- Regardless of billions in inflows to Bitcoin ETFs, BTC value reveals minimal motion. Consultants weigh in

- Elementary information reveals attention-grabbing traits that embrace excessive circulating provide and balancing acts between consumers and sellers.

Regardless of the numerous influx into spot Bitcoin [BTC] Alternate Traded Funds (ETFs), the anticipated corresponding rise in Bitcoin’s value has but to materialize, puzzling traders and analysts alike.

Stories point out an unprecedented surge in curiosity and capital influx into these monetary merchandise, highlighting a burgeoning enthusiasm within the cryptocurrency house.

Prior to now few weeks, these ETFs have skilled a report influx, marking the longest streak of constructive flows since their inception, with BlackRock’s IBIT main the pack with substantial web inflows.

On seventh June alone, the 11 spot Bitcoin ETFs tracked a collective web influx of over $200 million, spearheaded by a $350 million inflow into IBIT.

This culminated in a staggering $15.56 billion web influx since January.

Regardless of the substantial surge in spot ETFs over the previous week, Bitcoin has witnessed solely a modest enhance of 4.3% throughout the identical timeframe.

During the last 24 hours, the cryptocurrency has struggled to realize additional momentum, with its value hovering simply above $71,000.

ETF impression on Bitcoin

The present stagnation in Bitcoin’s value, regardless of substantial ETF inflows, raises questions concerning the precise impression of those monetary devices on the cryptocurrency’s market worth.

Consultants counsel a number of components are at play that dilute the ETFs’ affect on Bitcoin’s value.

In line with Christopher Inks, a seasoned crypto commerce, the market dynamics of Bitcoin are advanced, influenced by an amalgamation of spot buying and selling, futures, choices, and now ETFs.

Ink emphasised the multifaceted nature of the market, indicating that focusing solely on ETF actions gives an incomplete image of value actions.

Responding to an X person who requested why the spot ETFs usually are not transferring BTC’s value, Ink replied:

“You do realize the market is made up of spot, futures, ETFs, and options, right? Price at any point in time is a product of all of these, not just one of them.”

Additional discussions amongst monetary consultants, together with a notable trade between investor Frank Makrides and Bloomberg ETF analyst Eric Balchunas, make clear the nuanced interaction of market forces.

Supply: X

Balchunas identified that whereas ETFs are shopping for aggressively, there may be equal promoting from different market contributors, sustaining the worth at a steadiness.

This phenomenon is commonly described as ‘buy the rumor, sell the news,’ the place market anticipation of an occasion (just like the approval of ETFs) drives up costs quickly, solely to stabilize or drop as soon as the occasion materializes.

Jimie, one other analyst, highlighted that whereas ETFs now maintain roughly 5% of the full circulating Bitcoin provide, the remaining 95% is managed by a various group of traders, together with whales, whose buying and selling actions considerably sway the market.

Supply: X

This attitude was echoed by group reactions beneath Frank Makrides’s X submit, the place customers like Patrick Hubbard famous,

“If ETFs are buying, it’s because someone is selling.”

Analyzing Bitcoin’s stability

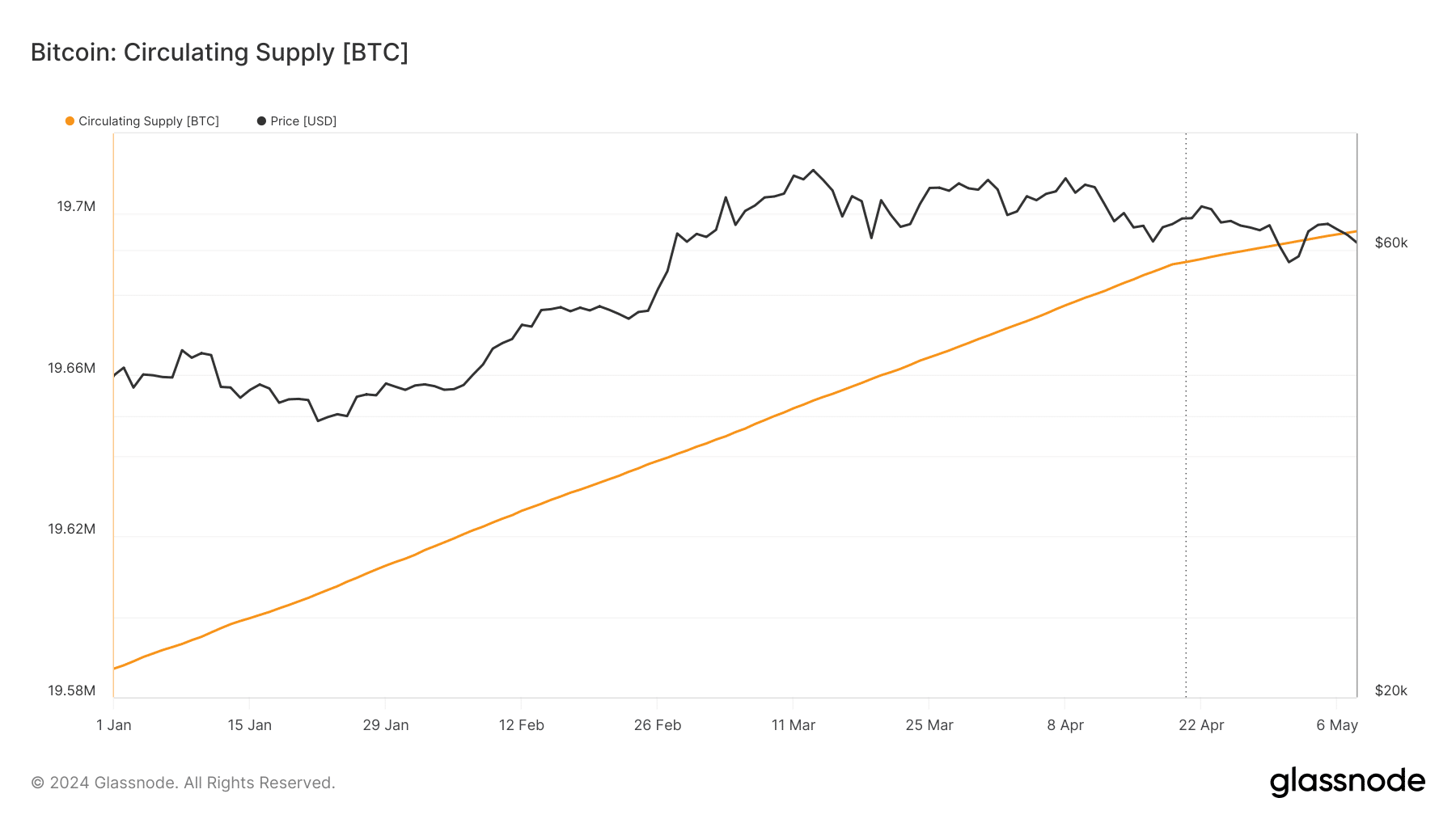

Inspecting Bitcoin’s fundamentals sheds gentle on why its value has not but mirrored the rising inflows into spot Bitcoin ETFs. In line with Glassnode, Bitcoin’s circulating provide has been on an uptrend for the reason that starting of the yr.

Supply: Glassnode

Usually, a rise in circulating provide suggests extra BTC can be found on the market, which may result in a value drop if demand decreases.

Nonetheless, the continuing demand from spot Bitcoin ETFs appears to be absorbing adequate provide to keep up present value ranges, though not sufficient to considerably drive costs increased.

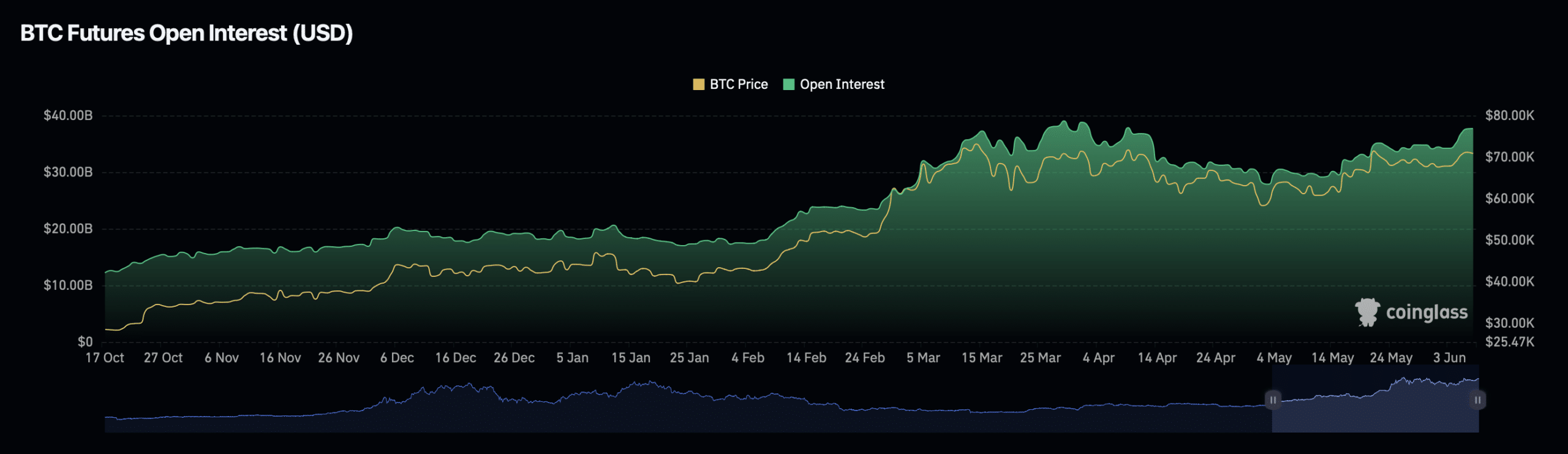

Furthermore, the dynamics of open curiosity additionally assist the present pricing traits of Bitcoin.

Information from Coinglass signifies that there was no vital motion in Bitcoin’s open curiosity; it recorded solely a minor enhance of 0.8% over the previous 24 hours, whereas choices quantity has declined by almost 40%.

This slight uptick in open curiosity, coupled with a decline in choices quantity, suggests a cautious market sentiment.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Regardless of these components, there are indicators of potential upward motion. A current AMBCrypto report highlighted a bullish crossover in Bitcoin’s MACD on its each day chart.

Moreover, Bitcoin’s Relative Power Index (RSI) stays properly above the impartial threshold, indicating that costs may rise within the close to future.