- Crypto Worry and Greed index recommended that the patrons had been getting grasping regardless of declining costs.

- BTC and ETH holders remained worthwhile, sentiment round SOL declined.

One would anticipate that the latest correction in costs for many cash may influence the general market sentiment negatively. Nevertheless, information signifies that the market was extra optimistic than ever.

Crypto Worry and Greed index reveals bulls are grasping

The crypto greed and concern index was at 70 on the time of writing indicating that many of the market nonetheless had an urge for food for purchasing as costs of varied cryptocurrencies fell.

Supply: different.me

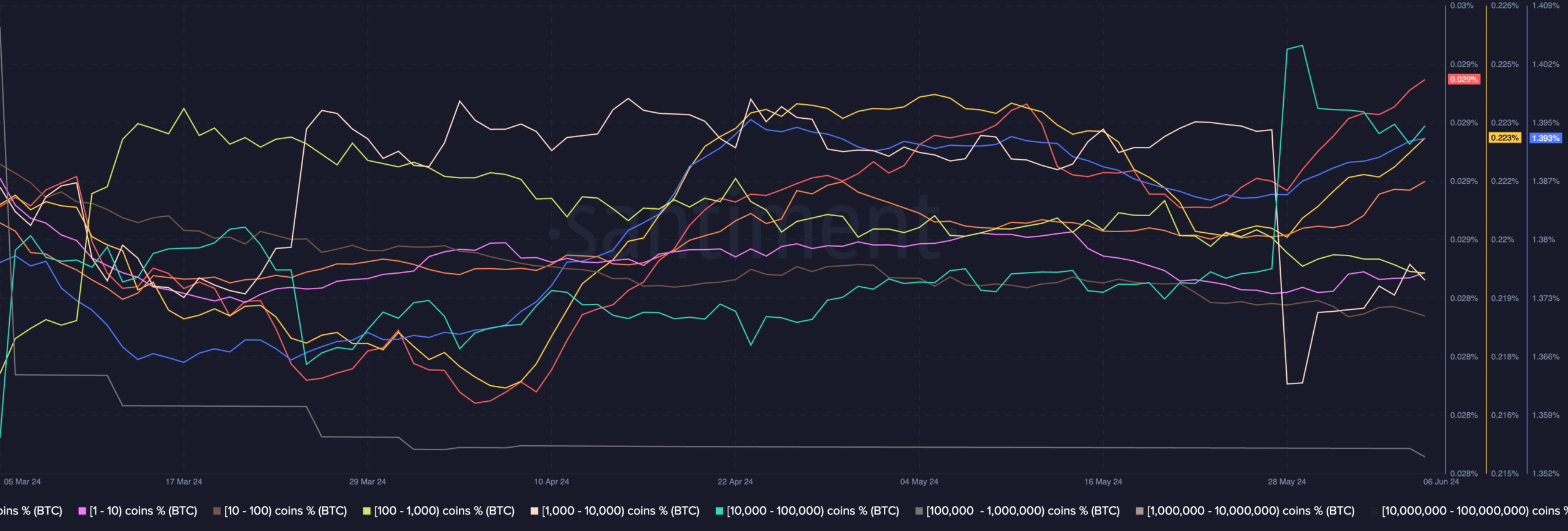

One of the vital telling indicators of curiosity showcased by addresses could be the behaviour of whales and retail buyers.

AMBCrypto’s evaluation of Santiment’s information indicated that whale addresses had started accumulating giant quantities of BTC. Coupled with that retail buyers had been displaying curiosity within the king coin as properly.

Supply: Santiment

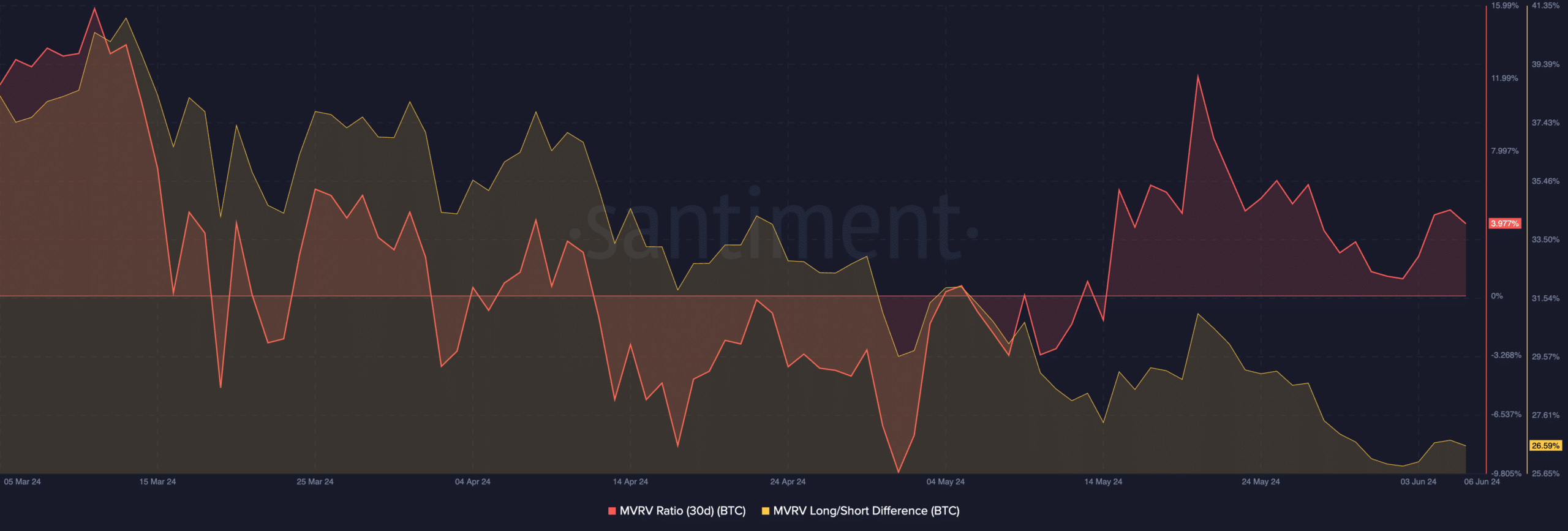

Regardless of the latest correction of BTC’s worth, the general addresses remained largely worthwhile as indicated by the MVRV ratio. Despite the fact that excessive profitability helps with the sentiment across the king coin, it additionally will increase the probabilities of profit-taking and future sell-offs.

The Lengthy/Brief distinction for BTC had additionally declined considerably throughout this era implying that long run holders of BTC had fallen which will increase the chance of a unload.

Supply: Santiment

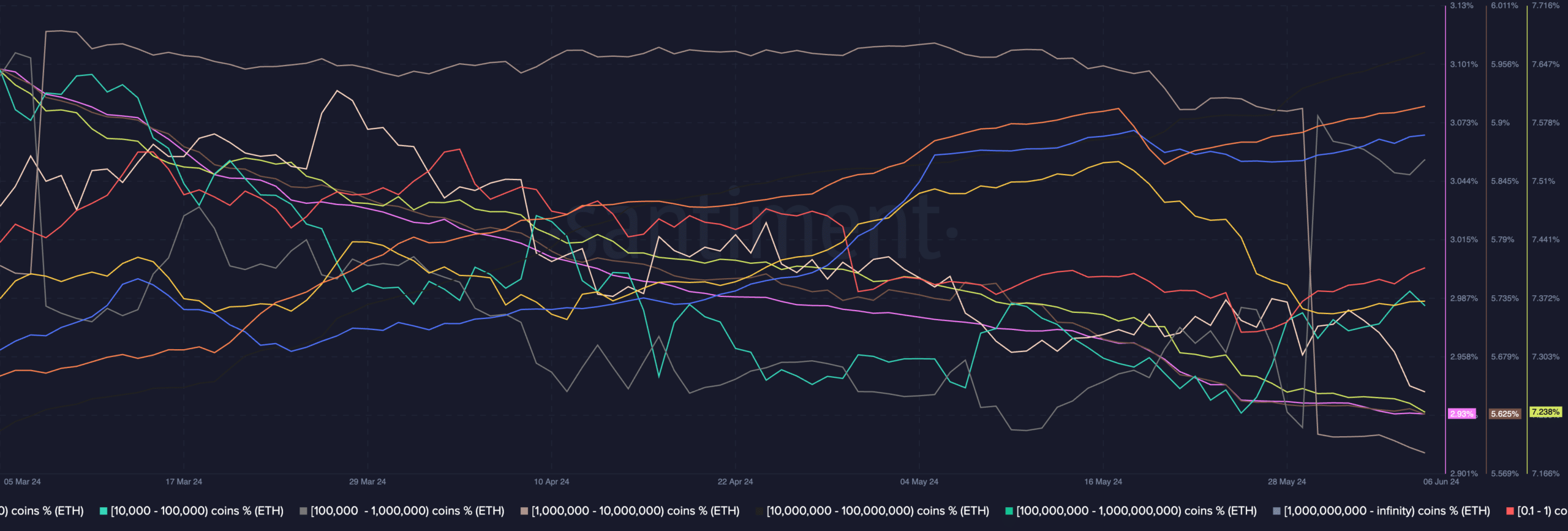

Ethereum nevertheless didn’t see the identical degree of behaviour from addresses. Retail buyers confirmed extra greed over the previous few days and engaged in important quantity of accumulation.

Nevertheless, the identical couldn’t be stated for whales that really bought their holdings.

Supply: Santiment

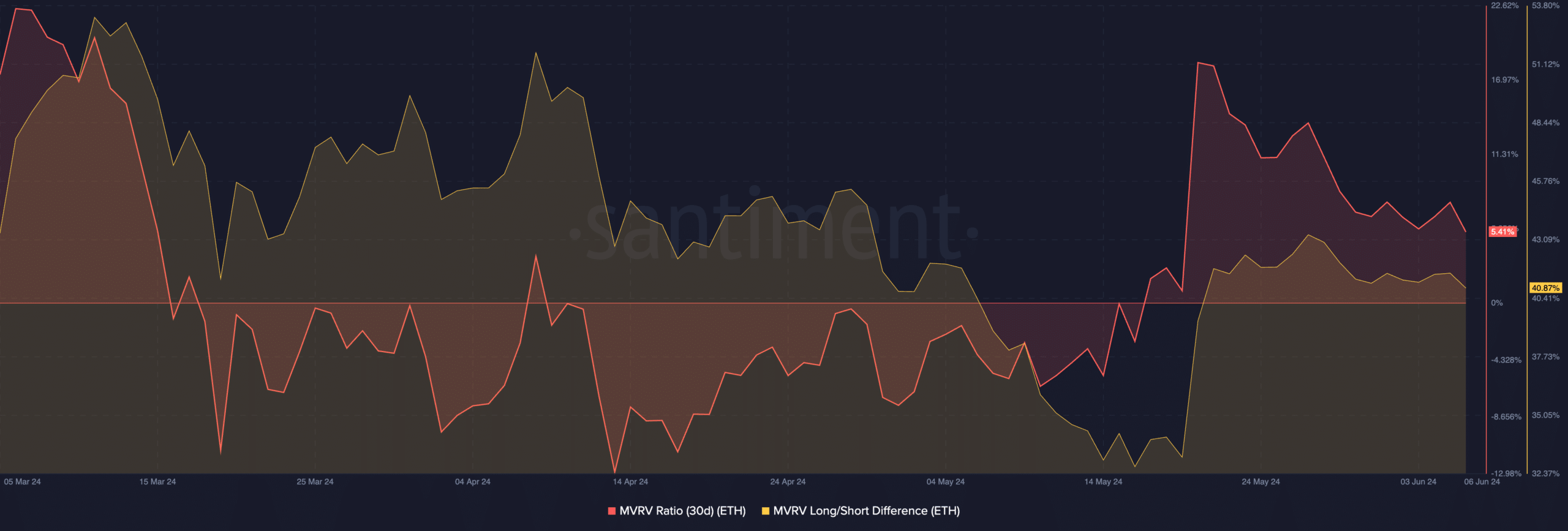

Coming to the state of its holders, it was seen that ETH holders had been extraordinarily worthwhile similar to BTC holders.

Nevertheless, the presence of long run holders for ETH was considerably increased in comparison with BTC addresses. The long run holders may assist ETH develop sustainably sooner or later.

Supply: Santiment

Destructive outlook for SOL

One other coin that was majorly affected by the latest change in tides was SOL. Over the previous week, the value of SOL fell by greater than 12 %.

Is your portfolio inexperienced? Try the SOL Revenue Calculator

The social quantity round SOL additionally fell indicative of the declining reputation of the token.

Furthermore, the weighted sentiment across the SOL token additionally fell, implying that the variety of damaging feedback round SOL had outnumbered the constructive ones on the time of writing.

Supply: Santiment