The winds of volatility swept by means of the crypto market in June, sending the worth of Bitcoin tumbling by $10,000. Information of a large Mt. Gox reimbursement, miner sell-offs, and government-related liquidations all contributed to the worth dip.

But, amidst the bearish sentiment, a stunning pattern emerged: traders in spot Bitcoin ETFs held their floor. This sudden resilience has analysts questioning their preliminary assumptions about each Bitcoin’s worth trajectory and the danger tolerance of a brand new era of traders – child boomers.

Bitcoin worth down in June. Supply: Coingecko

ETFs Present Regular Hand

Historically seen as a haven for stability, Alternate-Traded Funds (ETFs) have change into a gateway for mainstream traders to enter the risky world of cryptocurrency. Spot Bitcoin ETFs, which straight monitor the worth of Bitcoin, launched within the US earlier this yr and have been met with preliminary enthusiasm.

Nonetheless, issues arose when the Bitcoin worth began its descent in June. Analysts predicted a wave of panic promoting, particularly amongst millennials, as traders fled the sinking ship. However to everybody’s shock, spot Bitcoin ETFs defied expectations.

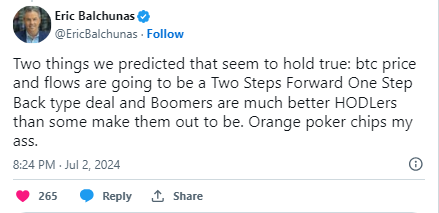

Was stunned to verify in on the bitcoin ETFs and see they really had web optimistic flows for 1D, 1W and 1M. Was anticipating worse given btc worth fell $10k. Throughout that stretch YTD web circulation held regular at +14.6b. Good signal that quantity held sturdy throughout a ‘step back’ section. pic.twitter.com/0YnRbD9W8g

— Eric Balchunas (@EricBalchunas) July 2, 2024

“I was expecting worse given the price fall,” admitted Eric Balchunas, a Bloomberg ETF analyst, in a current interview. Information confirmed that regardless of the worth drop, spot Bitcoin ETFs continued to see optimistic inflows all through June.

Much more remarkably, the year-to-date web circulation for these ETFs held regular at nearly $15 billion. This means a newfound maturity within the Bitcoin market, the place traders are more and more snug using out worth fluctuations and adopting a long-term perspective.

As of immediately, the market cap of cryptocurrencies stood at $2.2 trillion. Chart: TradingView.com

Boomers Embrace Crypto

One other sudden twist on this story is the habits of a demographic lengthy thought of risk-averse – child boomers. Historically, this era has been cautious of latest asset lessons, preferring the soundness of shares and bonds.

However, the optimistic circulation into Bitcoin ETFs factors in the direction of a possible shift of their funding technique. Balchunas believes these new entrants to the crypto house are proving to be surprisingly resilient HODLers (a crypto time period for holding onto an asset long-term).

In contrast to some traders who may be swayed by short-term worth actions, boomers appear to be specializing in the long-term potential of Bitcoin, Balchunas defined. This could possibly be resulting from a mixture of things, together with the rising institutional adoption of cryptocurrency lending it credibility and the potential for prime returns, even contemplating the current worth correction.

The current resilience of spot Bitcoin ETFs paints an optimistic image for the way forward for the cryptocurrency market. It means that traders have gotten extra snug with the inherent volatility of Bitcoin and are adopting a long-term outlook.

Featured picture from Unsplash, chart from TradingView