- Regardless of excessive community exercise, LTC was down by almost 15% within the final 30 days.

- Most metrics and indicators hinted at a continued worth decline.

Litecoin [LTC] has didn’t earn buyers income because it continues to drop on the record of the highest 30 cryptos. Nonetheless, the coin did handle to excel on a specific entrance.

The truth is, Litecoin outshone each Bitcoin [BTC] and Ethereum [ETH], which appeared fairly optimistic for the blockchain’s future.

Litecoin surpasses Bitcoin, Ethereum

Litecoin not too long ago posted a tweet mentioning an fascinating improvement. As per the tweet, LTC continued to dominate BTC and ETH when it comes to genuine energetic addresses.

This intently signified the rise in LTC’s adoption and excessive community utilization over the previous months.

The truth is, AMBCrypto’s evaluation of Santiment’s information additionally revealed an analogous image. Litecoin’s day by day energetic addresses remained excessive all through the final 30 days, because the quantity exceeded 858k on the sixth of June.

Supply: Santiment

LTC bulls take the again seat

Although the blockchain’s community exercise and utilization have been commendable, the identical can’t be stated for LTC’s worth motion. CoinMarketCap’s information revealed that LTC’s worth dropped by almost 15% within the final 30 days.

On the time of writing, LTC was buying and selling at $70.61 with a market capitalization of greater than $5.27 billion, making it the twenty second largest crypto.

Issues for LTC can worsen within the coming days as a key metric hinted at a worth correction.

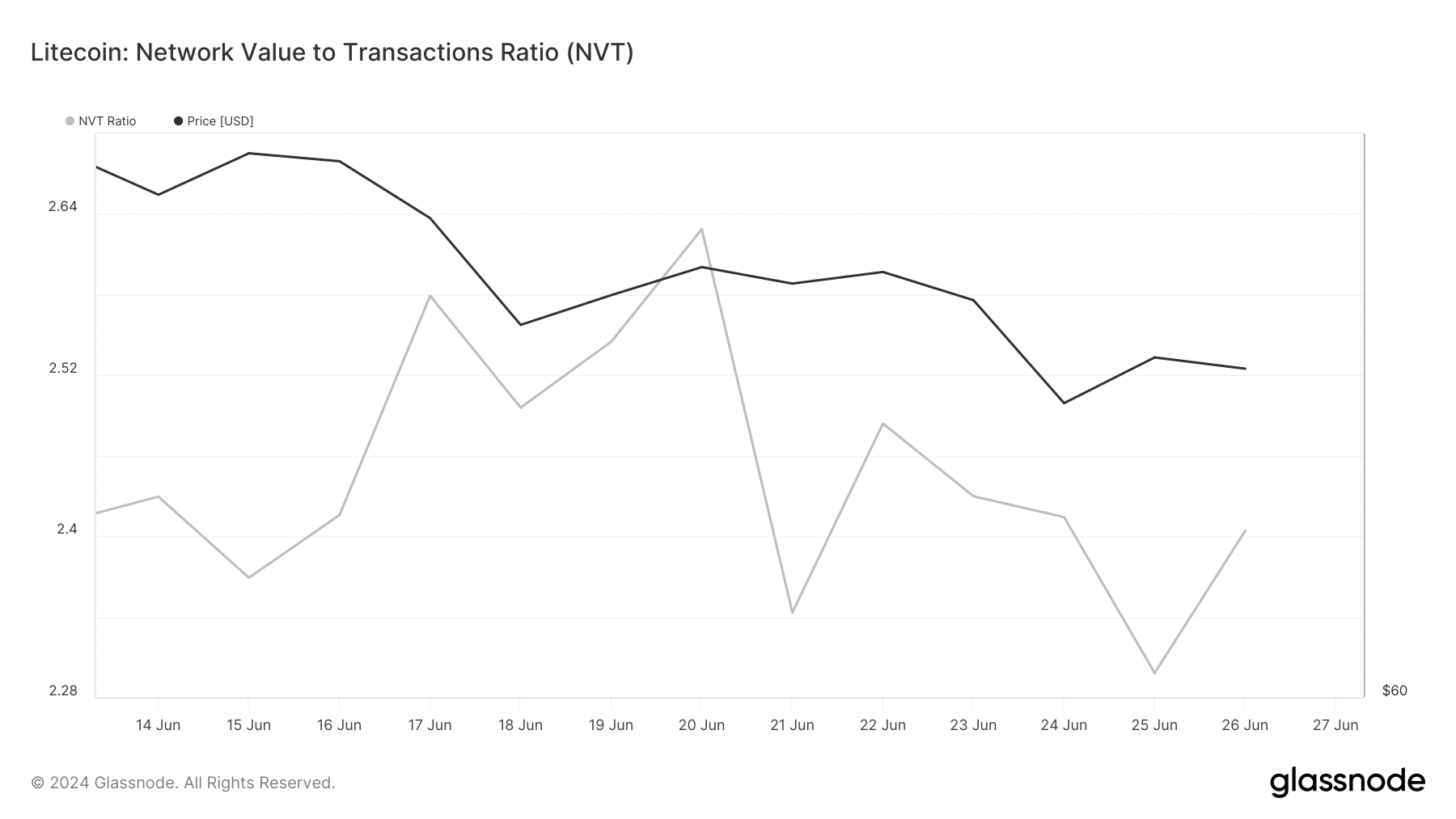

AMBCrypto’s take a look at Glassnode’s information clearly revealed a rise within the coin’s NVT ratio. Often, an increase within the metric hints that an asset is overvalued, rising the probabilities of a worth drop within the following days or perhaps weeks.

For the uninitiated, the NVT ratio is computed by dividing the market cap by the transferred on-chain quantity, measured in USD.

Supply: Glassnode

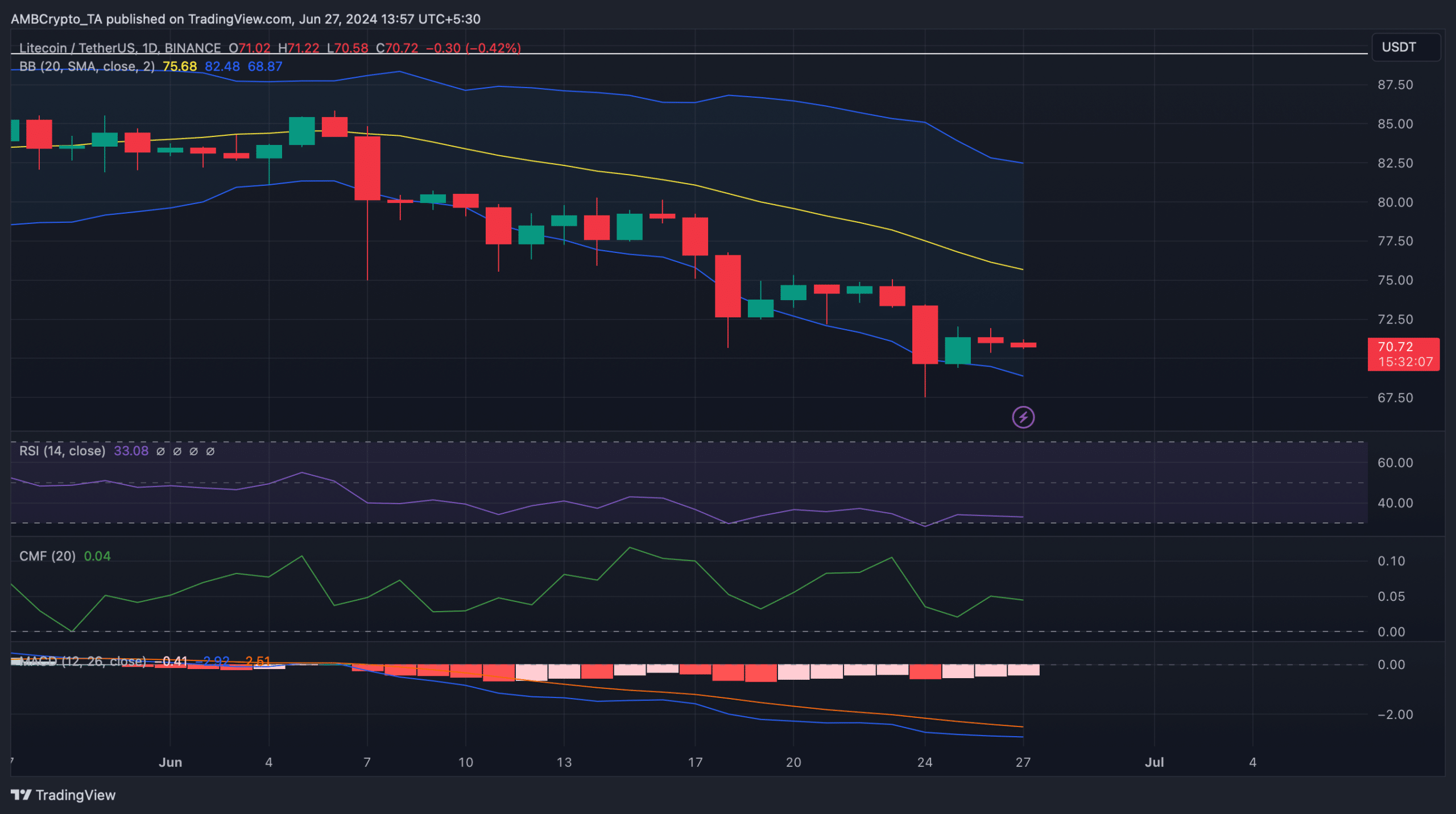

To see whether or not the bears would proceed to dominate, AMBCrypto then analyzed Litecoin’s day by day chart. We discovered that a lot of the market indicators have been within the sellers’ favor.

As an example, the MACD displayed a bearish benefit out there. The Chaikin Cash Move (CMF) registered a downtick and was headed in the direction of the impartial mark.

The same declining pattern was additionally seen on the Relative Power Index’s (RSI) chart, hinting at a continued worth drop.

Nonetheless, LTC’s worth had touched the decrease restrict of the Bollinger Bands, hinting at a potential restoration quickly.

Supply: TradingView

Reasonable or not, right here’s LTC’s market cap in BTC phrases

Our evaluation of Hyblock Capital’s information revealed that if the worth decline continues, buyers may witness LTC dropping to $67 within the coming days.

Nonetheless, within the occasion of a pattern reversal, LTC may first eye $81.4 to be able to start a full-fledged restoration.

Supply: Hyblock Capital