- Evaluation confirmed that concern has gripped the Bitcoin market.

- BTC continued to interrupt crucial help ranges.

The latest downtrend in Bitcoin’s [BTC] costs has stirred destructive sentiments amongst merchants, leading to substantial liquidation volumes.

Regardless of these setbacks, patrons have continued dominating the market, sustaining their positions regardless of losses.

Concern dominates Bitcoin’s sentiment

Evaluation of the BTC concern and greed index on Coinglass indicated that the market was experiencing a excessive degree of concern, with the index at round 29 at press time.

This advised a big prevalence of concern amongst merchants and buyers.

Additionally, concern has maintained dominance in over 33% of the observations, making it the prevailing sentiment within the present market pattern.

The dominance of concern is additional underscored by the excessive quantity of liquidation. This helps clarify why this cautious sentiment is so outstanding.

Extra lengthy positions get liquidated

AMBCrypto’s evaluation of Bitcoin’s liquidation volumes revealed that over the previous 24 hours, greater than $256 million has been liquidated.

This era has predominantly seen lengthy positions being liquidated, with essentially the most quantity.

Supply: Coinglass

Particularly, on the 4th of July, lengthy liquidations had been practically $142 million, whereas brief liquidations had been about $34 million, totaling over $170 million.

This quantity represented the second-highest liquidation quantity in latest months. At press time, the lengthy liquidation quantity is over $73 million. Additionally, the brief liquidation quantity has exceeded $16 million.

There was a decline within the by-product quantity for Bitcoin over the past 24 hours as effectively. At press time, the amount was roughly $29 billion, down from over $31 billion recorded on the 4th of July.

This discount in buying and selling quantity is a key issue contributing to the present place of the BTC concern and greed index.

Bitcoin continues to say no

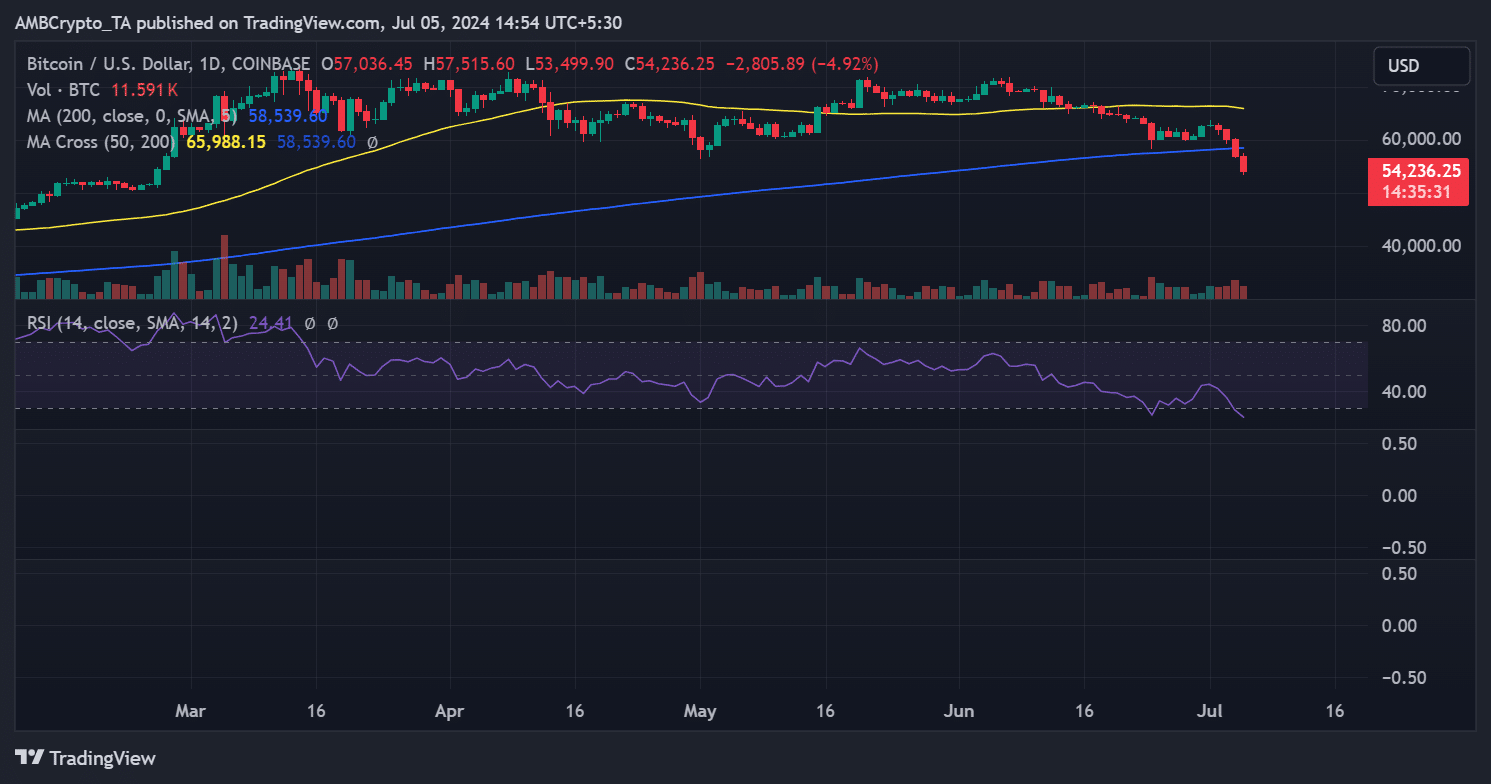

AMBCrypto’s evaluation of Bitcoin on a every day time-frame has highlighted why the BTC concern and greed index is presently dominated by concern.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

We famous that BTC was buying and selling with a decline of over 5%, priced at round $54,240 as of this writing. It concluded the earlier buying and selling session with the same decline of over 5%.

Supply: TradingView

This marked the primary occasion in additional than six months when BTC has skilled consecutive every day declines exceeding 5%. This has contributed considerably to the prevailing market concern.