- Bitcoin’s value dropped by over 6% within the final seven days.

- A number of metrics hinted at a market backside, however indicators steered in any other case.

Bitcoin [BTC] witnessed a substantial value correction final week, sparking concern amongst buyers. However issues may take a U-turn quickly, as there have been probabilities of a pattern reversal. This gave the impression to be the case as BTC was mimicking its 2017 value pattern.

Bitcoin’s historic pattern

Traders didn’t make a revenue final week as BTC’s chart remained crimson. In line with CoinMarketCap, BTC was down by greater than 6% within the final seven days, pushing its value as soon as once more beneath the $67k mark.

On the time of writing, BTC was buying and selling at $66,896.42 with a market capitalization of over $1.32 trillion.

In the meantime, Milkybull, a preferred crypto analyst, lately posted a tweet highlighting an attention-grabbing growth. As per the tweet, BTC was mimicking a pattern that it adopted again in 2017 earlier than starting a bull rally.

The tweet revealed that BTC’s value was about to succeed in a market backside, after which, if historical past repeats itself, BTC’s value may kickstart a bull rally. Moreover, an indicator was additionally exhibiting a bullish divergence, identical to in 2017.

There was much more excellent news. AMBCrypto’s evaluation of Glassnode’s knowledge additionally revealed a bullish indicator.

In line with BTC’s Pi Cycle High indicator, Bitcoin’s value was resting at its market backside, and if a pattern reversal occurs, then it’d contact $89k quickly.

Supply: Glassnode

Is BTC making ready for a rally?

AMBCrypto then checked CryptoQuant’s knowledge to see whether or not metrics additionally hinted at a value improve. BTC’s change reserve was dropping, which means that promoting stress on BTC was low.

Supply: CryptoQuant

Its Binary CDD was additionally inexperienced, which means that long-term holders’ actions within the final seven days had been decrease than common. They’ve a motive to carry their cash. Nonetheless, the remainder of the metrics appeared bearish.

As an example, BTC’s aSORP steered that extra buyers are promoting at a revenue, which could trigger additional hassle for BTC’s already bearish value motion.

On high of that, BTC’s concern and greed index had a price of 63% at press time, which means that the market was in a “greed” part. Every time the metric reaches this degree, it signifies that the probabilities of a value decline are excessive.

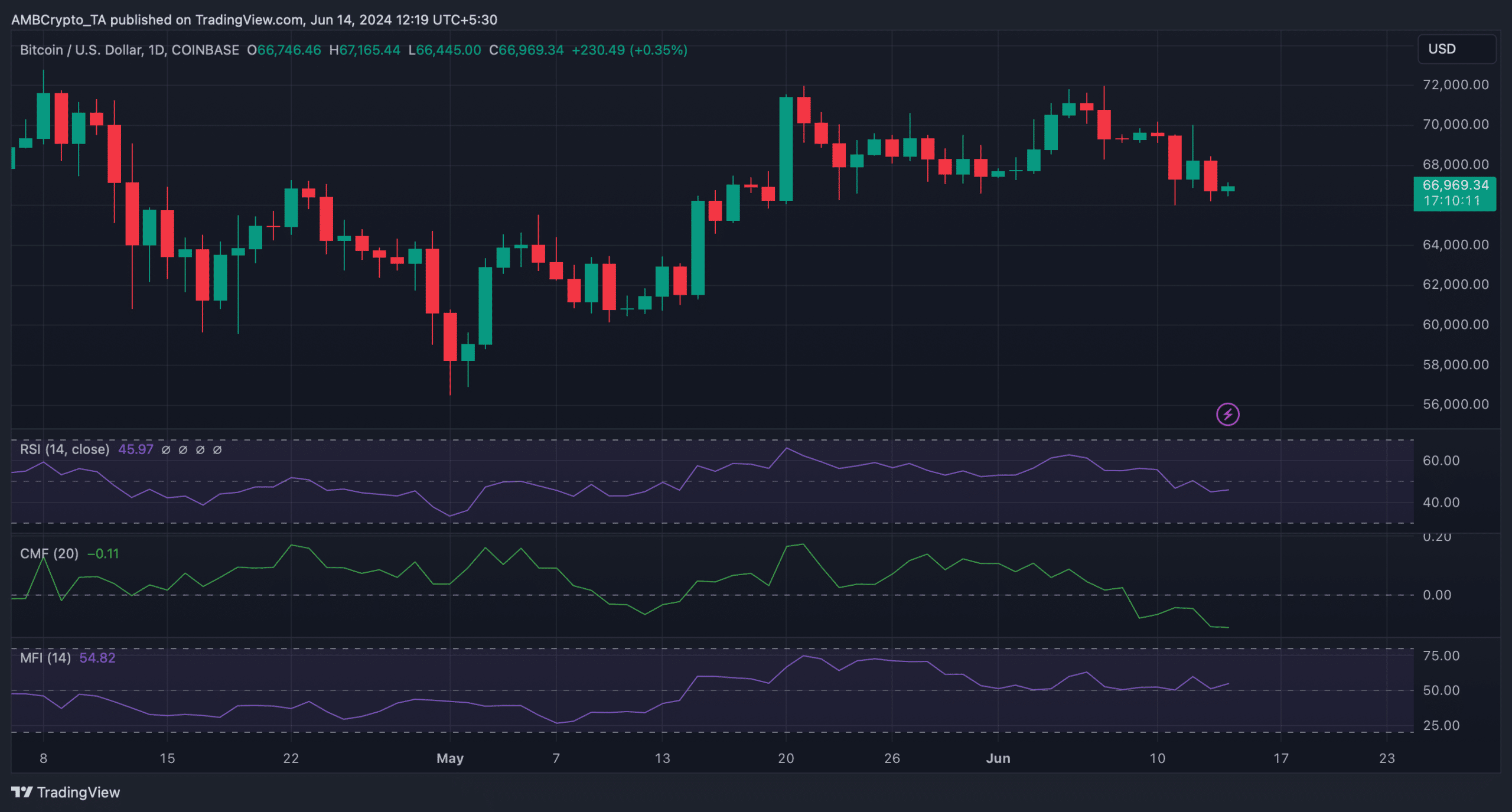

A number of of the market indicators additionally appeared fairly bearish. For instance, its Chaikin Cash Move (CMF) had registered a pointy downtick.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

Moreover, the Relative Power Index (RSI) was additionally resting beneath the impartial mark, indicating an additional value decline.

Nonetheless, the Cash Move Index (MFI) supported the bulls because it moved northwards from the impartial mark.

Supply: TradingView