Picture supply: Getty Photos

Might round £85bn of passive earnings be up for grabs from FTSE 100 shares?

Analysts at AJ Bell assume the reply is sure.

Dividends are by no means, ever assured. However shares on the Footsie have a terrific document of paying giant and sustainable dividends over time. Robust steadiness sheets and various, market-leading operations make them a dependable method to make a second earnings.

These analysts I point out actually anticipate the index to proceed producing huge dividends. All traders need to do is personal a few of these shares to have an opportunity of having fun with a bumper payday.

Dividend development

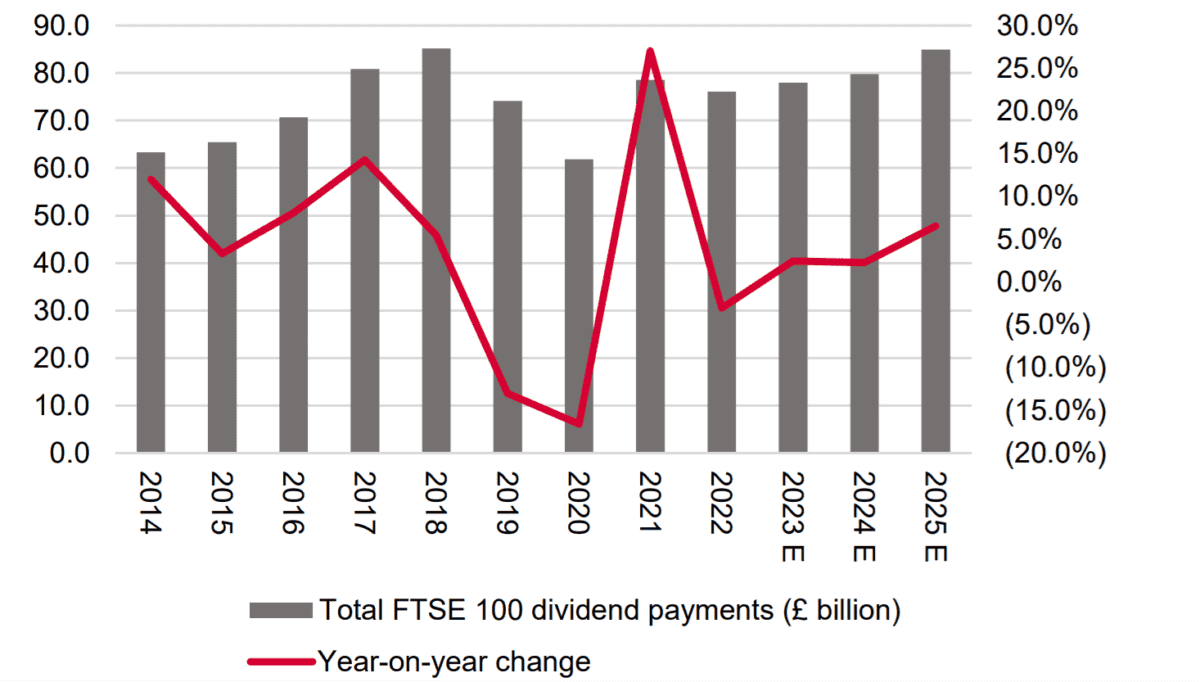

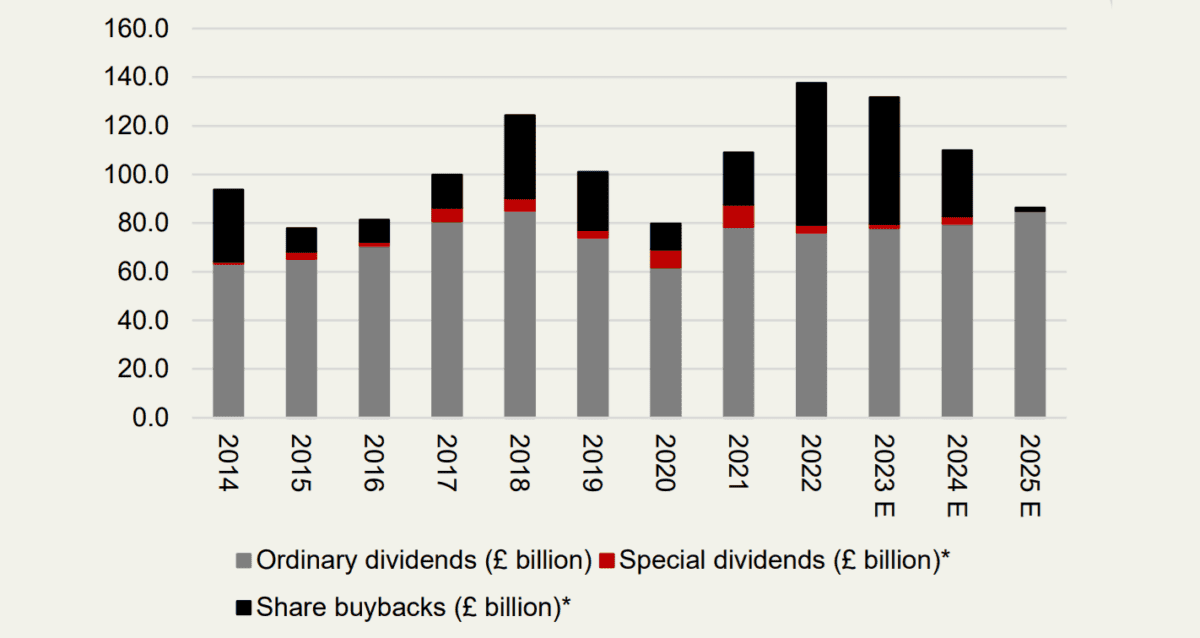

In keeping with AJ Bell, FTSE 100 corporations will elevate whole strange dividends to £79.7bn in 2024. That’s up from £77.8bn final 12 months.

And issues look even higher for 2025, with whole distributions of £84.9bn predicted. And that’s excluding particular dividends.

With these supplementary payouts included, combination payouts for each years exceed £80bn, as proven beneath.

Cautious now

In fact there’s a couple of vital issues to recollect. The primary of which is that — as I stated above — dividends are by no means a certainty.

These AJ Bell forecasts replicate hopes that FTSE 100 corporations will develop income by means of to 2025. However a contemporary financial crash or hassle particularly sectors may nicely scupper these predictions.

Moreover, Footsie companies can use their discretion in terms of deciding how a lot of their capital to pay in dividends. They don’t need to pay any in any respect!

For example this level, each Vodafone and Nationwide Grid have rebased their dividends in 2024.

A prime dividend inventory

Nevertheless, there are steps I can take as an investor to spice up my probabilities of receiving a dividend. Learning buying and selling experiences, monetary information, and dealer estimates would possibly set me as much as obtain a lavish passive earnings.

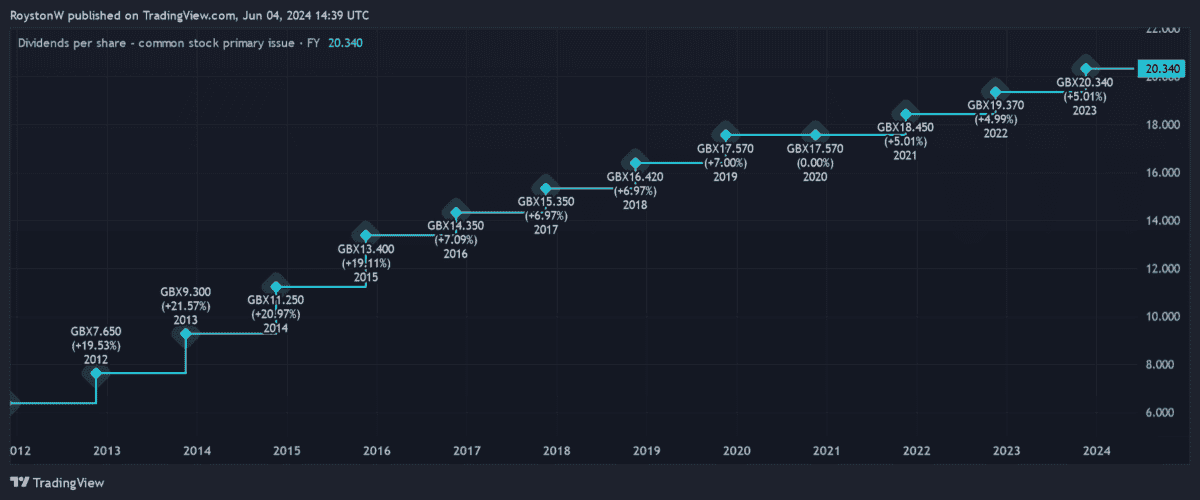

Authorized & Normal Group (LSE:LGEN) is an organization I’d purchase for dividend earnings. Historical past reveals us that the life insurance coverage large has a beneficiant method to dividends, as proven by its lengthy document of sustained payout development.

A robust steadiness sheet means the agency appears good to maintain this spectacular development going, too. Its Solvency II capital ratio was 224% as of December. This places it in fine condition to hit its goal of rising dividends by 5% every year.

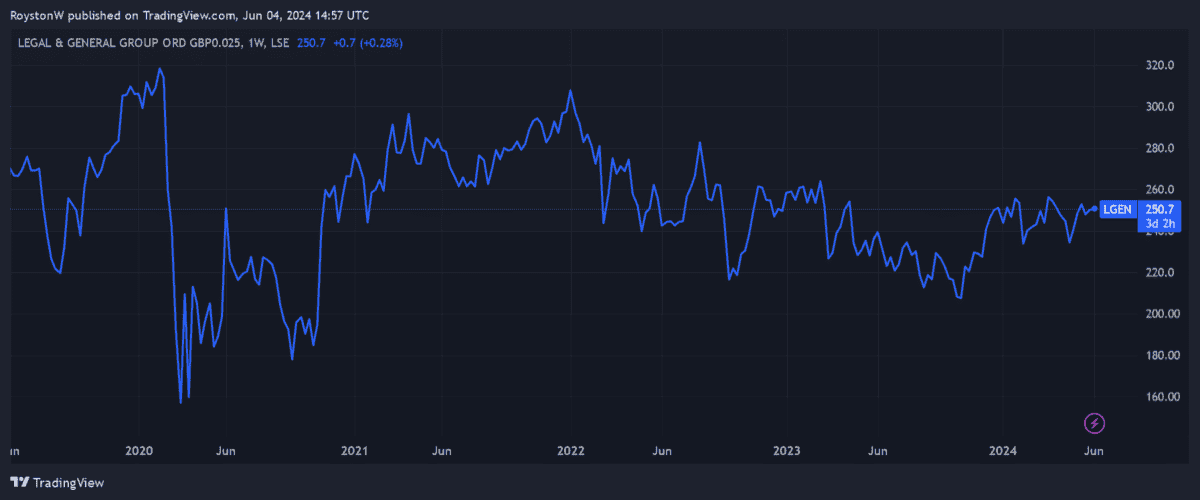

On the draw back, Authorized & Normal is struggling to develop income because of the robust rate of interest setting. And this might stay an issue heading into the second half of 2024.

Nevertheless, I don’t imagine this could impression dividends within the close to time period. And these issues are more likely to be short-term, too. The truth is, I imagine earnings may rise strongly over the long run, pushed by demographic traits that supercharge demand for monetary merchandise.

One remaining however vital factor in terms of Authorized & Normal shares. At 250.7p per share, they carry a mighty 8.1% dividend yield. That is the kind of determine that would assist turbocharge the overall passive earnings I obtain.