- Bitcoin ETF inflows surged over the previous week as costs elevated.

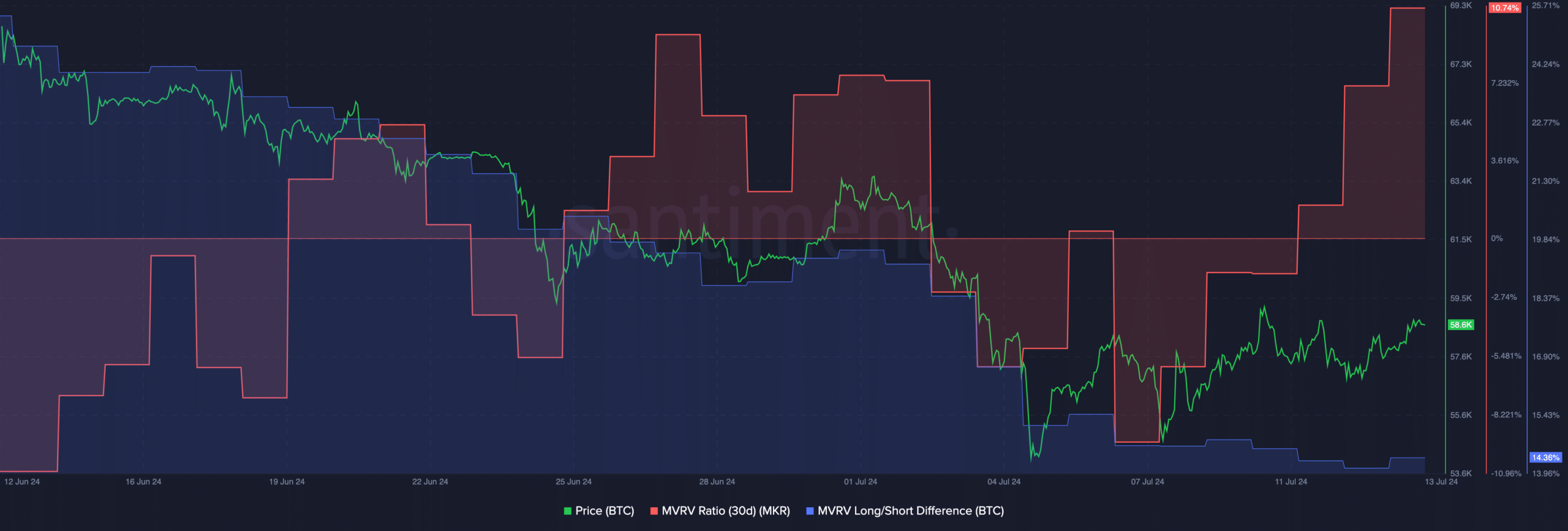

- MVRV additionally spiked, indicating that profitability of holders had surged.

Bitcoin [BTC] has managed to make a comeback over the previous couple of days and has seen an enormous surge in value with Alternate-Traded Funds (ETF) taking part in a giant position.

ETFs come to the rescue!

Bitcoin ETFs have seen a exceptional inflow of capital since their launch in January 2024, totaling a staggering $16.35 billion. This surge in investor curiosity has culminated in a record-breaking week, with inflows reaching $1.05 billion by fifteenth July.

The substantial progress of Bitcoin ETF property below administration is seen by market analysts as a bullish indicator, fueling hypothesis that the cryptocurrency could have bottomed out.

Collectively, these ETFs now maintain an unprecedented 888,607 Bitcoin, accounting for about 4.5% of the whole circulating provide.

This funding frenzy is being pushed by each institutional and retail traders, with some funds experiencing inflows as substantial as $310 million in a single week.

Supply: X

Germany’s BTC holdings

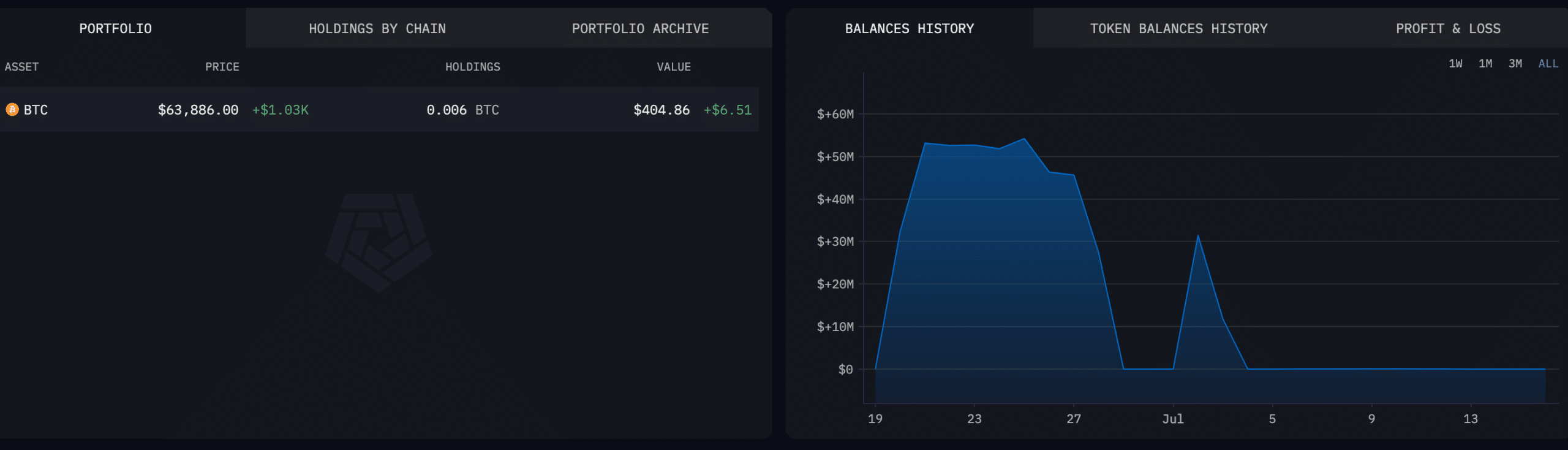

One of many causes for the current decline in value earlier than the uptick was the German authorities’s actions.

The Germany’s current $3 billion Bitcoin sell-off, executed by means of numerous crypto exchanges and buying and selling companies, despatched shockwaves by means of the cryptocurrency market. Nevertheless, the large offloading concluded late final week.

Surprisingly, since then, the federal government has acquired a modest inflow of Bitcoin, totaling roughly $420, from a number of wallets.

These incoming funds had been dispersed throughout over 4 dozen transactions, the biggest of which amounted to $118 and occurred on thirteenth July, as revealed by blockchain information analyzed by Arkham.

The German authorities has quietly amassed a small Bitcoin portfolio by means of a collection of those transactions. This BTC was despatched by customers who wished to specific their discontent with the German authorities.

A few of these transactions included uncommon references, such because the names Adolf Hitler and Elon Musk, and likewise different expletives.

Supply: Arkham Intelligence

Learn Bitcoin (BTC) Worth Prediction 2024-25

At press time, BTC was buying and selling at $63,882.81 and its value had grown by 1.53% within the final 24 hours. The MVRV ratio for BTC had surged because of the surge within the value of BTC. This meant that almost all addresses had been worthwhile.

Though the profitability can affect sentiment positively, there’s an incentive to promote their BTC holdings for the holders which might add promoting strain on BTC.

Supply: Santimet