from present low ranges.

Analysts at Statista predict banks’ internet curiosity earnings will develop at a compound annual development price of 5.8% between now and 2029. This metric — which measures the distinction between the curiosity banks get from debtors and what they pay savers — is tipped to soar to $7.77trn by the top of the interval.

HSBC has appreciable monetary energy it may use to capitalise on this chance, too. Its CET1 capital ratio improved to fifteen.2% as of March.

Threat vs reward

Doubling-down on Asia doesn’t come with out threat, nevertheless. Rising markets are likely to exhibit better political and financial volatility in comparison with developed markets.

China’s economic system is actually struggling a protracted slowdown. A gradual cooling within the nation’s property market is very worrying. Information at the moment (17 June) confirmed common house values plunging at their quickest price for a decade in Might.

However the dangers this poses to HSBC’s income forecasts appear baked into its rock-bottom share worth, for my part.

Nice worth

At the moment the banking large trades on a ahead price-to-earnings (P/E) ratio of 6.9 instances. Moreover, its price-to-earnings development (PEG) ratio is available in at 0.8.

A reminder that any studying under 1 signifies {that a} share is undervalued.

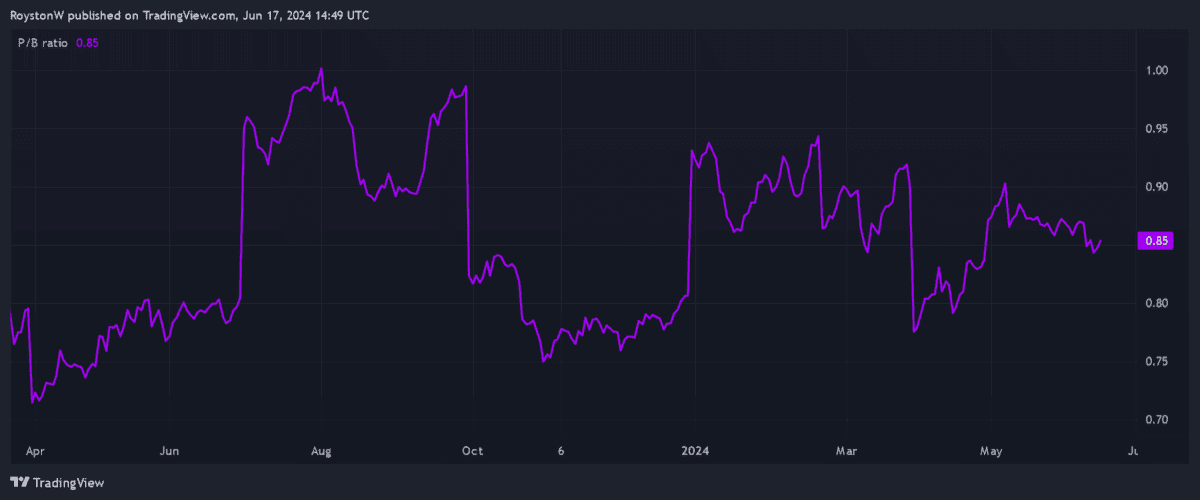

HSBC shares additionally look low cost once we take into account the financial institution’s guide worth (complete belongings minus complete liabilities). Because the graph exhibits, its price-to-book (P/B) ratio stands at round 0.9, additionally under the worth threshold of 1.

Lastly, the dividend yield on the financial institution’s shares is available in at 9.1%. This makes it one of many greatest potential earnings payers on the FTSE 100 for this 12 months.

HSBC shares aren’t with out threat. However I consider that the Footsie financial institution has what it takes to ship gorgeous investor returns over the lengthy haul and is price contemplating.