- The altcoin market cap elevated towards the Bitcoin market cap fall.

- The launch of the spot Ethereum ETFs might ship Bitcoin dominance additional down.

AMBCrypto’s evaluation revealed that the Bitcoin [BTC] dominance chart has been lowering. On the tenth of July, the dominance was 55.10%. Nevertheless, at press time, it was all the way down to 54.62%.

Bitcoin dominance is a crucial indicator of BTC’s value. It is because it reveals how the coin’s market cap compares to the market cap of different cryptocurrencies.

Can BTC dominance proceed?

If Bitcoin’s dominance will increase, it signifies that the coin is outperforming the common altcoin. Nevertheless, when it decreases, it signifies that BTC is shedding momentum and altcoins are performing higher.

On a 12 months-To-Date (YTD) foundation, the cash have carried out higher. However over the past month, and in latest instances, the other has been the case. If this continues, Bitcoin might fall additional regardless of the correction it has had.

Supply: TradingView

At press time, BTC modified palms at $58.257. This represented a 1.37% enhance within the final seven days. Nevertheless, an indicator to examine if Bitcoin is starting to lose it superiority is the TOTAL2.

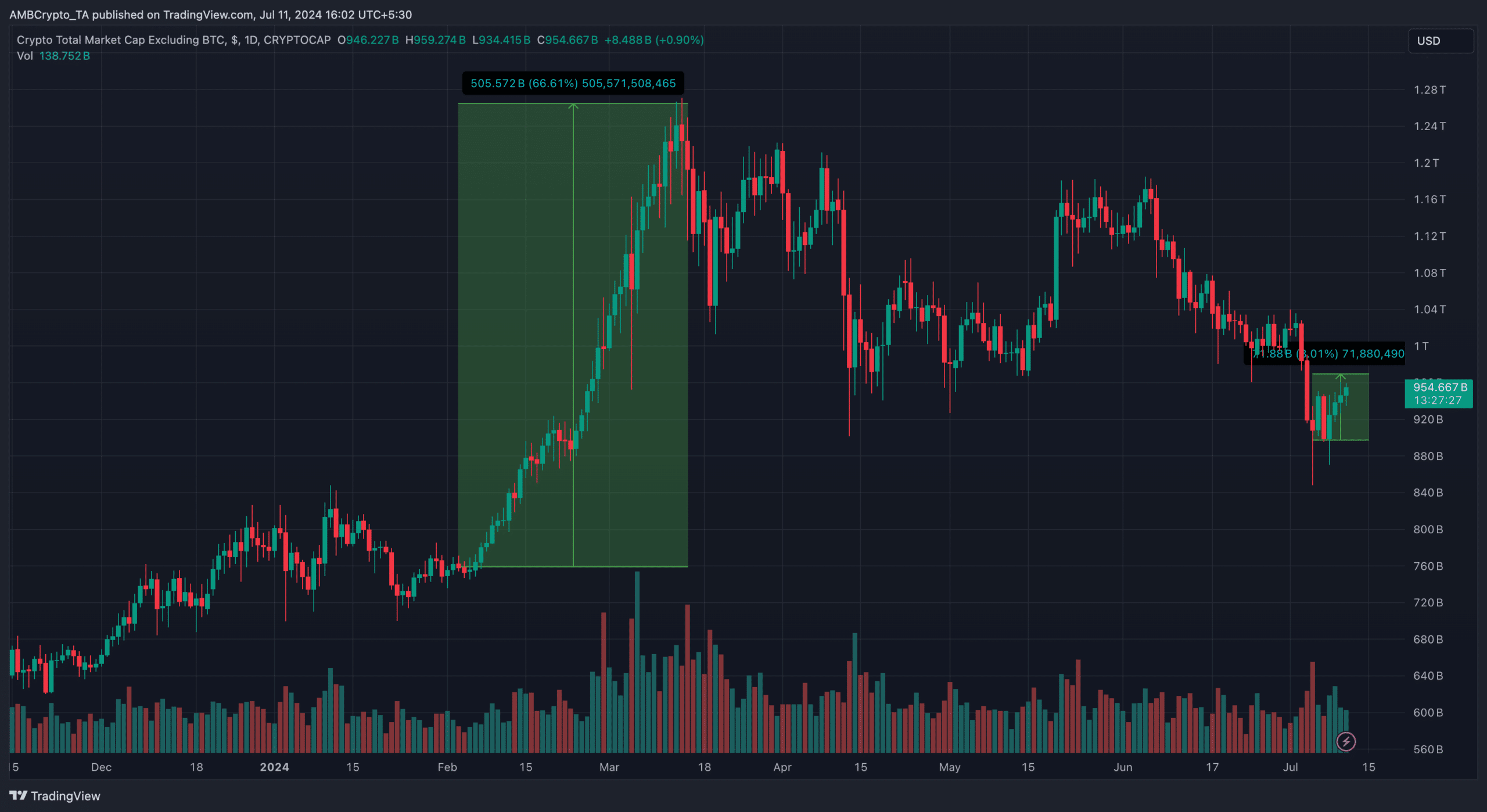

The TOTAL2 is also called the full market cap of the crypto market excluding BTC. If it will increase, it means altcoins are displaying a stronger efficiency than Bitcoin.

However when it decreases, it implies that BTC is main the market resurgence.

Between the fifth of July and the time of writing, the TOTAL2 has risen by 8.01%, indicating that the costs of the common altcoins have been higher than Bitcoin dominance.

Altcoins are ready to provide the king a combat

The final time, the indicator took such steps, the market cap jumped by 66.61% between February and March because the market cap additionally crossed $1.20 trillion. At press time, the market cap was $953.68 billion.

If this continues to extend, it might hit $1 trillion, probably driving a better transfer to the much-anticipated altcoin season. If this occurs, the BTC’s correction would proceed.

Supply: TradingView

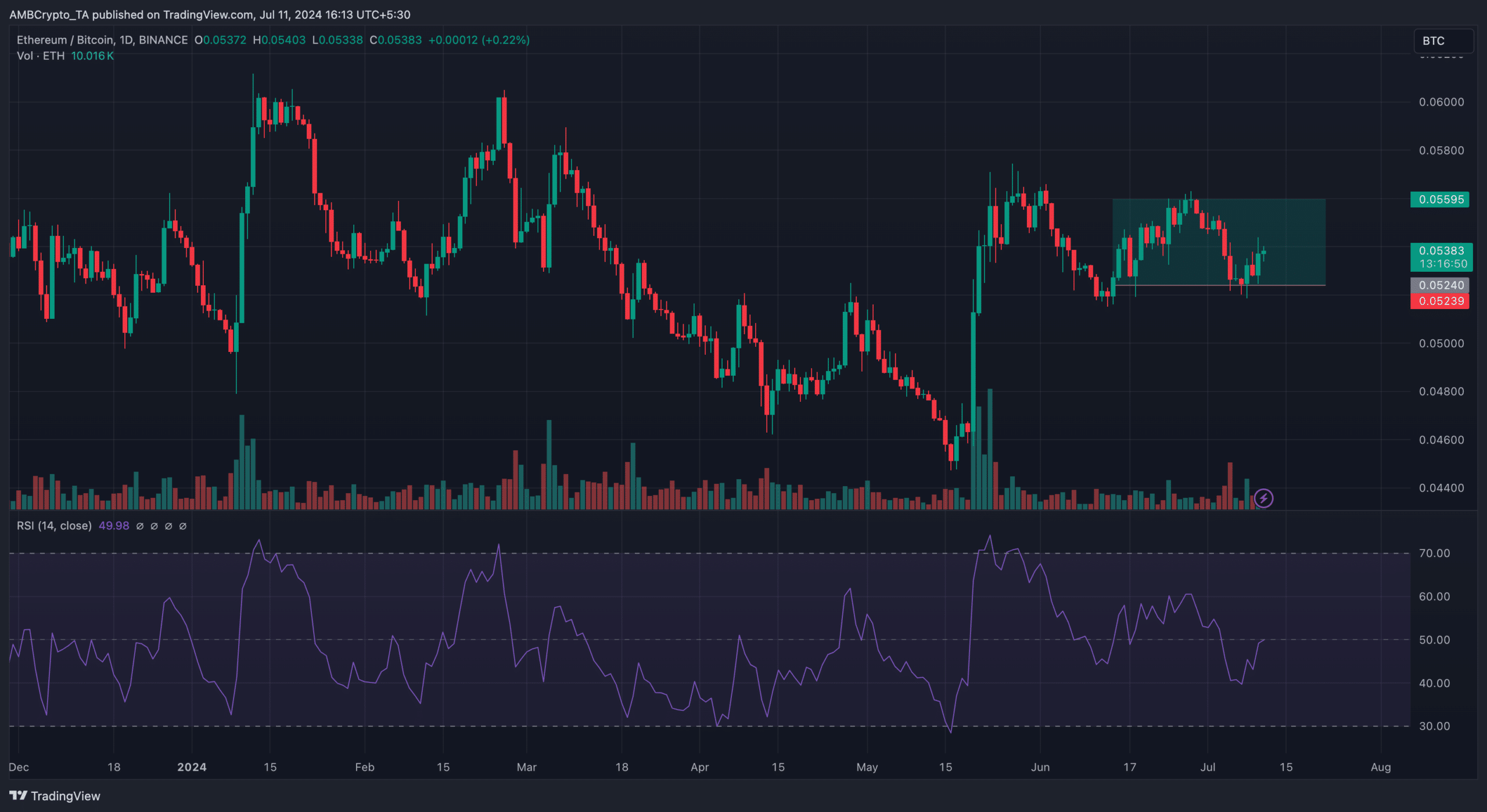

One issue that may drive a rise within the dominance is Ethereum [ETH]. Traditionally, when ETH’s value efficiency higher than BTC, it offers energy to different altcoins.

In flip, it reduces Bitcoin dominance. One catalyst market members are wanting ahead to is the launch of the spot Ethereum ETFs.

Nevertheless, it’s also essential to take a look at the ETH/BTC chart to see if the altcoin would take over Bitcoin dominance within the coming weeks.

When the ETH/BTC will increase, it signifies that Ethereum is outperforming Bitcoin. However a lower suggests in any other case. Beforehand, the ETH/BTC ratio was 0.051.

Supply: TradingView

Sensible or not, right here’s BTC’s market cap in ETH phrases

However as of this writing, that has elevated to 0.053, that means 1 ETH equaled 0.053 BTC. As well as, the Relative Energy Index (RSI) revealed that ETH was gathering a superb degree of momentum.

If sustained, this might drive the ratio to 0.056, and attainable ship Bitcoin dominance down.

![As Bitcoin [BTC] dominance drops beneath 55%, is altcoin season right here? As Bitcoin [BTC] dominance drops beneath 55%, is altcoin season right here?](https://i2.wp.com/ambcrypto.com/wp-content/uploads/2024/07/bitcoin-dominance-alts.png?w=1068&resize=1068,0&ssl=1)