- Whales amassed vital quantities of BTC over the previous few days.

- Retail curiosity was excessive, open curiosity additionally surged.

Whales amassed a big quantity Bitcoin [BTC] over the previous few weeks. Information urged a renewed surge in Bitcoin shopping for by whales, reaching a two-month excessive.

Their Bitcoin holdings have additionally hit a document peak. This renewed shopping for spree signifies that enormous buyers understand present costs, that are already extraordinarily excessive, as a lovely entry level for accumulating Bitcoin.

Whereas previous efficiency just isn’t essentially indicative of future outcomes, whales’ historic affect in the marketplace suggests their shopping for exercise might be a bullish indicator for Bitcoin.

Supply: CryptoQuant

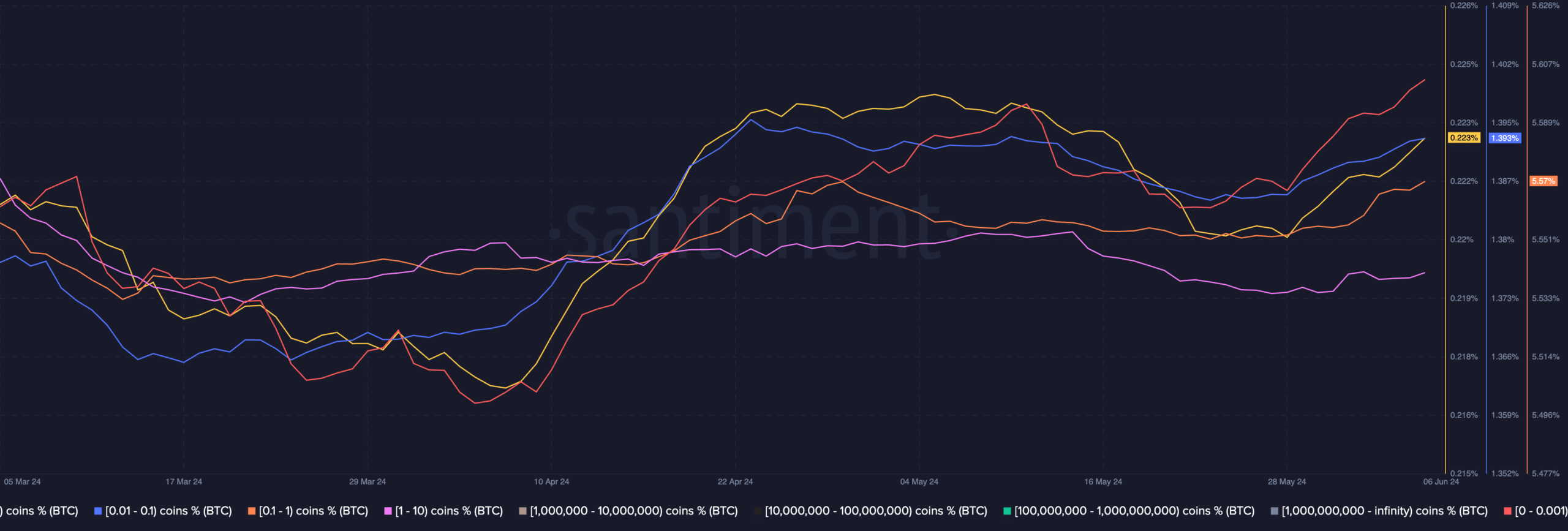

Retail buyers additionally confirmed curiosity in BTC. AMBCrypto’s evaluation of Santiment’s knowledge revealed that the cohort of addresses starting from 0.1 to 10 had confirmed curiosity in BTC.

Supply: Santiment

Curiosity in BTC ETFs was additionally rising

Regardless of a surge in curiosity for Bitcoin ETFs, with a document 19-day streak of inflows into US-based spot Bitcoin ETFs, there wasn’t a budge in BTC’s costs.

Whereas holdings in spot Bitcoin ETFs globally have reached a big stage, with round 1.3 million Bitcoin or 5.2% of circulating provide as of sixth June, and a big portion concentrated in US-listed ETFs, the worth hasn’t reacted as dramatically as some may count on.

Information from Farside confirmed inflows on June sixth alone reached $217.7 million. Complete inflows since launch have surpassed $15.5 billion, however some merchants consider this quantity remains to be inadequate to considerably transfer the worth needle till different markets open up.

Supply: Farside

Open Curiosity surges

Aside from that, the Open Curiosity(OI) in BTC additionally grew.

Traditionally, excessive OI was marked by extreme leverage and hypothesis typically precedes a value correction. Nevertheless, this didn’t appear to be the case on the time of writing.

Whereas funding charges which mirror the willingness of lengthy and quick positions to pay one another remained barely optimistic, they had been considerably decrease in comparison with the highs seen in March.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This indicated that bullish lengthy positions had been dominant and bulls had been prepared to pay bears to keep up their quick positions. Nevertheless, the market was not as heated in comparison with March.

At press time, BTC was buying and selling at $71,138.10 and within the final 24 hours, it had grown by 1.09%.

Supply: Coinglass