- Hong Kong Bitcoin ETF reserves touched 4,941 BTC, price over $310 million.

- BTC was up by 4% within the final 24 hours, however a number of metrics have been bearish.

Bitcoin [BTC] ETFs have remained a scorching subject of dialogue within the crypto area since their approval in January 2024.

Whereas the US dominated the ETF sector at a world degree, new gamers have now began to enter. For instance, Australia and Hong Kong ETFs not too long ago set data.

Bitcoin ETF: Australia, Hong Kong prepared the ground

To start with, Hong Kong’s Bitcoin ETFs have witnessed a considerable improve in flows over the previous few days. Exactly, BTC ETFs in Hong Kong registered a 28.6% improve from the earlier reserve.

The latest uptick pushed its BTC reserves to 4,941 BTC. In accordance with the AMBCrypto Converter, the full Hong Kong BTC ETF reserves have been valued at over $310 million.

Like Hong Kong, Australia’s Monochrome Bitcoin ETF (IBTC) additionally made it to the headlines. Since its debut, it has acquired 83 BTC in inflow. This approached the 100 Bitcoin threshold by way of whole holdings.

Since there was a lot traction round BTC ETFs, AMBCrypto deliberate to have a greater take a look at what’s happening. Our evaluation of Dune Analytics’ knowledge revealed that BTC ETFs’ netflows have declined over the previous few weeks.

Nevertheless, it was fascinating to notice that its web inflows remained increased, reflecting BTC’s demand and traders’ confidence within the king of cryptos.

Supply: Dune

BTC turns bullish

Whereas all this occurred, Bitcoin bulls stepped up their sport as its weekly and each day charts turned inexperienced. In accordance with CoinMarketCap, BTC was up by greater than 4% within the final 24 hours.

On the time of writing, BTC was buying and selling at $62,810.22 with a market capitalization of over $1.23 trillion.

Our take a look at Coinglass’ knowledge revealed a bullish sign. Bitcoin’s Lengthy/Brief Ratio registered an enormous uptick at press time, reflecting extra lengthy positions available in the market than brief positions.

This instructed that bullish sentiment across the coin was rising available in the market.

Supply: Coinglass

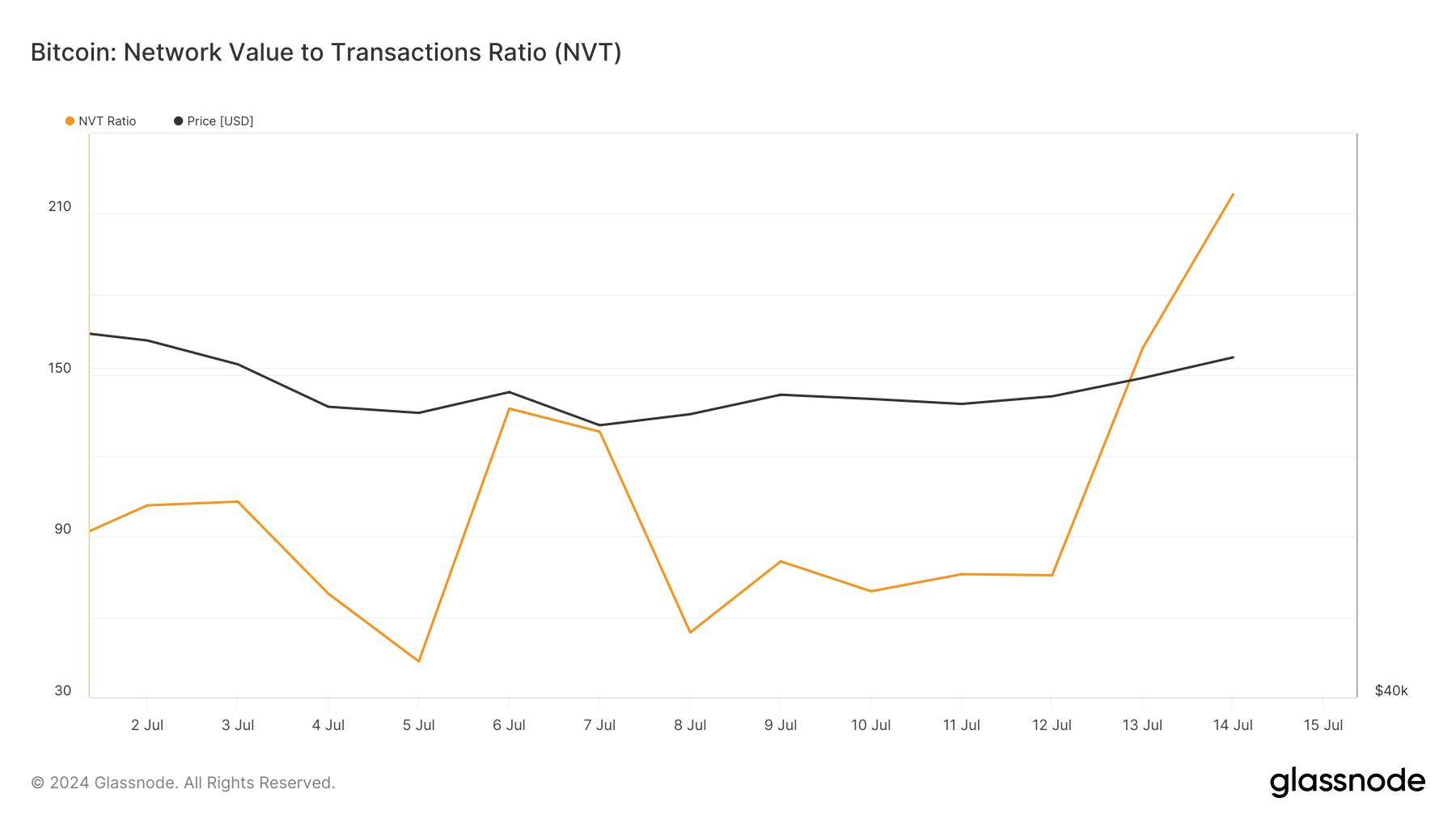

Nevertheless, not every little thing was working in BTC’s favor. For instance, BTC’s NVT ratio registered a rise. At any time when the metric rises, it means that an asset is overvalued, hinting at a attainable value correction.

Supply: Glassnode

Due to this fact, AMBCrypto checked Hyblock Capital’s knowledge to search for short-term assist and resistance ranges.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

We discovered that if the bulls proceed to manage the market, then it gained’t be stunning to see BTC touching $68k within the coming days.

Nevertheless, if a pattern reversal occurs, as instructed by the NVT ratio, it’d drop to $56k as soon as once more.

Supply: Hyblock Capital