- The crypto market shed over $300B following the Fed’s hawkish reduce.

- BTC remained resilient above $100K regardless of dumping by long-term holders.

On Wednesday, 18th December, the US Federal Reserve adopted a hawkish tone for the 2025 charge reduce projection, a transfer that triggered carnage in conventional and crypto markets.

Bitcoin [BTC] led the crypto decline because it dropped from a latest lifetime excessive of $108.3K to a low of $98.8K earlier than rebounding barely to $101K at press time. However altcoins dumped tougher.

Over the identical interval, the crypto market cap dropped from $3.77 trillion to $3.46 trillion – A whopping $330 billion was worn out of the crypto markets previously 48 hours.

Supply: CoinMarketCap

Fed slows charge reduce in 2025

Through the assembly, the Fed slashed rates of interest once more by 0.25% to 4.25%-4.50%. Since September, the Fed has reduce the speed by 100bps, an total increase to risk-on property, together with crypto because of the availability of low cost capital.

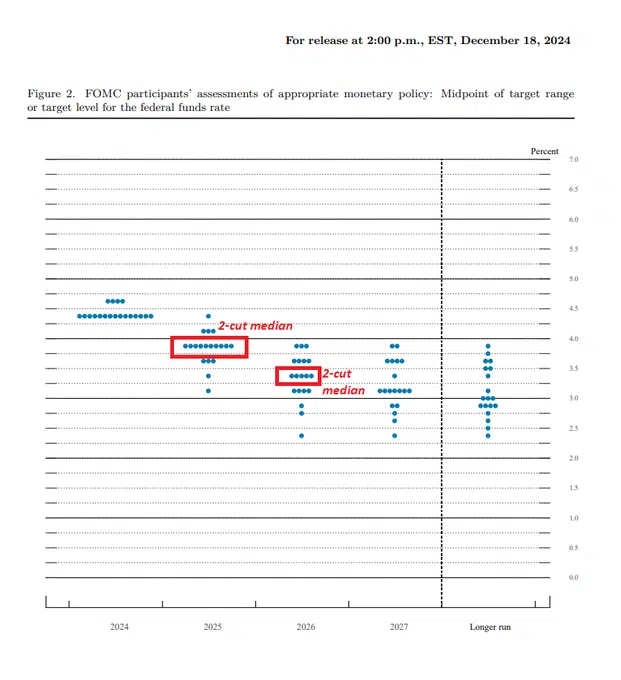

The market anticipated the Fed charge path to increase to 2025 with one other three charge cuts. Nonetheless, inflation made a comeback with a latest spike of two.7% on year-to-date (YTD) for the newest November studying.

This knowledgeable the Fed’s sluggish tempo of charge cuts in 2025, dropping them from three to 2. Reacting to the identical, analyst and market commentator Kobeissi Letter, famous,

“Rather, it would about the Fed’s outlook for 2025 which shifted SHARPLY in the hawkish direction. As seen below, the Fed revised their 2025 outlook from 3 rate cuts to 2 rate cuts, a total of 50 bps.”

Supply: Federal Reserve

Amongst the majors, BTC solely dropped 5.5% on Wednesday. However Ethereum [ETH] and Ripple [XRP] dumped 6% and 10% respectively. Solana [SOL] shed 7.45% of its worth over the identical interval.

Aside from the FOMC-driven sell-off, BTC long-term holders (LTHs) took benefit of the liquidity above $100K and booked income.

In response to analyst James Van Straten, the cohort dumped 40K BTC on Tuesday and has distributed almost 1M BTC up to now.

Learn Bitcoin [BTC] Worth Prediction 2024-2025

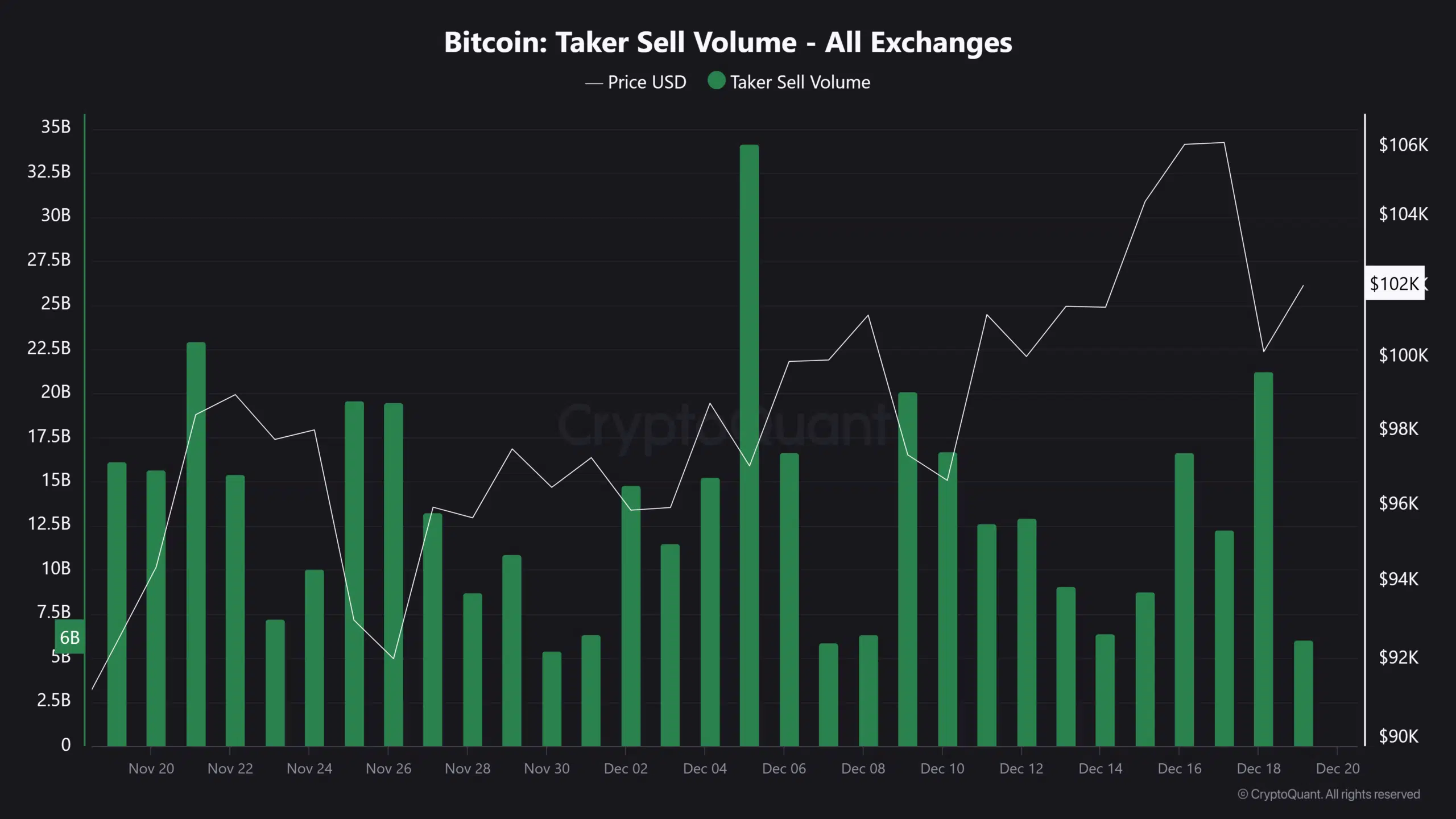

On Wednesday, the BTC promote stress throughout all exchanges hit $21 billion per CryptoQuant information. However the king coin defended the $100K degree.

Nonetheless, BTC dominance additionally surged to 58% which may additional derail the altcoin momentum.

Supply: CryptoQuant