- Bitcoin’s latest on-chain metrics indicated a possible market prime, with a cycle peak much like earlier years.

- Analysts noticed elevated promoting exercise, aligning with historic developments.

Bitcoin [BTC] was experiencing a downturn at press time, reversing its earlier rally above $63,000.

Over the previous week, the cryptocurrency has now seen a 1.1% drop, with a extra important 2.7% decline within the final 24 hours alone, bringing its buying and selling value right down to $60,929.

Amid these market actions, Charles Edwards, the founding father of Capriole Investments, has indicated that varied on-chain metrics counsel a possible weakening in Bitcoin’s market energy.

Bitcoin’s turning level?

Charles Edwards pointed to varied on-chain indicators as potentials of market exhaustion. One important signal is the conduct of Bitcoin’s Lengthy-Time period Holder (LTH) inflation fee, which Glassnode displays.

Supply: Capriole Investments

The LTH inflation fee, which measures the annualized fee at which long-term holders are promoting their Bitcoin relative to new cash mined, has seen a sustained enhance over the previous two years.

At present, it hovers close to a crucial mark traditionally related to market tops. Edwards famous that the LTH market inflation fee nearing the two.0 nominal inflation fee typically indicators a cycle peak.

At press time, the king coin was dangerously shut at 1.9.

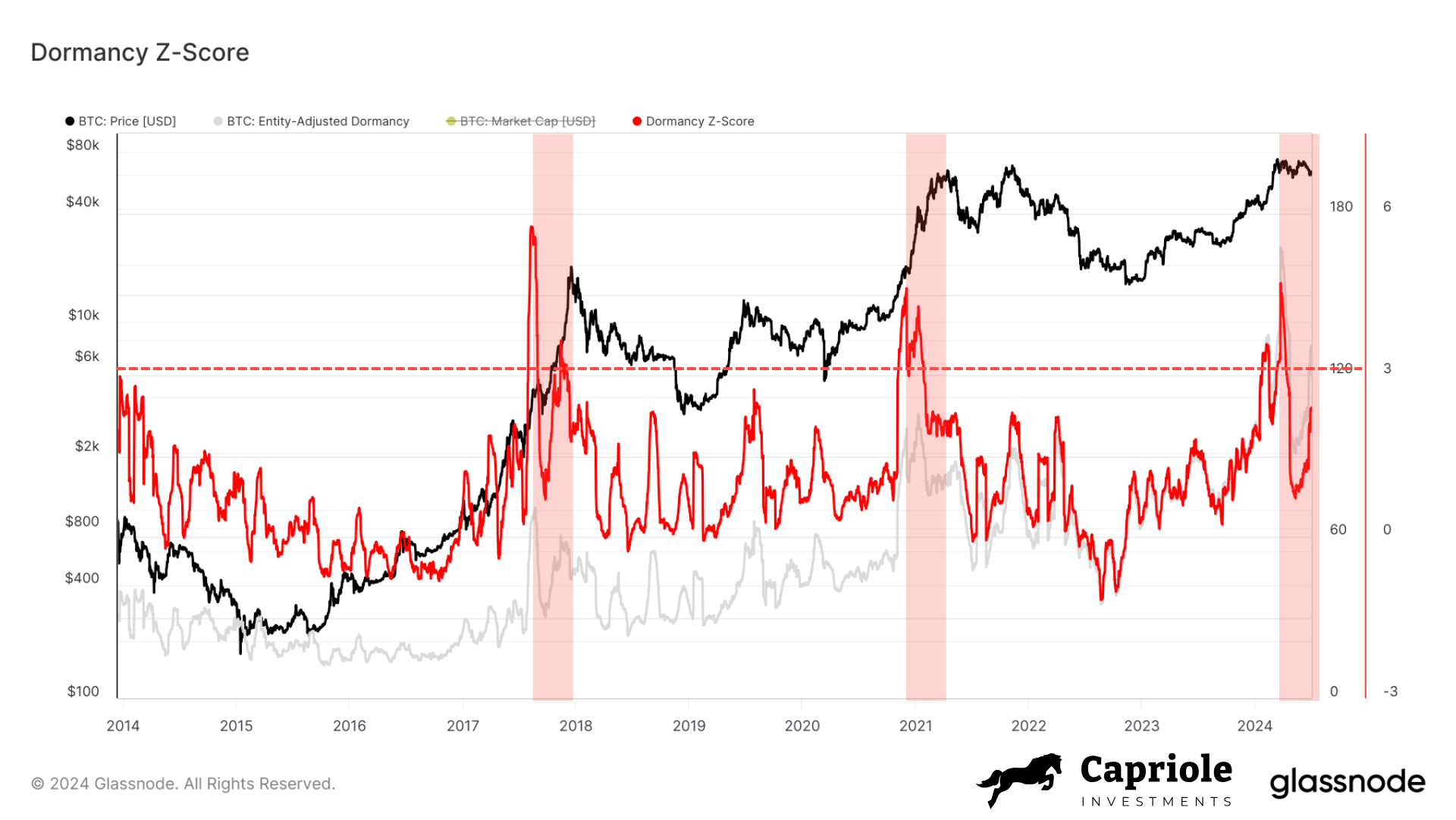

One other pivotal metric mentioned by Edwards was the Dormancy Move, which evaluated the worth of spent cash relative to their age and the general transaction quantity.

Latest knowledge has proven a pointy rise within the Dormancy Z-score, notably in April 2024, which might indicate that older cash are shifting at a fee suggestive of a cycle prime.

Supply: Capriole Investments

Edwards elaborated,

“Peaks in this metric (z-score) typically see cycle tops just three months later. Well, it’s now three months later. The price has only gone down, and the Dormancy Z-Score peak remains with a structure very comparable to the 2017 and 2021 tops.”

The Dormancy Move Z-score, at press time, steered that Bitcoin’s value could be peaking for this cycle, because it appeared overvalued primarily based on transaction volumes of older cash, doubtlessly indicating a broader market downturn.

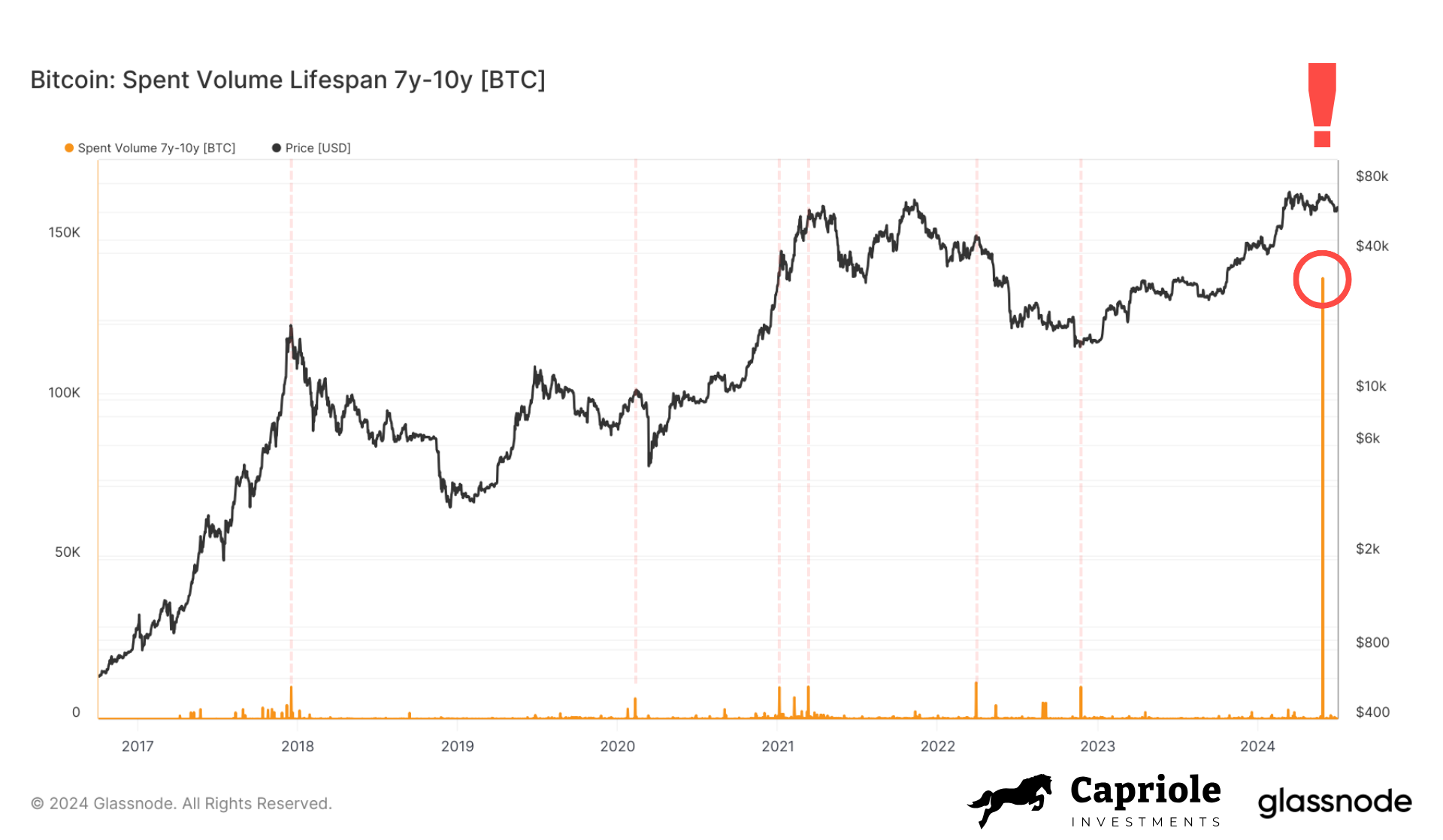

Moreover, spikes in Bitcoin’s Spent Quantity, notably from cash 7–10 years outdated, typically sign the highest of a cycle resulting from growing market danger.

Supply: Capriole Investments

Edwards famous a major enhance in Spent Quantity in 2024, describing the motion of an unprecedented quantity of Bitcoin on-chain as extraordinary.

He additionally talked about that over $9 billion price of Bitcoin from dormant accounts over ten years outdated has been mobilized, primarily related to the settlement actions of the defunct Mt. Gox trade.

Cycle prime in: Are merchants conscious?

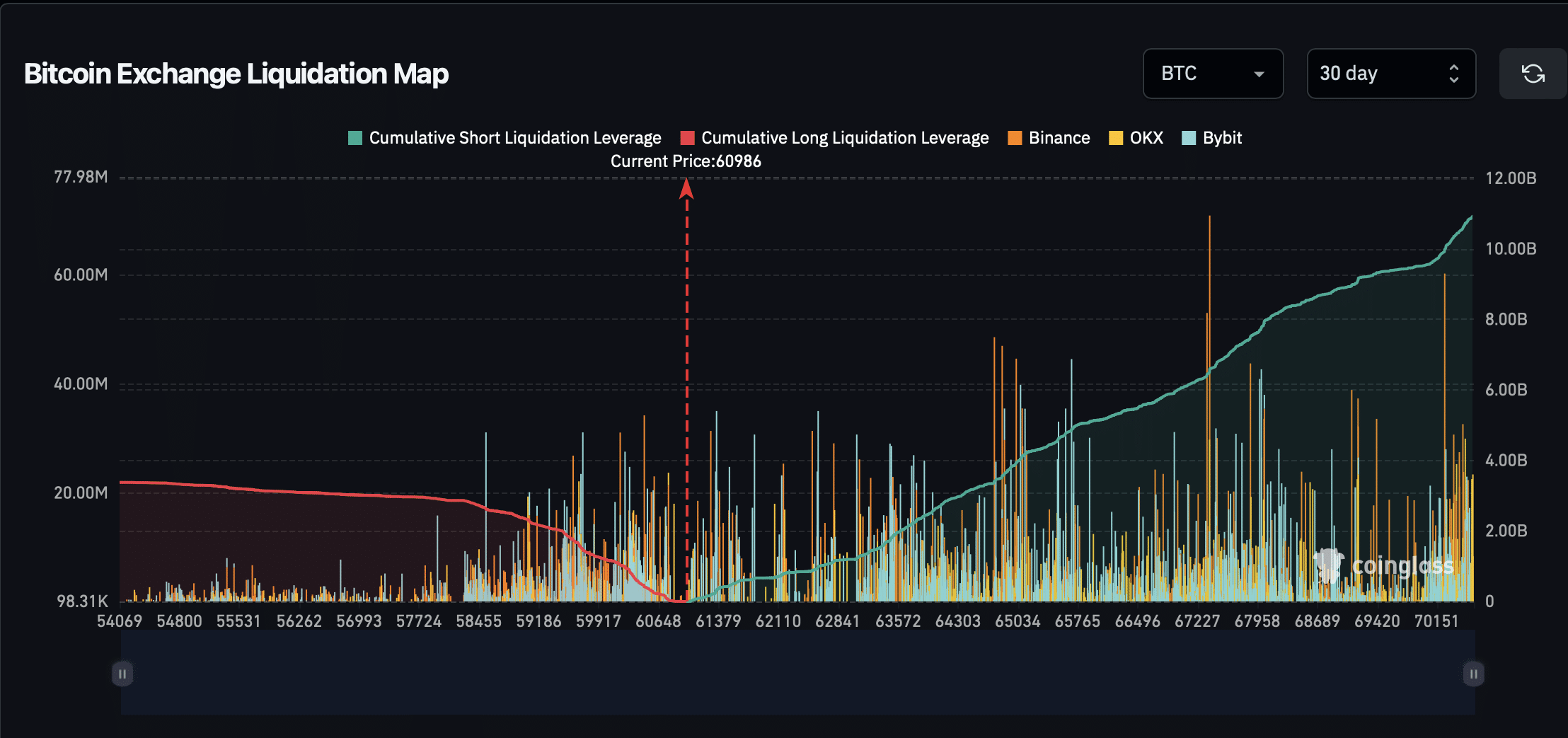

Whereas Charles Edwards highlighted potential weaknesses in Bitcoin’s value, it’s prudent to look at different views.

Analyzing BTC’s quick and lengthy liquidation leverage on Coinglass, knowledge revealed that almost all of liquidations over the previous 30 days have been lengthy positions, suggesting that many merchants anticipate an increase in Bitcoin’s worth.

Supply: Coinglass

Whether or not these lengthy positions will show worthwhile for the merchants or if Bitcoin’s value will proceed to say no, affirming Edwards’ perspective, solely time can inform.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In the meantime, when it comes to the place the worth is headed, AMBCrypto’s latest report has hinted at a constructive shift in miner exercise.

Particularly, there was a notable enhance in miners’ reserves, which might doubtlessly bolster Bitcoin’s value.