Picture supply: Getty Photos

Electrical equipment retailer AO World (LSE: AO) has been on a inventory market rollercoaster journey previously few years. After itemizing at £2.85 in 2014, the AO World share value hit £4.12 on its first day of buying and selling, earlier than falling to lower than one seventh of that by April 2020.

The next yr it hit £4.29, earlier than dropping over 90% of its worth by 2022. Over the previous yr, the shares are up 36%.

With the corporate having launched its last outcomes in the present day (26 June), I’ve been whether or not I ought so as to add the corporate to my portfolio within the hope of the AO World share value hitting its outdated highs above £4 once more.

Gross sales are down, however earnings are up

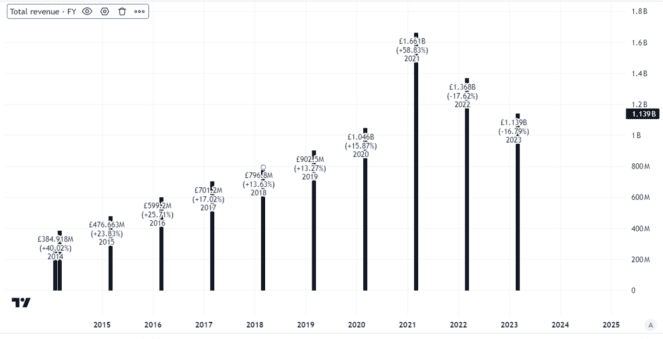

Final yr noticed revenues fall 9% to £1.0bn. That follows a latest pattern of declining revenues for the corporate after years of steadily rising gross sales previous to the pandemic.

Created utilizing TradingView

The constantly declining gross sales pattern is a transparent concern to me. Nonetheless, gross sales are nonetheless above the place they had been earlier than the pandemic, despite the fact that they’re effectively under their pandemic peak.

Partially, these declining gross sales mirror an elevated give attention to profitability. The corporate says it has made a “strategic pivot to focus on profit and cash generation”. That has included strikes like exiting the German market and controlling overheads.

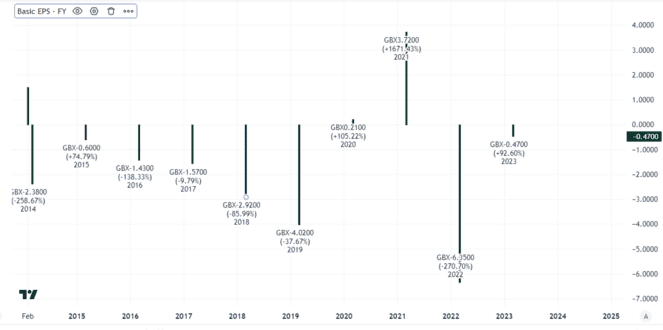

The push for profitability appears to be working. Final yr, fundamental earnings per share practically quadrupled to 4.3p. That’s the greatest efficiency since itemizing.

Created utilizing TradingView

Funding case seems extra enticing

Declining revenues concern me as in the long run, I feel mass market retail is about promoting excessive volumes. However eliminating some unprofitable gross sales to spice up earnings could make good monetary sense, as I feel AO World’s efficiency final yr clearly demonstrates.

Internet debt greater than halved to £31m. The UK enterprise elevated its money influx to £22m. On the strategic priorities of enhancing profitability and cashflows, I feel the enterprise is headed in the correct route.

For the present yr, the corporate expects to ship double-digit income progress and adjusted revenue earlier than tax of £36m-£41m. That might be an enchancment on final yr’s adjusted revenue earlier than tax of £34m.

With a sizeable buyer base, extra targeted operation and aggressive place in a market space that may see long-term demand, I’m optimistic concerning the funding case for AO World.

Excessive P/E ratio

Nonetheless, even with the a lot stronger fundamental earnings per share, the corporate is buying and selling on a price-to-earnings (P/E) ratio of 27, which I see as costly.

Hitting a £4 share value implies a potential P/E ratio of 93. For a house home equipment retailer with pretty modest profitability that strikes me as far too expensive.

In any case, web revenue margin final yr was simply 2.4%. If a competitor – and there are numerous – decides to low cost closely, AO World dangers dropping gross sales, or else chopping its already skinny revenue margins.

The anticipated progress in adjusted revenue earlier than tax this yr just isn’t essentially the identical as a progress in earnings. For now, a minimum of, I feel the shares are pricy as they’re. I might be shocked in the event that they hit £4 any time quickly and haven’t any plans to take a position.