Picture supply: Getty Photos

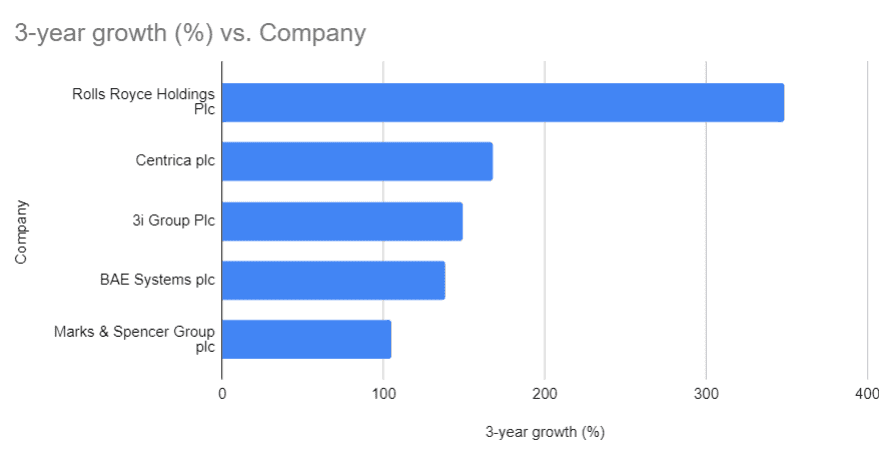

Rolls-Royce has been the undefeated champion of FTSE 100 progress shares for the previous three years, gaining 350%. That’s greater than double the second-highest on the listing, Centrica, which is up 167%.

Nonetheless, after wanting on the figures final month I made a decision to promote my Rolls-Royce shares. I could also be confirmed incorrect however I imagine the inventory is closely overbought and heading for a pointy correction. Don’t get me incorrect, I’ve loved watching the rally — and the returns far outmatched anything in my portfolio!

However as we head right into a interval of financial uncertainty, I’m rebalancing my portfolio into extra dependable revenue shares. Nonetheless, there stays one promising progress inventory that I’ve had my eye on for a while. May this undervalued gem be the subsequent mega-rally share like Rolls?

Betting on the long run

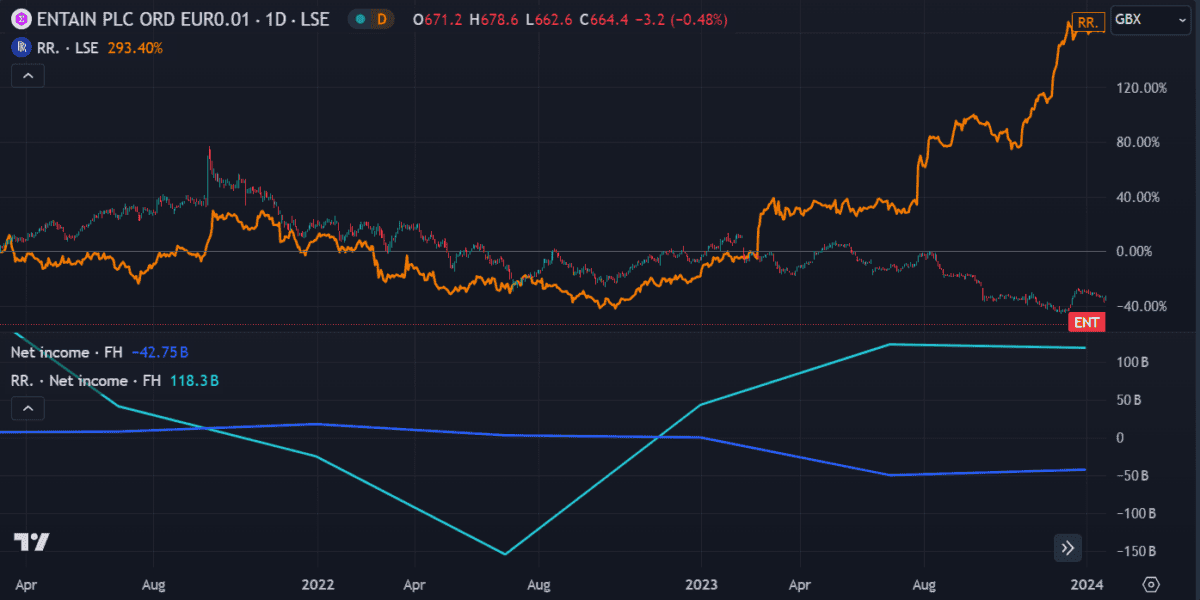

Down 65%, Entain (LSE: ENT) has been the worst-performing firm on the FTSE 100 listing for over three years. The worldwide sports activities betting and playing firm has had a troublesome time just lately, as excessive inflation forces shoppers to chop spending on non-essential actions.

Within the FY 2023 earnings outcomes, earnings per share (EPS) fell from 6.4p to a £1.41 loss and internet revenue got here out at a £870m loss, main the corporate to turn out to be unprofitable. Subsequently, its 3.4bn debt load is now 24% larger than its fairness.

Issues look fairly dismal, to be sincere.

However circumstances could also be bettering. The Euro remaining has introduced followers flocking to the favored Entain-owned bookies Ladbrokes, serving to enhance the share worth by 6% this week.

Earnings are forecast to extend at an annual charge of 97%, which may carry the corporate’s price-to-earnings (P/E) ratio right down to 24.3. That’s nonetheless barely larger than the primary competitor, Playtech (17.8), however a lot nearer to the trade common of twenty-two. It’s definitely a step in the proper path.

Unbiased analysts evaluating the inventory are in good settlement that the value will rise greater than 50% within the coming 12 months. On paper, that ought to carry the corporate again into profitability. If I bear in mind accurately, Rolls was in an identical place not way back.

Reliance on financial restoration

At face worth, evaluating a multinational aerospace and defence engineer to a playing firm may appear illogical. And the elements that drove the Rolls rally definitely aren’t akin to Entain. However contemplating it was over £22 only some years in the past, the present £6.66 worth seems to be low cost to me. A return to these costs within the coming years may triple any funding made as we speak — much like how the Rolls share worth tripled since October 2021.

Realistically, anticipating something to develop that a lot is hopeful. There’s no concrete proof but that the financial system will enhance. The overall election outcomes ignited some constructive sentiment relating to the UK inventory market. However modifications to itemizing necessities have rattled some shareholders. Some fear that the brand new guidelines, geared toward protecting corporations from leaving for the US, will dilute the standard of a London itemizing.

Total, I feel there’s probability Entain will start a restoration this yr. Perhaps not fairly to the extent of Rolls-Royce, however who is aware of? I like its odds, so my cash might be on Entain in my subsequent shopping for spherical.