- Bitcoin had a bearish bias as a result of relentless promoting.

- Accumulation has been sturdy over the previous month and would possibly set the stage for a restoration.

Bitcoin [BTC] had its halving occasion happen practically three months in the past, however the promised bull run was not but in play. Some traders query why BTC is struggling even with the demand from ETFs or the cooling inflation.

A deeper dive into the long-term metrics confirmed that the Bitcoin predictions of a backside being shut, or already in, are seemingly true.

Bitcoin predictions: Gleaning clues from value motion

Supply: BTC/USDT on TradingView

The 4-hour value chart confirmed a spread formation (purple) between $53.5k and $58.9k. The provision zone (crimson field) at $59.2k-$61k has been examined twice previously few days, however to no avail.

The OBV confirmed that purchasing strain was not sturdy. The RSI was pushed beneath impartial 50 after the worth rejection on the vary highs.

The bulls had been unable to maintain the strain, and merchants can put together for an additional value dip towards $55k over the weekend.

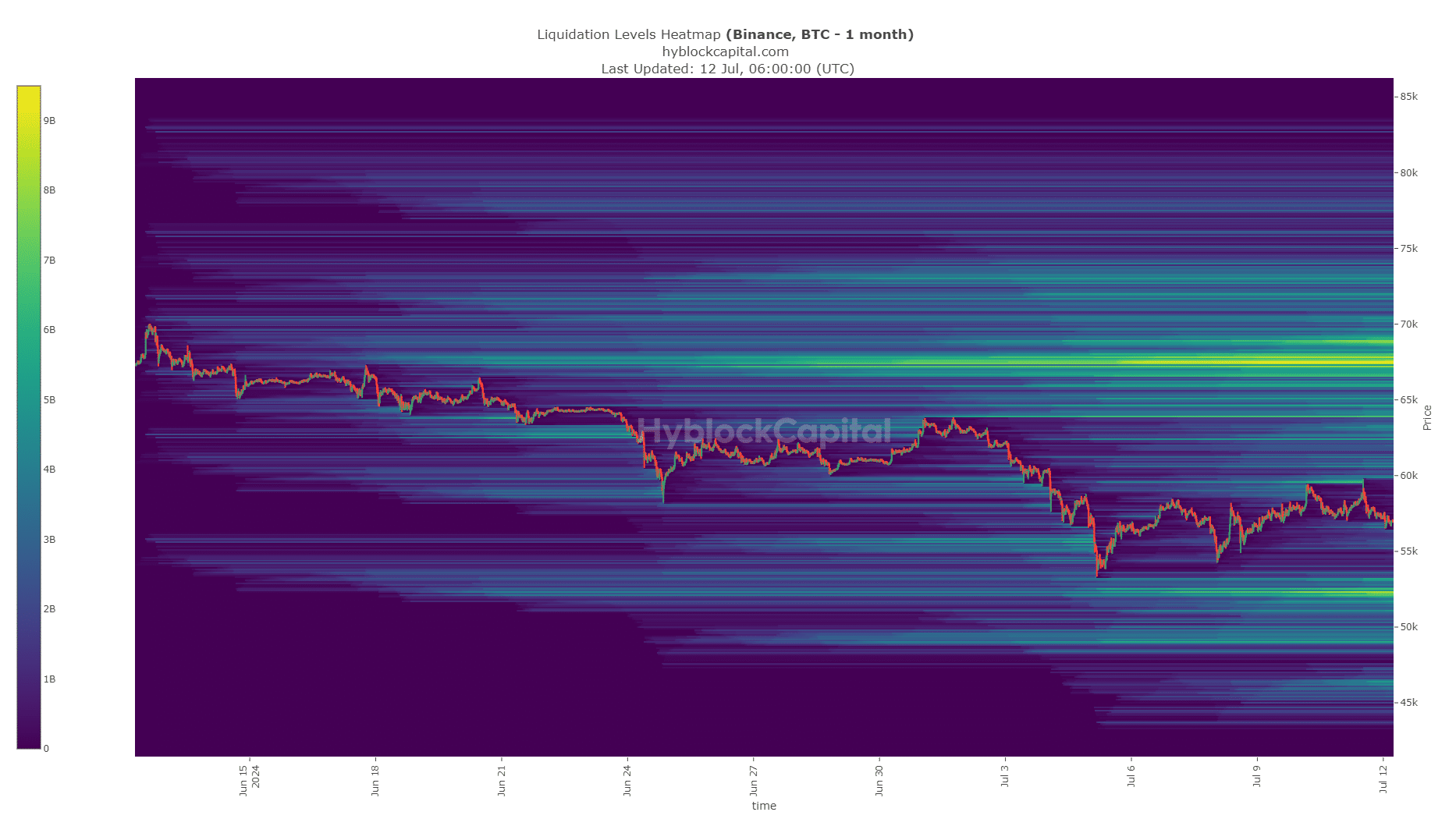

Supply: Hyblock

The previous month’s liquidation heatmap confirmed that the $59.5k liquidity pocket was examined on the eleventh of July and costs instantly retraced. This was an indication that the liquidity cluster at $52.1k was the subsequent goal.

If the consumers had been dominant, BTC would have damaged by means of the $60k barrier. Because it didn’t, the near-term Bitcoin predictions favor extra losses.

Good alternative for merchants

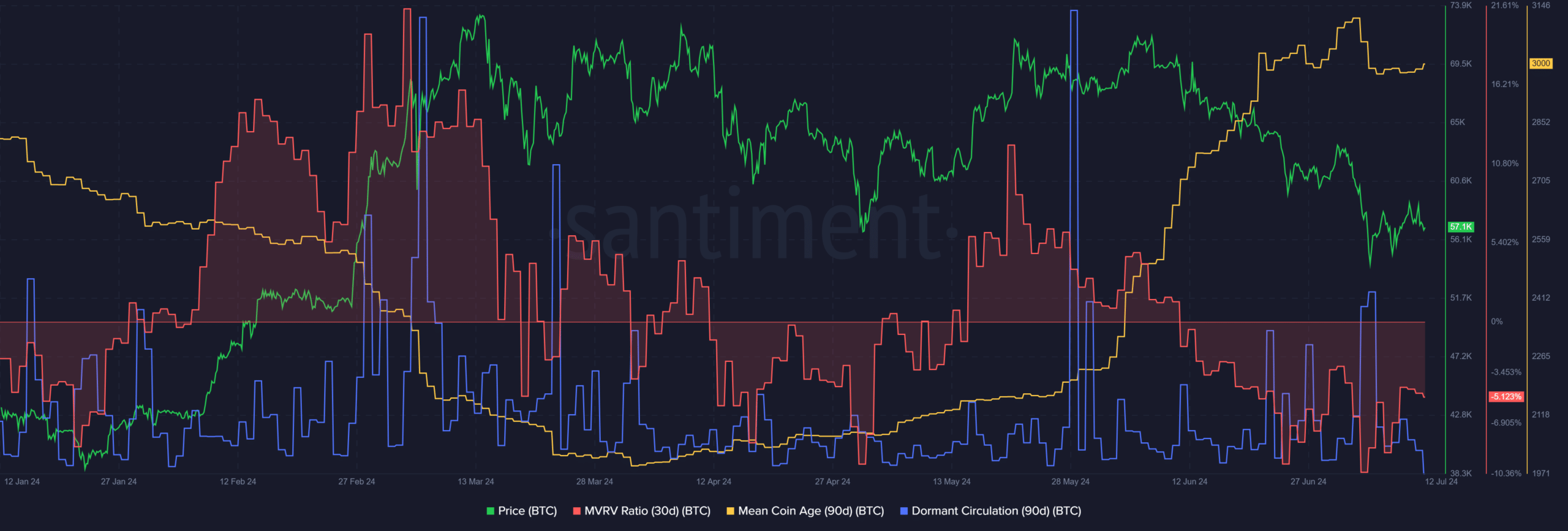

Supply: Santiment

The imply coin age has trended increased since Might. Over the previous ten days, it has stalled, however general the metric instructed sturdy network-wide accumulation through the previous month’s value dip.

The 30-day MVRV was damaging, exhibiting short-term holders at a loss. Collectively, this mix is a robust purchase sign.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The dormant circulation spiked dramatically on the fifth of July as Bitcoin costs cratered, however has been quiet since then.

Total, the Bitcoin predictions of extra losses maintain weight as a result of liquidity at $52.1k. The $46k area could be focused too if sentiment will get weak sufficient. As issues stand, traders can look to purchase the dip.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.