- Bitcoin hit its historic peak due to widespread bullish investor expectations

- Cryptocurrency started a downtrend after hitting its peak, settling under $85,000 at press time

In 2024, Bitcoin reached its historic peak due to widespread bullish investor expectations that emerged via the Bitcoin Sentiment Vote chart. The truth is, Bitcoin’s worth climbed above $100,000, whereas the Vote Up sentiment grew to become very sturdy.

As soon as it achieved its peak, the market sentiment about its worth began to say no quickly. Market sentiment shifted to unfavourable when merchants alongside buyers started voting down, leading to decrease sentiment values.

Supply: CryptoQuant

The rally began by flashing constructive expectations, however darkened with each worry together with merchants promoting to cut back their holdings after reaching its highest level. The worth of BTC started a downtrend after hitting its peak, with the crypto settling under $85,000 by March 2025.

The distinction in investor feeling is an indication of deepening market reluctance. Particularly as sentiment stands equal to what it did throughout September 2024, proper earlier than the bullish interval began.

Bitcoin’s sentiment ranges mirror September 2024 tendencies

Bitcoin’s Sentiment Vote steered that March 2025 marked the return of sentiment ratios similar to these in September 2024. The measurements all through that interval revealed impartial opinions because the ratio stayed near 4 – Indicative of unsure emotions.

The newest market development demonstrated a serious fall, in comparison with the earlier all-time excessive ranges above 12 which Bitcoin reached throughout its peak. These indicators highlighted a neutral-to-bearish outlook as “Vote Down” sentiment continued to rise within the 90-day transferring common along with normal deviation.

The prevailing sentiment amongst merchants matches earlier market situations earlier than the rally, indicating that they continue to be hesitant about Bitcoin’s upcoming efficiency. The identical state of affairs as earlier than Bitcoin’s earlier main upward surge exists as we speak as buyers sense reluctance.

Lengthy-term holders’ promoting conduct and its market implications

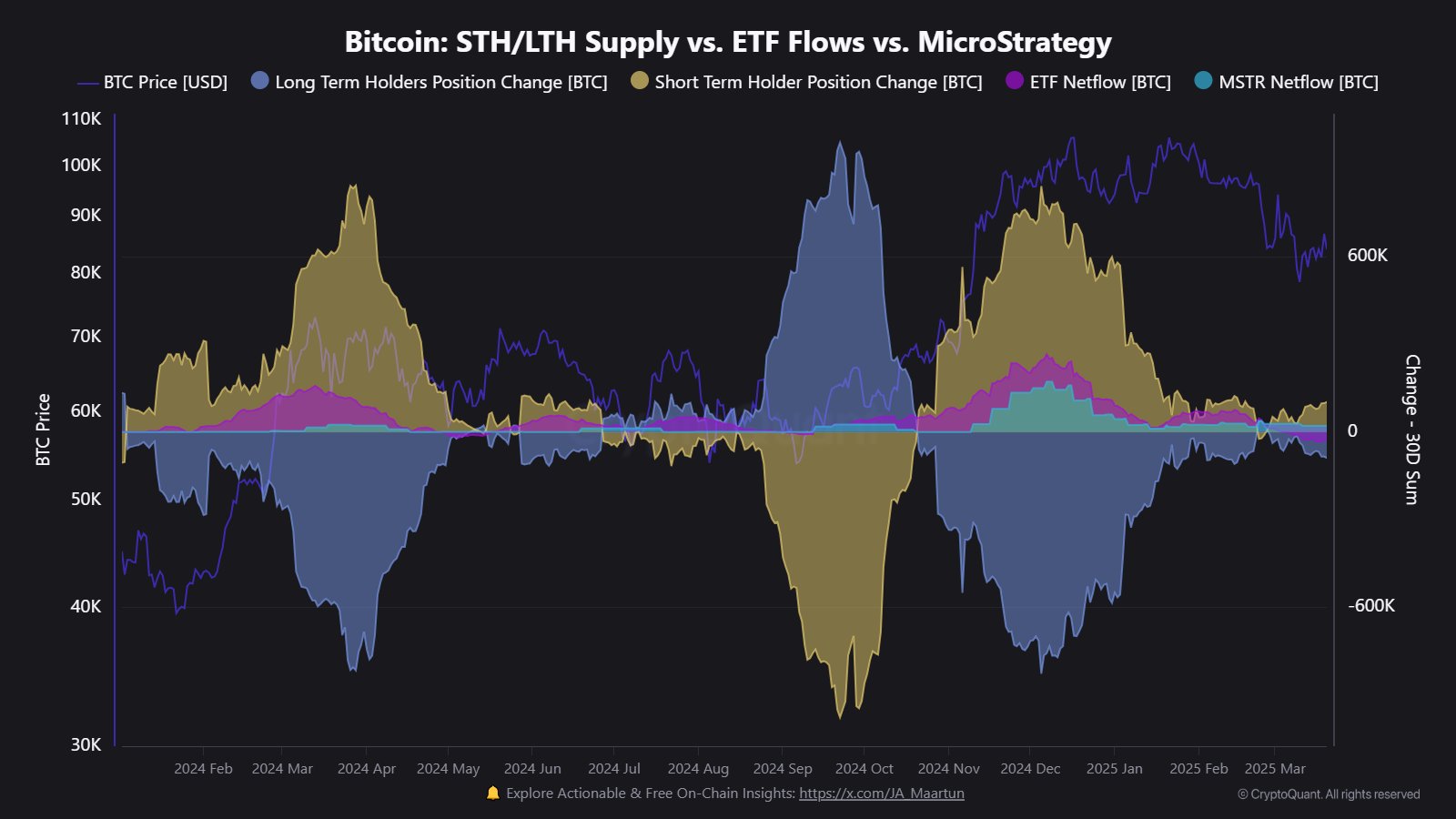

Lastly, Bitcoin’s STH/LTH Provide vs. ETF Flows vs. MicroStrategy chart highlighted sustained promoting strain from Lengthy-Time period Holders (LTH). Though the tempo did decelerate since Bitcoin surpassed $100,000, a 30-day LTH provide discount of 89,738 BTC may very well be an indication of ongoing profit-taking.

Souce: CryptoQuant

The chart’s downtrend in LTH place modifications could be a signal of risk-off conduct, aligning with bearish sentiment from the primary chart. The persistence of LTH promoting, albeit at a lowered charge, hinted at a insecurity in Bitcoin’s quick restoration.

This development additional supported the return of sentiment to September 2024 ranges, reinforcing a cautious market outlook. As Bitcoin struggles to regain upward momentum, investor conduct will proceed to mirror hesitation and uncertainty about its future trajectory.