- Crypto Worry and Greed confirmed that the market has descended into concern.

- Lengthy liquidation quantity additionally spiked.

The latest drop in Bitcoin’s [BTC] value has had a notable ripple impact throughout the cryptocurrency market. This decline has impacted market sentiment considerably, as evidenced by modifications within the Worry and Greed crypto index.

The impression of the value drop was additionally seen within the liquidation map.

Worry dominates crypto

The press time studying of the Worry and Greed crypto Index, at 30, as reported by Coinglass, clearly indicated that concern was dominating the market sentiment.

This measure gauges the final sentiment amongst cryptocurrency traders by compiling knowledge throughout varied sources, together with market volatility, social media sentiment, developments, and different related components.

Supply: Coinglass

A rating of 30 falls within the “fear” class, suggesting that traders are involved about potential draw back dangers. This sentiment usually arises in response to latest destructive market occasions, akin to important value drops.

This will result in a extra cautious strategy amongst traders.

In such situations, buying and selling volumes would possibly lower as traders maintain off on shopping for, fearing additional losses. Conversely, they could dump their holdings to keep away from deeper losses in the event that they anticipate additional downtrend.

This shift in direction of concern displays rising uncertainty and pessimism concerning the market’s near-term prospects.

Market sees elevated liquidation

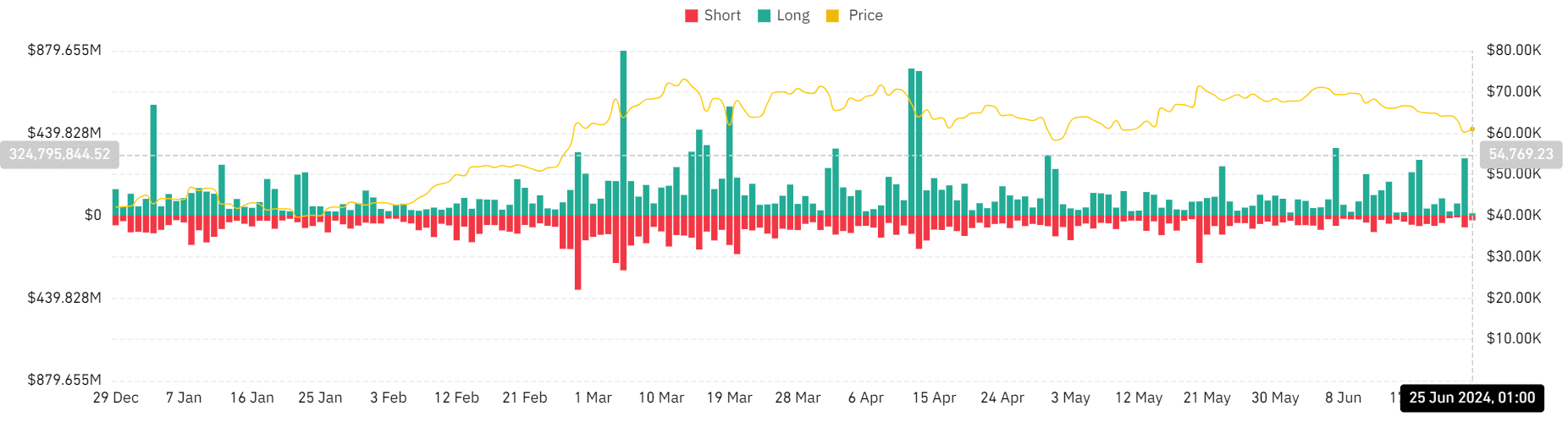

The evaluation of the liquidation chart highlights a major spike in liquidations on the twenty fourth of June, totaling over $367 million.

The liquidations have been dominated by lengthy positions, which accounted for over $305 million. It’s a vital issue that contributed to the shift in direction of concern within the Worry and Greed crypto index.

When lengthy positions liquidate on such a big scale, it signifies that many traders, who have been betting on the value of cryptocurrencies to rise, have been pressured to exit their positions.

This will result in a pointy decline in costs because the market is flooded with promote orders.

Supply: Coinglass

The smaller quantity of quick liquidations, over $62 million, confirmed that fewer merchants betting in opposition to the market forcefully closed their positions.

This prompt that traders anticipated continued development, which didn’t materialize.

How Worry and Greed crypto may have formed up

This imbalance between lengthy and quick liquidations usually exacerbates downward value actions, growing concern and uncertainty out there. A spike in brief liquidations sometimes has the other impact.

It signifies that pessimistic merchants are being squeezed out, which may push costs upward and doubtlessly shift sentiment in direction of greed if sustained.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The latest occasions, as illustrated by these liquidations, are key indicators of market sentiment and dynamics.

They mirror not solely the reactions of particular person merchants to cost actions, but in addition the broader market psychology that may drive future buying and selling conduct.