- Institutional curiosity in Bitcoin has remained unchanged at the same time as retail gross sales persevered.

- Bitcoin whales have continued regular accumulation within the face of worth dips beneath $60K help.

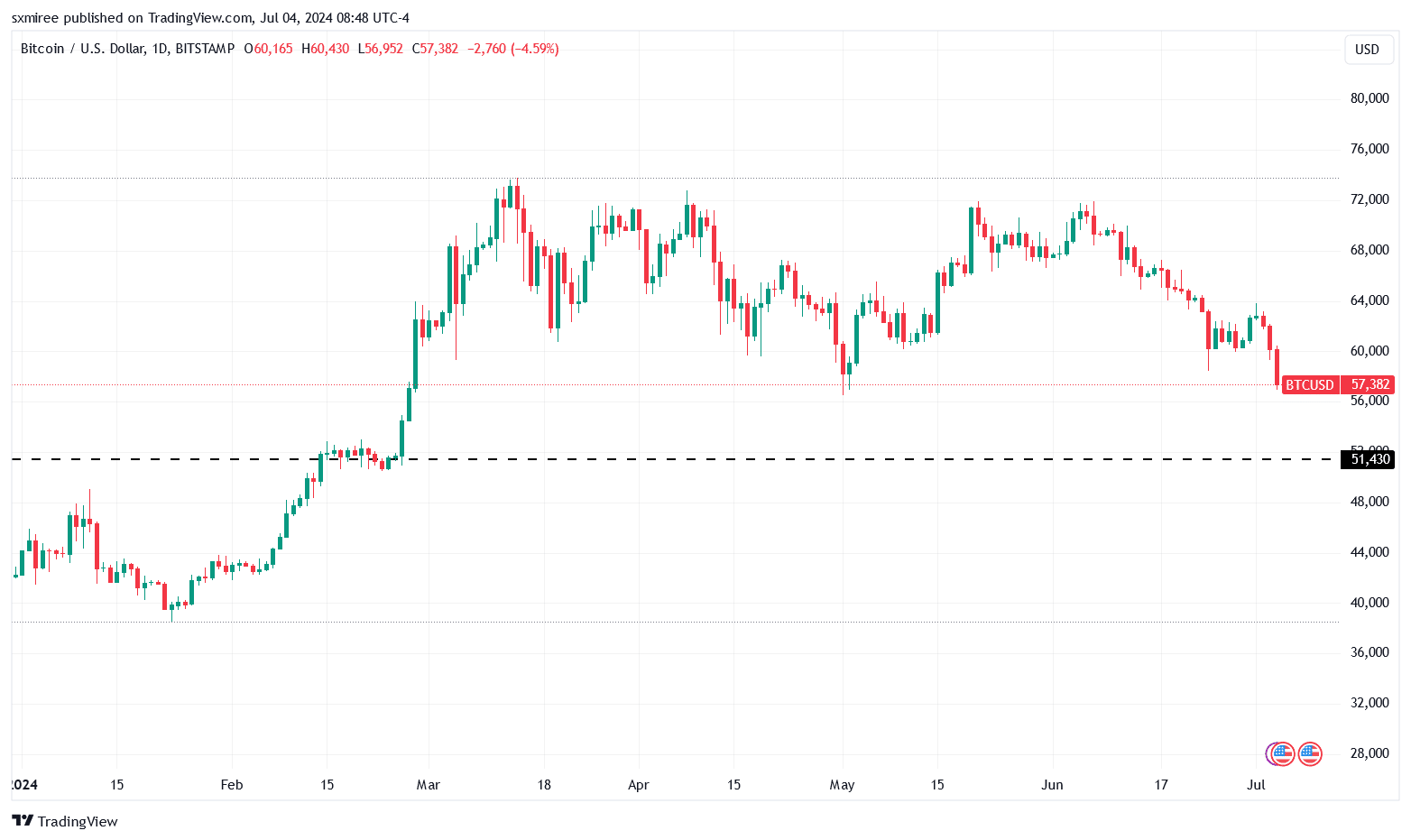

Bitcoin [BTC] retraced for a 3rd straight day on the 4th of July, printing an enormous purple candle on the BTC/USDT every day chart because it sharply fell by $58,000.

This decline noticed Bitcoin hit a nine-week low and lose its footing above the 200-day easy transferring common (SMA) for the primary time since October.

Supply: TradingView

The newest draw back has been ascribed to a scarcity of clear route within the spot markets, hawkish feedback from Fed Chair Jerome Powell, and regular sell-side stress arising from a number of elements.

German authorities promoting BTC

Continued Bitcoin promoting by the German authorities has mounted extra supply-side stress available in the market.

Per on-chain analytics platform Arkham Intelligence, the German authorities transferred 1,500 BTC on the first of July.

The pockets moved an additional 832.7 BTC in 4 particular person transactions on the 2nd of July, and has adopted up with 3,000 BTC moved on the 4th of July.

Giant holders are nonetheless taking over extra cash

Apparently, deep-pocket traders have been shopping for extra of the flagship crypto, undeterred by the market’s unstable worth swings.

Market intelligence platform Santiment noticed earlier this week that wallets holding a minimum of 10 cash had added 1.07% to their collective stash over the past six months and reached a file excessive of 16.17 million BTC.

Adjustments within the wallets of huge USDT and USDC holders help the exercise of those giant BTC holders.

Wallets holding between 100,000 and 1 million USDT account for 30.3% of the overall Tether provide, whereas these with 100,000 and 1 million USDC maintain 34.2% of USD Coin provide.

Santiment famous that these figures signify 5.37% and 1.99% declines respectively in comparison with half a dozen months in the past.

Bitcoin whales have notably been lively in accumulating throughout dips beneath $60,000.

Per IntoTheBlock information, giant Bitcoin whales holding greater than 0.1% of the Bitcoin provide have registered a constructive circulate of greater than 55K BTC over the previous 30 days.

Institutional curiosity

Whilst Bitcoin exhibited indicators of weak point, publicly traded corporations have continued to accumulate extra of the asset.

Information from BitcoinTreasuries.web confirmed that public corporations all over the world cumulatively owned 321,802 BTC as of the 4th of July, led by MicroStrategy, which held 226,331 BTC.

Japan-based Metaplanet, this week, introduced the addition of 20.2 BTC to its treasury holdings.

The funding agency has made Bitcoin purchases within the final three months -on the twenty third of April, the tenth of Might, and the tenth of June. The newest purchase marks the corporate’s fourth, bringing its complete holdings to 161.27 BTC.

El Salvador has equally saved up with its streak of shopping for 1 BTC day by day. In March, President Nayib Bukele transferred a big quantity of the nation’s BTC holdings to a chilly pockets saved in a bodily vault.

BitInfoCharts information exhibits this pockets held 5,600 BTC, value over $400 million, at press time.

Bitcoin worth motion

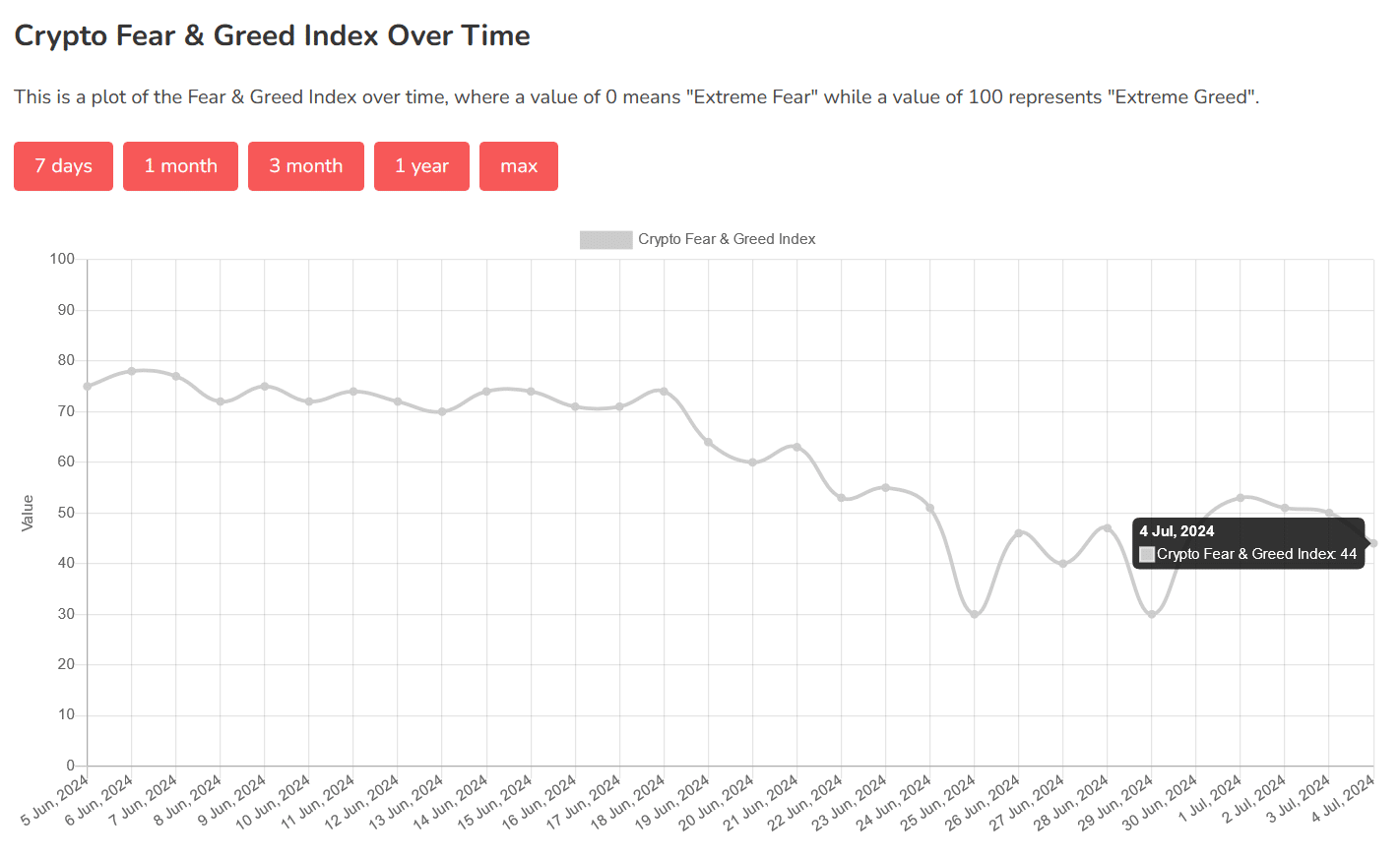

The retest of the crucial help MA for the primary time in 10 months underscored market fears of a cycle high. Different.me’s crypto Concern and Greed Index tracker has dropped 9 factors because the 1st of July to 44 on the time of writing.

Supply: Different.me

BTC was altering fingers at $57,580, down 16.51% over the past 30 days and virtually 22% from an all-time excessive above $73,700 set in March.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Zooming in, the YTD chart confirmed that additional sell-offs beneath the present costs might set off a 12% decline in the direction of $51.5k, the place it consolidated in February.

Supply: TradingView

A possible breakout will solely be on the playing cards if BTC worth can rise from the downtrend that has prolonged since mid-June.