- The crypto concern and greed index just lately hit 74, indicating excessive market greed.

- Bitcoin miner income soared over the previous month.

The rally that Bitcoin [BTC] noticed over the previous few weeks, brought about the value to surge and stagnate on the $68,000 degree. Nevertheless, new knowledge indicated that the urge for food of the bulls continued to extend.

Crypto concern and greed index tells you…

Information from Different.com showcased that the crypto concern and greed index was at 74, implying that the market was extraordinarily grasping. Throughout this era, the danger urge for food for merchants and holders will increase as they’re extra prone to accumulate extra BTC.

Despite the fact that BTC is near its all-time excessive (ATH), the rising greed of merchants signifies that there’s an expectation for BTC to achieve its beforehand attained ATH and even surpass it sooner or later.

Supply: Different.com

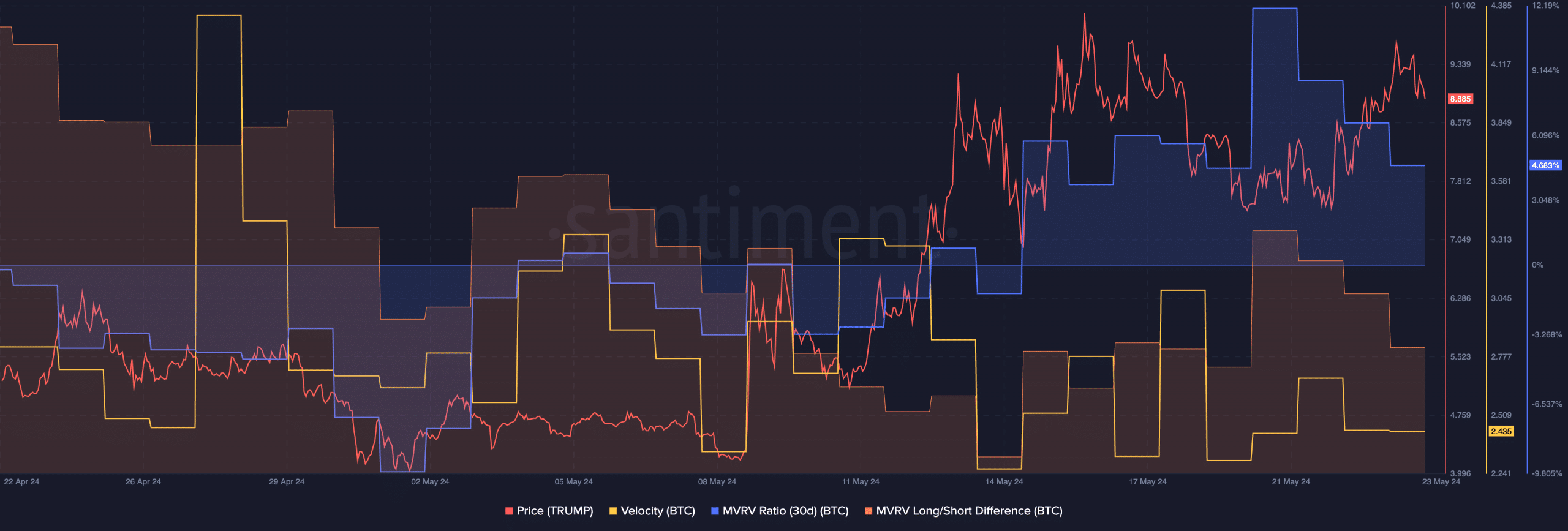

At press time, BTC was buying and selling at $68,385.79. It will want an uptick of seven.21% to achieve its earlier ATH. The rate at which BTC was buying and selling at declined materially, implying that the majority addresses have been eager on holding their BTC.

The MVRV ratio was comparatively excessive, indicating that the majority holders have been worthwhile on the time of writing.

Excessive profitability is usually a double-edged sword for BTC. On one hand, profitability can assist enhance sentiment round BTC.

Alternatively, some addresses possibly incentivized to take pleasure in revenue taking inflicting promoting strain on BTC. The habits of holders can present an perception on whether or not these holders resolve to promote their holdings.

The Lengthy/Quick distinction declined over the previous few days, suggesting that the presence of short-term holders (STH) was rising. These STHs usually tend to promote their BTC for income which may trigger volatility for the king coin in the long term.

Supply: Santiment

Miners rejoice

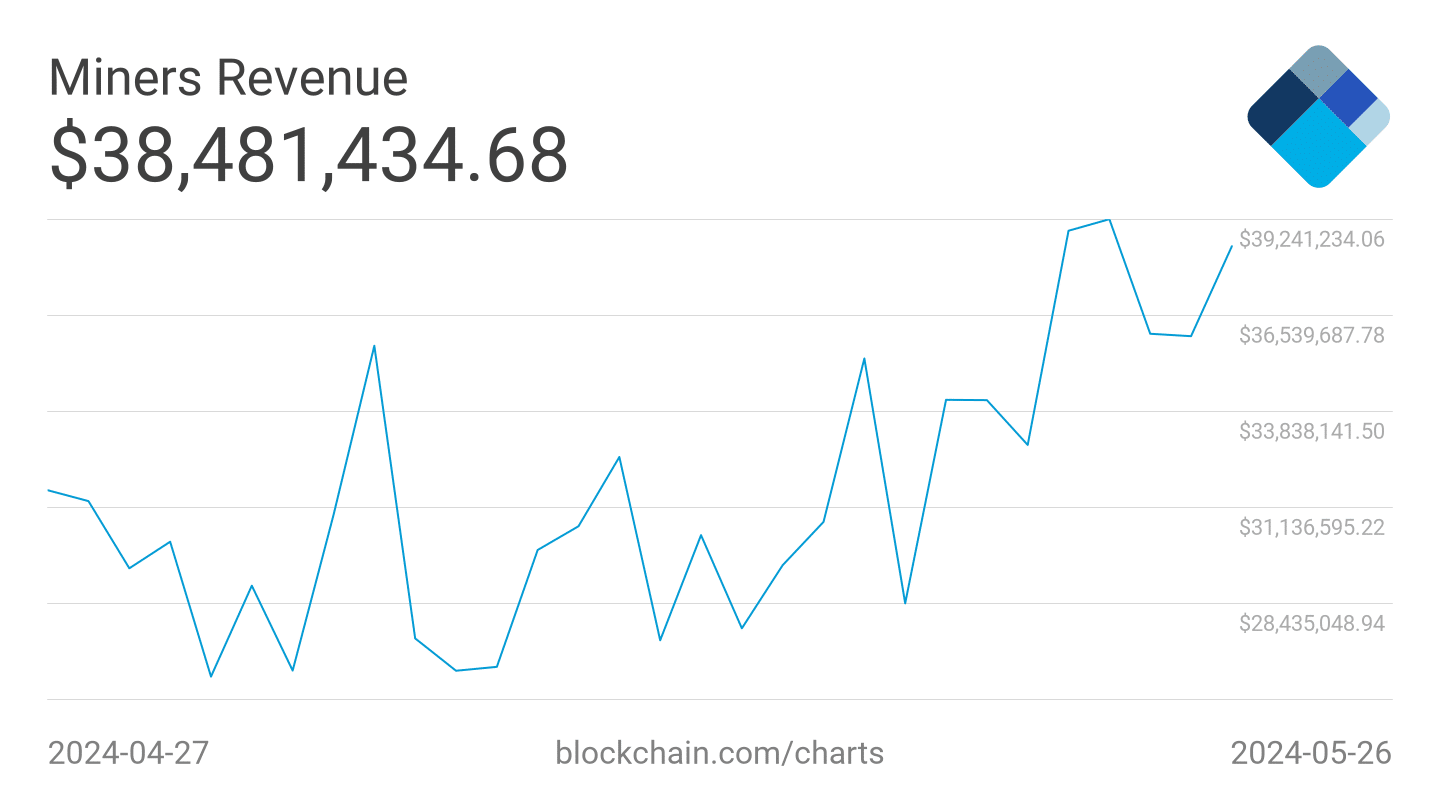

One other issue that may deeply affect promoting strain on BTC could be the state of miners. If miner revenues decline, miners are compelled to promote their holdings to stay worthwhile which may trigger issues for the value of BTC.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

On the time of writing, issues regarded constructive for miners. AMBCrypto’s evaluation of Blockchain.com’s knowledge revealed that each day miner income soared from $28,435,048 to $39,241,234 over the previous few days.

Contemplating these elements, the probabilities of a BTC correction are low.

Supply: Blockchain