- Bitcoin’s Taker Purchase Promote Ratio has risen over one.

- BTC remained within the $66,000 value vary.

Prior to now few days, the worth of Bitcoin [BTC] has fallen, hitting new lows every day. Regardless of the obvious decline, one metric means that the worth may decide up quickly.

Bitcoin takers and sellers

AMBCrypto’s evaluation of the Bitcoin Taker Purchase Promote Ratio on CryptoQuant confirmed a current constructive pattern.

The chart indicated that on the finish of buying and selling on the fifteenth of June, the ratio was trending under one, signaling a bearish sentiment.

Nonetheless, the metric has been rising as of the earlier buying and selling session.

Additional evaluation revealed that it had spiked above one on some exchanges, indicating a shift in direction of a bullish sentiment as extra purchase orders are being executed in comparison with promote orders.

Supply: CryptoQuant

As of this writing, the BTC Taker Purchase Promote Ratio has damaged above one. This indicated that purchasing strain was exceeding promoting strain throughout many of the exchanges.

This shift urged that the market sentiment is turning into extra constructive, and it may result in a possible value improve for BTC quickly.

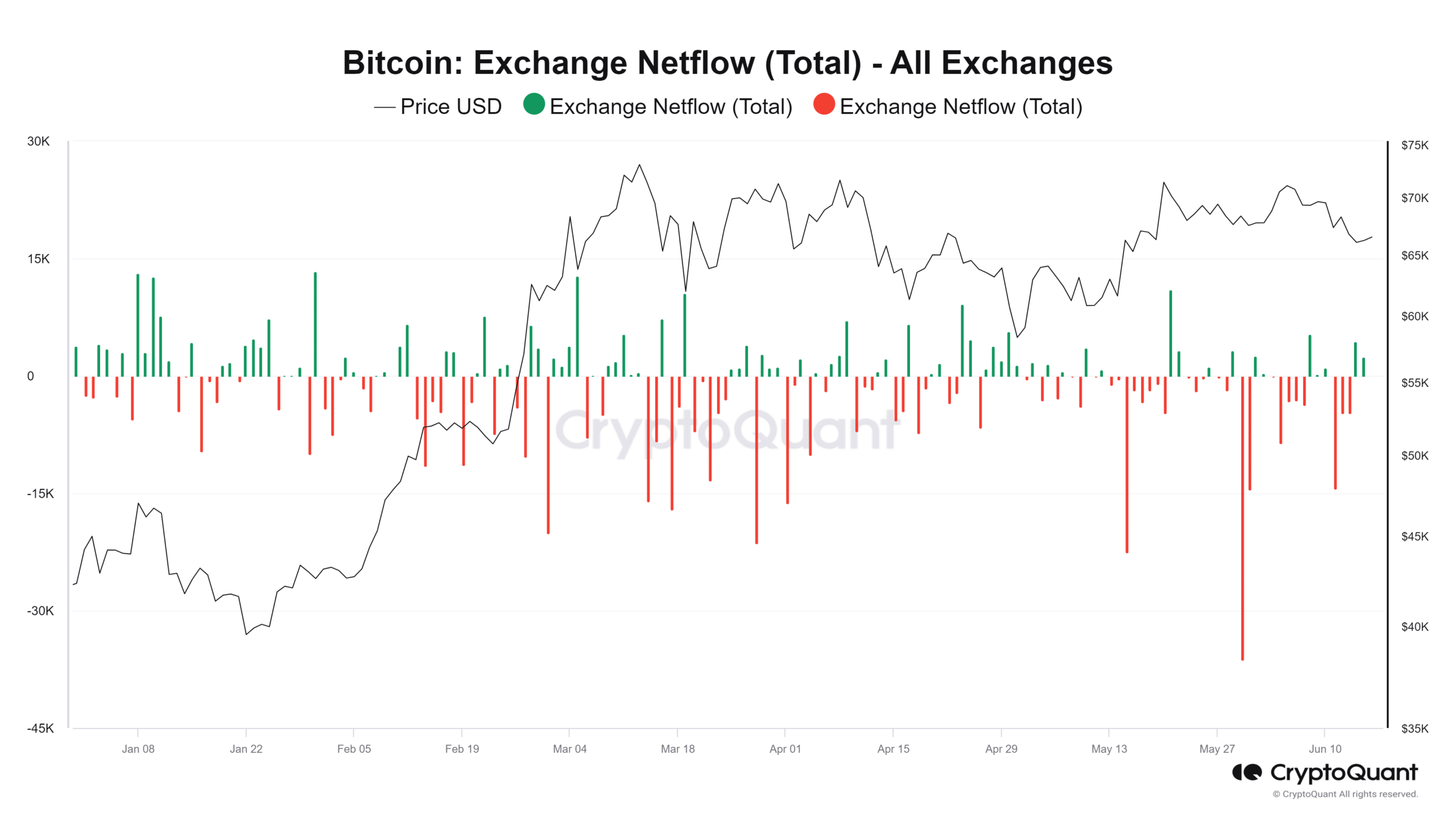

Inflows dominate, however there’s a catch

Bitcoin’s Alternate Netflow confirmed that it has been constructive for the previous few days. This indicated that extra BTC is being despatched to exchanges than withdrawn from them.

Whereas this may initially look like a bearish sign, additional evaluation revealed that the influx continues to be comparatively low in comparison with the outflow in the previous couple of weeks.

Supply: CryptoQuant

Regardless of the current improve in BTC being despatched to exchanges, the general pattern of accumulation and withdrawal to non-public wallets stays robust, which may nonetheless help a bullish outlook for BTC.

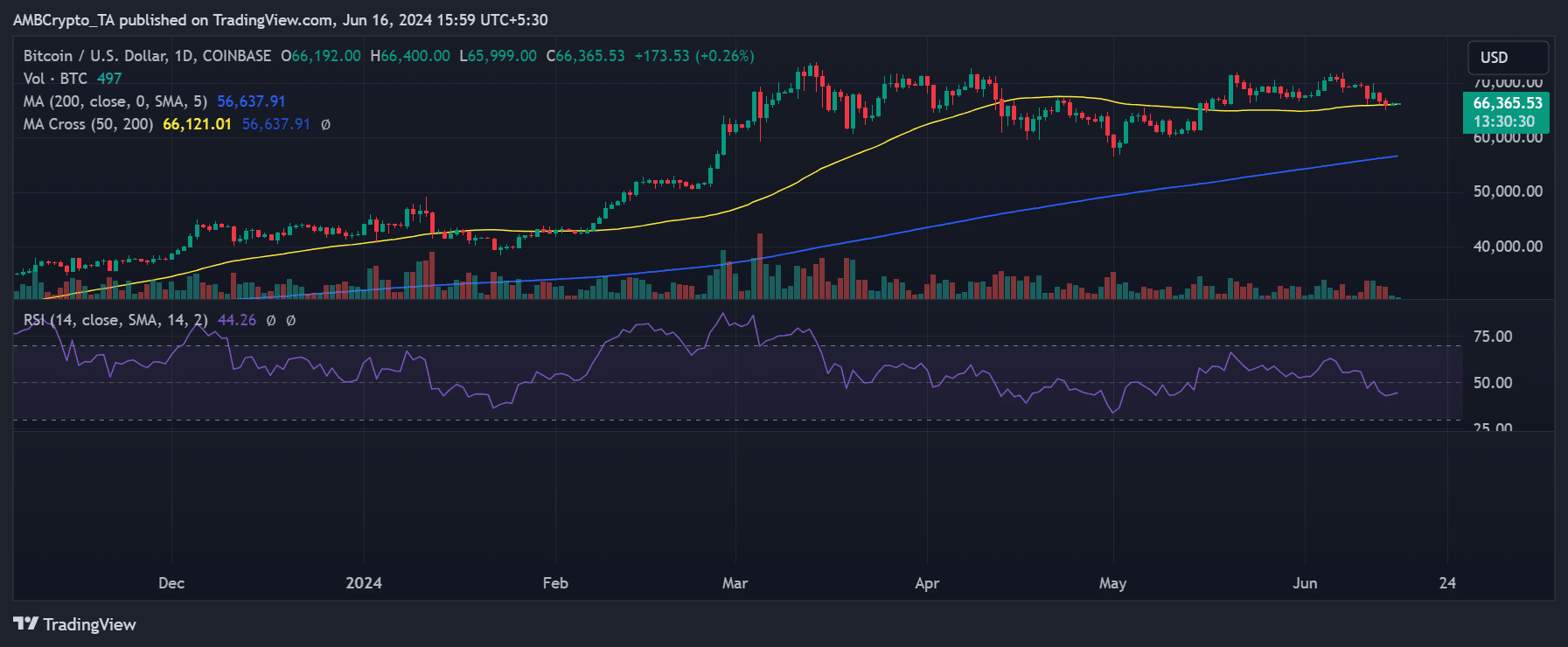

Bitcoin stays bearish

AMBCrypto’s evaluation of Bitcoin on a day by day timeframe confirmed an general decline previously few days, with minor uptrends not being ample to stabilize it.

As of this writing, BTC was buying and selling at round $66,360 regardless of a minor uptrend.

Supply: TradingView

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Moreover, BTC’s help was now strained, as the worth was resting closely on it. The final help vary is round $65,000, and Bitcoin continues to be buying and selling above this degree for now.

Moreover, the Relative Energy Index (RSI) remained under the impartial line. As of this writing, the RSI is round 45, indicating that BTC is in a bear pattern.