- The rise in realized losses on-chain signifies that one other BTC rally was shut.

- Historic knowledge introduced by the cycle detector reveals the coin will not be in a bear part.

If the present cycle continues to be in a bull part, then Bitcoin [BTC] is near its backside. This was the indication AMBCrypto bought after wanting on the Quick Time period Holder (STH) SOPR.

SOPR stands for Spent Output Revenue Ratio. This indicator offers insights into the realized income of all cash traded on-chain. However this time, the main focus is on the brief time period.

Are losses nice for Bitcoin’s value?

If the STH-SOPR is larger than 1, it implies that the worth at whereas BTC was bought is larger than the acquisition worth. This means numerous realized income on-chain.

Nonetheless, when, the metric is beneath 1, it means costs bought are larger than weighted shopping for worth. This means realized losses on-chain. In line with CryptoQuant, Bitcoin’s STH-SOPR was all the way down to 0.98.

Supply: CryptoQuant

Traditionally, when this occurs, it implies that Bitcoin has hit the underside or it’s near it. As seen within the picture above, it was the same incidence in September 2023.

Round that point, Bitcoin’s value was $26, 253. The SOPR had additionally dropped to the same area. By November of the identical yr, the coin had reached $35,441.

Different bull cycles like 2021 and 2018 additionally present comparable pattern, indicating that the sample usually rhymes. Ought to this be the identical case, the worth of Bitcoin might leap by 34.99% in lower than two month.

At press time, BTC’s value was $57,154. Going by this calculation, the worth of the coin might commerce round $77,100 in September.

Ought to this grow to be actuality, it implies that BTC might attain a brand new all-time excessive this quarter.

Nonetheless, no matter the constructive outlook, it is very important examine if the cycle continues to be in a bull part.

Bears, it’s not but your time but!

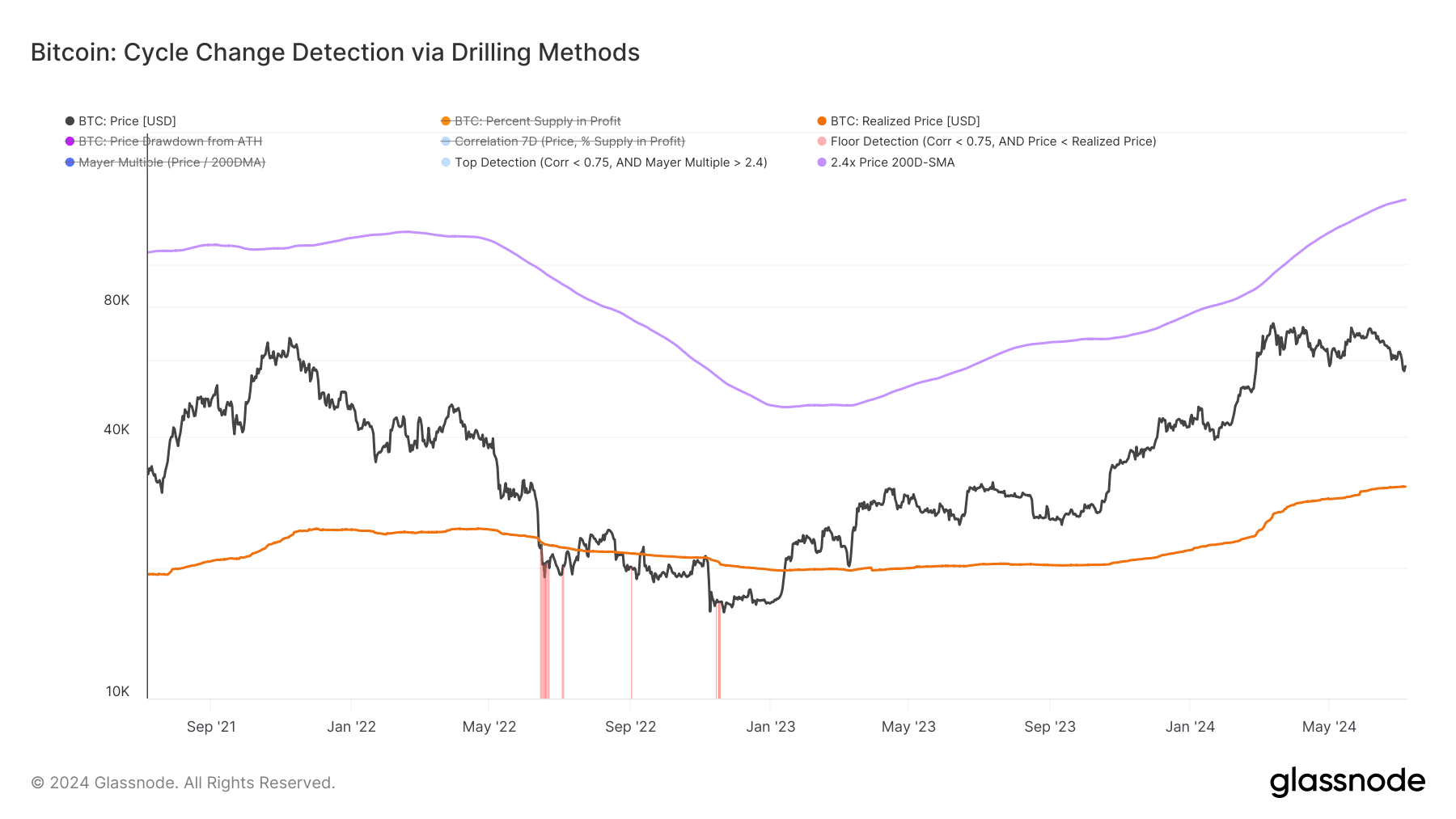

Beforehand, when Bitcoin dropped to $54, 274, there have been calls of a return to the bear market. However opinions don’t validate issues like this. That was why AMBCrypto seemed to Glassnode to have first-hand data of the scenario.

To do that, we examined the Bitcoin Cycle Change Detector. This detector spots transitions from a bull market to a bear market. It additionally tells if a bear market has become a bull one.

If the market adjustments to a bear one, the shade on the chart turns crimson. This was evident from the market situation of November 2022. However as of this writing, that was not the case.

Supply: Glassnode

Besides the whole Bitcoin in circulation hits almost 100% in income, the transition to a bear cycle wouldn’t occur. As this was the case, it’s potential that BTC may need hit the underside.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Subsequently, the coin may attain a much-higher worth earlier than the quarter ends — probably between $76,000 and a extremely bullish value above $80,000.

Nonetheless, this prediction can be invalidated if promoting strain hits the market prefer it did in latest weeks.