- Crypto buying and selling volumes hit second month-to-month low post-BTC halving occasion.

- Derivatives dominated the crypto market at +70% due to ETH ETF hypothesis.

The standard monetary lull related to summer season appears to be enjoying out in crypto markets.

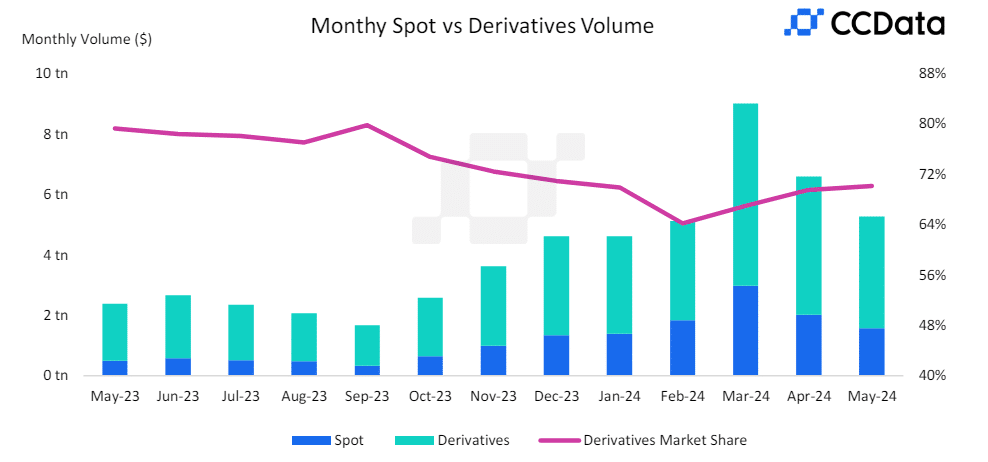

In Could, crypto buying and selling exercise fell by 20%, marking the second month of a drop in buying and selling quantity throughout main exchanges, per a CCData report.

A part of the report cited the ‘rangebound’ marketplace for the development and browse,

‘In May, the combined spot and derivatives trading volume on centralised exchanges fell 20.1% to $5.27tn as the prices of major digital assets continued to trend rangebound following the Bitcoin halving event in March.’

A downtrend in crypto buying and selling quantity

Supply: CCData

The report famous that within the spot market phase, Could’s buying and selling volumes throughout centralized exchanges dropped 21.6% to $1.57 trillion, decrease than the +$2 trillion volumes hit in April.

Based mostly on particular person exchanges, Binance was the highest contender on the spot market buying and selling quantity at $545 trillion in Could. In descending order, different exchanges that adopted Binance’s lead have been Bybit, OKX, Coinbase, and Gate.io.

Nevertheless, every change recorded key drops in buying and selling volumes in Could in comparison with April.

On year-to-date efficiency on the spot market share, Binance noticed essentially the most vital features and ramped up its dominance to 34.6%.

Bybit, Bitget, and XT.com additionally surged in market share over the identical interval. However Coinbase noticed a modest decline whereas Upbit, OKX, and MEXC World recorded ‘the greatest decline in market share.’

Spinoff market dominance surge to 70%

Nevertheless, cash within the crypto market was concentrated primarily within the derivatives market. Per the report,

‘The derivatives market now represents 70.1% of the entire crypto market (vs 69.5% in April).’

Supply: CCData

Regardless of the spike in spinoff market dominance, general buying and selling volumes have been subdued just like the spot market. The report famous that,

‘Derivatives volumes decreased by 19.4% in May to $3.69tn, recording the second consecutive decline in monthly derivatives volume.’

Not like the standard sluggish monetary exercise in TradFi through the summer season, the report attributed the low volumes to historic patterns related to low exercise after the Bitcoin halving occasions.

Amidst the lull, the report famous that merchants have been nonetheless bullish, based mostly on an uptick in funding charges and a surge in Ethereum [ETH] choice volumes on US ETH ETFs hypothesis.

‘Across the four exchanges analysed, the average funding rates continued to decline, reaching 3.23%. However, the funding rate started trending upwards on May 23rd as traders turned bullish after the SEC’s shock pivot on the Spot Ethereum ETF purposes.’