- MicroStrategy’s inventory MSTR led the market with triple-digit good points in H1

- Stable H1 rally, elevated regulatory readability, upcoming ETH ETF, and anticipated Fed charge cuts are key catalysts for H2 2024

Crypto-related equities and Bitcoin [BTC] miners shares emerged as the largest winners within the first half of the 12 months, led by MicroStrategy’s inventory [MSTR], which posted triple-digit good points.

As per CCData’s current report, ‘2024 H2 Outlook,’ MSTR posted a whopping 380%, which the report linked to its large BTC holdings.

“MicroStrategy led with a 380% rise in stock price, driven by its 214,000 Bitcoin holdings now worth $13.3bn, purchased at an average cost of $35,158. These holdings have earned the company approximately $6.54bn since 2020.”

BTC miner shares and total market efficiency

Moreover, different crypto-related shares like Coinbase [COIN] and Robinhood [HOOD] additionally posted spectacular surges, rising by 329% and 122%, respectively, in keeping with the report.

Crypto mining shares additionally recorded a outstanding restoration. After April’s halving occasion, shares like Hut 8 Corp [HUT] and Bitfarms Ltd [BITF] rallied by 86% and 34%, respectively, outperforming the king coin. For its half, over the identical interval, it fell by 3.2%.

Supply: CCData

So far as spot BTC ETFs are involved, the report famous that the merchandise have ‘enhanced institutional adoption.’ These merchandise have attracted,

“$14.41billion in inflows and pushing the total net assets to $53.56bn. These ETFs now represent about 4.4% of Bitcoin’s total market cap. The IBIT ETF alone has drawn nearly $17.64bn, capturing over 1.5% of Bitcoin’s market cap.”

CEX markets share dynamics

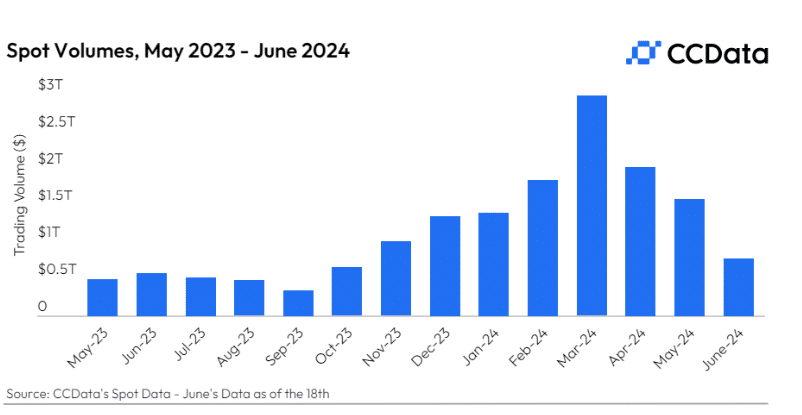

Large development was seen within the centralized change (CEX) sector too, with the primary half (H1) netting an combination spot quantity of $10.6 trillion – A 145% hike from H2 2023.

Supply: CCData

In the marketplace share entrance, the report added,

“Bitget, Crypto.com, and Bybit have seen the largest increases of 38.4%, 24.6%, and 22.2%, respectively, while Coinbase experienced minor declines of around 6.0%.”

Bitcoin and crypto markets: H2 2024 outlook

The report underscored that H1’s efficiency might be a strong basis for a fair higher H2. Notably, it seen the anticipated Fed rate of interest cuts later in 2024 and the upcoming launch of the Ethereum [ETH] ETF as key catalysts for the market.

Moreover, rising regulatory readability within the U.S and EU (by means of MiCA) are essential catalysts for H2 too. The truth is, AMBCrypto’s current July outlook report echoed these bullish prospects, particularly for BTC and memecoins.