Picture supply: Getty Photos

I plan on dividends enjoying an necessary position in my retirement. That’s why I make investments frequently to generate a sizeable future passive revenue from my Shares and Shares ISA.

Right here, I’ll discover how £9,000 invested as we speak might lay the foundations for a sizeable second revenue.

Superb progress

Earlier than attending to the maths, one inventory I personal however would nonetheless purchase as we speak is Video games Workshop (LSE: GAW). That is the maker of the Warhammer tabletop wargame franchise.

On 19 June, the FTSE 250 agency launched a cracking set of full-year figures masking the 53 weeks to 2 June. It mentioned income can be a minimum of £490m, representing not less than 10% progress on the 12 months earlier than.

Given the robust client backdrop, that is very pleasing to see. It means its high line has greater than doubled since 2018!

In the meantime, annual pre-tax revenue’s anticipated to be not less than £200m, up from £171m, and greater than market forecasts.

Additionally encouraging was that licensing revenue, which comes from permitting different firms to make use of its mental property (IP), rose 20% to £30m. This revenue’s helpful as a result of it leverages the corporate’s current IP and expands its model with out the necessity for important further funding.

There was no additional commentary on its take care of Amazon to make Warhammer 40,000 content material. Maybe we’ll hear extra about this when the complete annual report’s launched on 30 July.

Nonetheless, the market appeared blissful sufficient. The inventory rose 13% within the days following this replace.

‘Wokehammer’ backlash

One potential concern I’d spotlight right here is current on-line squabbles in regards to the agency including a feminine character to a beforehand all-male military squadron. Some long-time clients weren’t blissful about this.

Whereas this will likely look like a storm in a teacup, it might have an effect on gross sales if teams of followers boycott new merchandise in protest.

Disney’s probably the most high-profile firm to get caught up in such stuff. I’m positive Video games Workshop will get this stability proper, nevertheless it’s one thing value noting.

Loads of money

A key factor I like in regards to the inventory from a wealth-building perspective is that it frequently pays dividends. It presently yields 4%, which is excessive on condition that the share value has greater than doubled in 5 years.

After all, this may not at all times be the case as payouts aren’t assured. However the firm does have an amazing file of rewarding shareholders (and staff) with rising revenue. I prefer to see that.

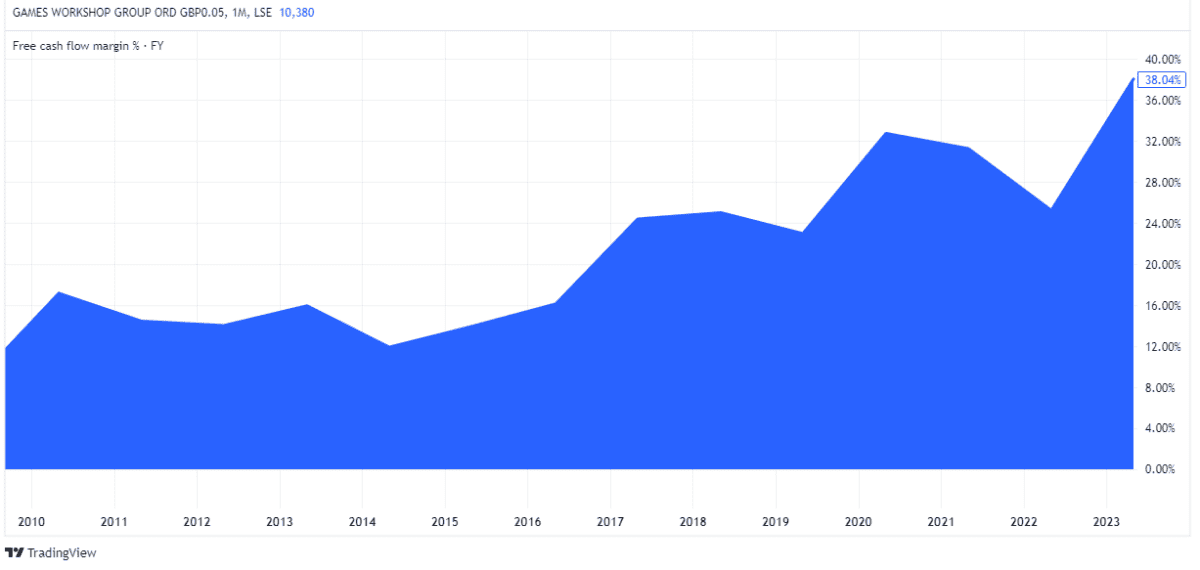

Extra importantly, these dividends ought to stay beneficiant given how a lot money the asset-light agency generates. Its free money movement margin has been trending greater for years and is now above 30%.

Revenue era

Let’s assume I make investments my £9,000 within the inventory and the 4% yield is sustained, together with 4% common share value progress (far lower than prior to now). On this conservative situation, I’d have £41,948 after 20 years.

Nonetheless, if I invested an extra £600 a month in different shares returning 8%, my ultimate determine can be £383,515, assuming I reinvested dividends.

By this level, I’d be receiving £19,175 in revenue yearly if my portfolio had been yielding simply 5%.

This exhibits how investing in high-quality shares with reasonably priced sums of cash can lead to engaging passive revenue down the street.