- Bitcoin holder loss tendencies confirmed that the bulls may be hopeful of a restoration

- If historic tendencies repeat themselves, a fair deeper value correction is likely to be due

Bitcoin [BTC] has twice confronted rejection from the short-term vary highs at $58.8k in two days. After dropping the psychological $60k assist final week, sentiment throughout the market was fearful.

There’s some hope for a rebound although. At press time, the rising accumulation development rating urged patrons had been keen, however different metrics implied extra ache could also be due.

Supply: Axel Adler on X

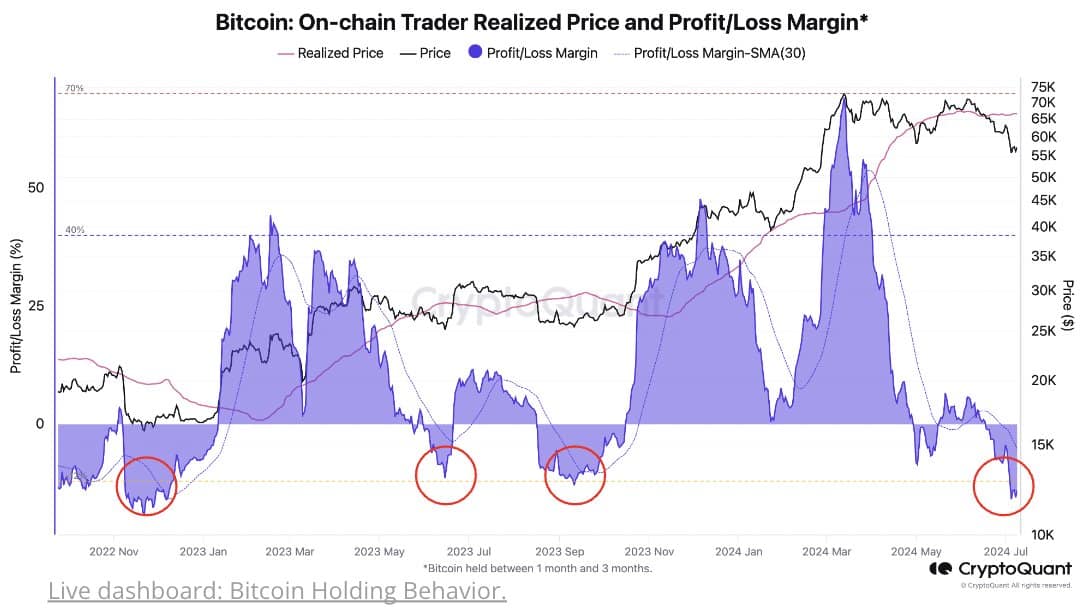

In a submit on X, crypto analyst Axel Adler drew consideration to the present common losses of short-term holders (STHs). Whereas the losses match that of June 2023, the magnitude was far decrease than the ache seen in 2021 or 2022.

Whereas it did sign a possible native backside, it additionally confirmed that merchants and buyers should be ready for the worst-case situation of a sharper value drop on the charts.

Clues that Bitcoin’s native lows are behind us

Supply: CryptoQuant on X

CryptoQuant noticed that the dealer realized revenue/loss margin was at -17%. This was in the identical ballpark because the market bottoms over the previous two years, reinforcing the concept Bitcoin is extra more likely to rebound greater than to drop decrease.

Supply: Ki Younger Ju on X

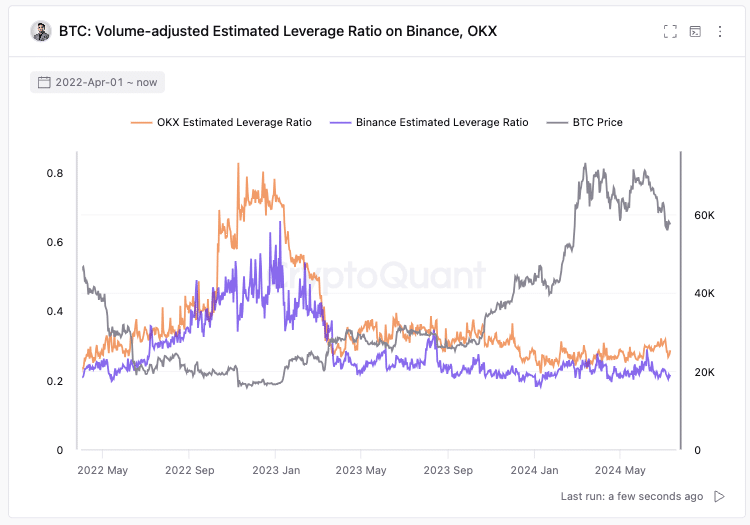

In accordance with Founder and CEO of CryptoQuant Ki Younger Ju, whales have a tendency to make use of leverage at their cyclical bottoms, making the markets over-leveraged and forcing one other downward value flush.

At press time, whales weren’t over-leveraged, which might have set the stage for a deeper correction beneath the $50k-mark.

Merchants had been humbled after making an attempt to catch the breakout and ATH

Supply: CryptoQuant

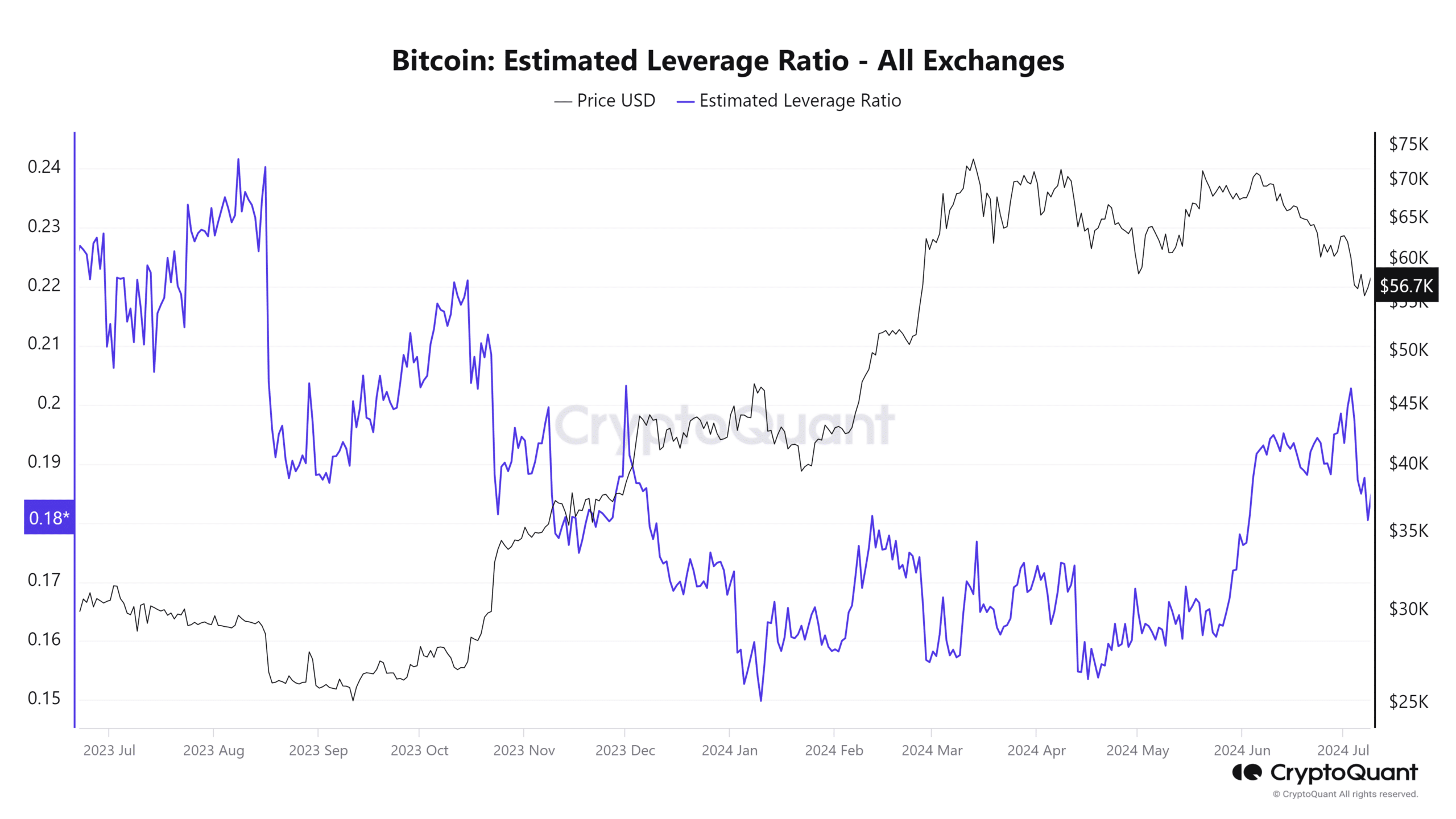

From the ultimate week of Could to the three July, the estimated leverage ratio on exchanges rose rapidly. Throughout that point, the worth of Bitcoin was hovering round $67k-$69k. As the worth fell beneath $66k, the leverage ratio climbed as soon as extra, indicating that merchants had been making an attempt to time the underside out of greed.

Over the previous week, their hopes had been quelled by BTC’s sustained descent. The leverage ratio additionally fell decrease, which may very well be wholesome for the market.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Total, it’s arduous to say with certainty that Bitcoin has fashioned a backside.

A number of backside alerts have been flashing and vendor stress may start to drop. Even so, buyers ought to nonetheless have a plan of motion in case the worth fall beneath $50k.