- Drop in charges alerts a difficult interval for the community’s profitability

- Provide on exchanges fell, with different developments supporting a value hike

The overall charges generated by the Bitcoin [BTC] community fell by 18.25%, in comparison with the earlier week’s worth. Based on IntoTheBlock, Bitcoin made solely $5.90 million.

Nevertheless, that was not the one factor. The decline additionally meant that the community registered the bottom charges since November 2023.

Decrease transactions equal decrease charges

For these unfamiliar, the buying and selling quantity of Bitcoin often determines how a lot in charges the community makes. If quantity is excessive, it means consumer demand for block area would improve.

Due to this fact, miners would be capable of validate new blocks whereas making earnings. The final time such a factor occurred was through the halving when the Runes protocol got here into play.

Supply: IntoTheBlock

On the time, charges spiked and miners’ profitability hit a excessive level. Alas, in current instances, that has not been the case, with BTC’s value being one of many culprits.

At press time, Bitcoin’s value was $58,135. Earlier than its most-recent hike, the coin was buying and selling at a stage as little as $54,832, whereas combating falling curiosity and low demand.

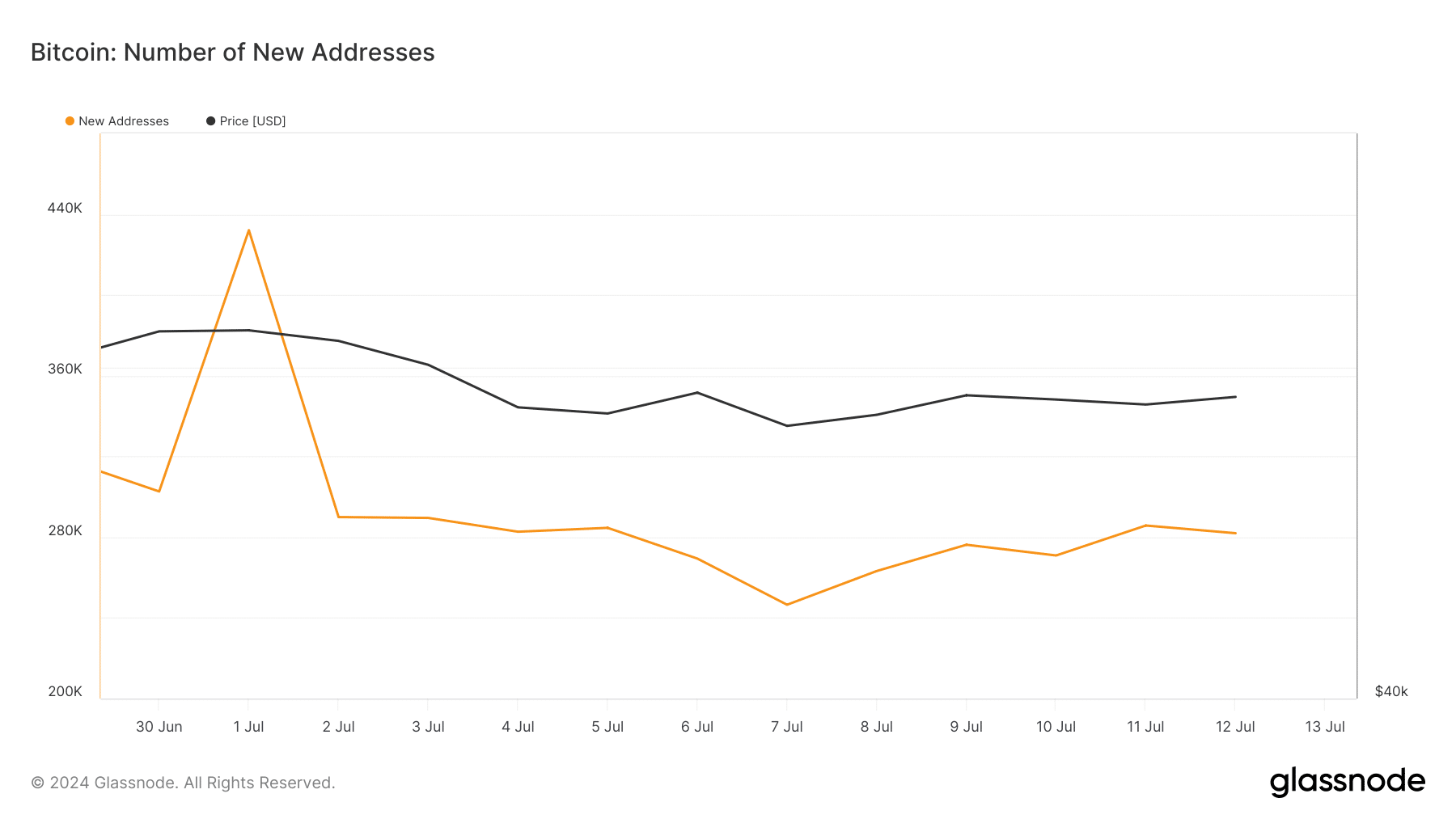

AMBCrypto discovered proof of the low demand by wanting on the variety of new addresses. Based on Glassnode, the variety of new Bitcoin addresses on 12 July was simply 289,915. In the direction of the start of the month, nonetheless, this identical metric stood at 432,026.

This decline implies that there was a drop in first time transactions made by distinctive addresses on the community.

Supply: Glassnode

BTC set to stroll its manner again up

If this determine continues to fall, it might be inevitable to not file one other decline in Bitcoin charges. Nevertheless, if a bounce happens within the coming weeks, the community may make extra income and BTC’s value may additionally respect.

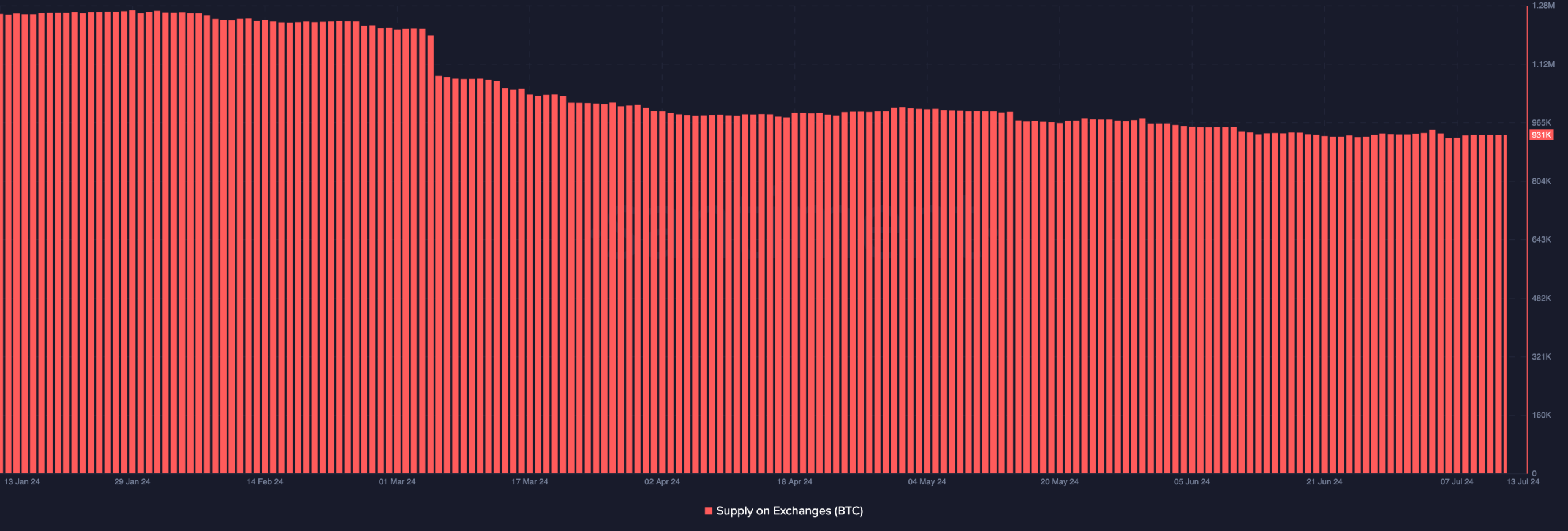

Moreover, we seemed on the provide on exchanges. When the availability on exchanges will increase, it signifies that holders are almost definitely trying to promote. If this occurs, the worth of Bitcoin may fall on the charts.

On the time of writing, the availability was right down to 931,000. Ought to this stay the case as time goes on, the cryptocurrency’s value will rebound and it would re-test $60,000 within the brief time period.

Supply: Santiment

Additionally, it appeared that Bitcoin could also be heading in direction of an ideal situation for a notable hike. For instance – AMBCrypto reported how the Crypto Concern and Greed Index dropped to excessive worry, hinting at a shopping for alternative.

Moreover that, the German authorities had a hand in pushing the worth down on the again of its huge sell-offs. Lastly, Bitcoin additionally registered it highest ETF inflows for the month on 12 July.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Ought to these situation stay, and if they’re later accompanied by shopping for strain, BTC’s value may start a hike that takes it in direction of $63,000 or $65,000 in a matter of weeks.

Nevertheless, this prediction could possibly be invalidated if one other spherical of whale sell-offs seem. If that’s the case, Bitcoin may fall to $57,000 once more.