- Bitcoin ETFs noticed $880 million inflows on the 4th of June.

- Regardless of Bitcoin’s rise, Google searches for associated phrases stay low.

Since its debut in January 2024, spot Bitcoin [BTC] Alternate-Traded Funds (ETFs) have showcased distinctive efficiency.

Latest information signifies substantial inflows, with a collective $880 million and $488.1 million inflows recorded on 4th June and fifth June respectively.

Farside Traders’ information reveals that on 4th June, the Constancy Smart Origin Bitcoin Fund led in inflows, totaling $220.6 million.

On the similar time, Bitcoin has additionally breached its much-anticipated $70K mark, with press time costs of $71,082.55.

Google information reveals a declining development

Nonetheless, what’s shocking right here is that Google information confirmed a strikingly low degree of search curiosity in comparison with the 2021 bull run.

This means that retail buyers, a major market phase, have but to completely interact with Bitcoin ETFs which is likely to be a bullish indicator for potential future progress.

In response to Google Tendencies, which assigns a rating primarily based on a search curiosity’s relative peak recognition, phrases like “Bitcoin” and “btc” scored 41 and 17 out of 100 respectively.

Nonetheless, phrases similar to “bitcoin etf,” “btc etf,” and “Bitcoin ETF inflows” registered a rating of lower than 1 globally.

Supply: Google Tendencies

Execs weighs in

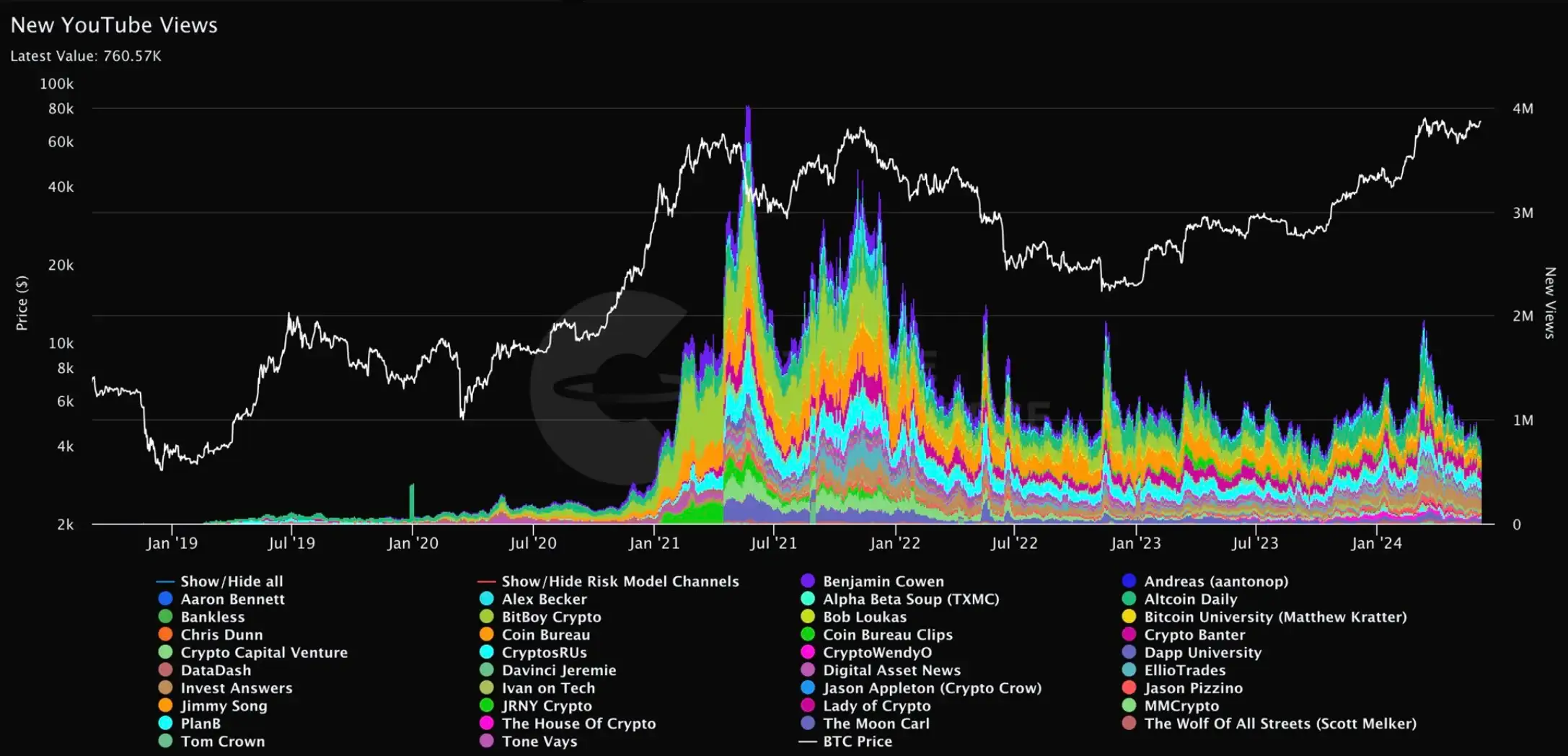

Including to the fray, Crypto analyst Miles Deutscher, in his sixth June X submit, underlined that curiosity in crypto-related content material on YouTube has declined in comparison with the height ranges seen in 2021.

“There is no indicator in the world that sums up the current state of the market better than crypto YT views. $BTC at $70k in 2021: 4m views/day. $BTC at $70k in 2024: 800k views/day. Retail isn’t back yet.”

Supply: Miles Deutsche/X

Deutscher additional highlighted that the present market cycle has posed better challenges for many buyers in comparison with earlier bullish intervals.

Moreover, altcoins have typically not carried out in addition to Bitcoin, resulting in a mismatch between market sentiment and precise worth actions.

Regardless of the decline in search curiosity, the neighborhood stays bullish on Bitcoin, particularly applauding the buildup of Bitcoin by varied Bitcoin ETFs.

Echoing an identical sentiment, Bit Paine took to X and mentioned,

Supply: Bit Paine/X