- BTC, ETH, and XRP defended essential short-term assist ranges.

- Will they bounce again to their new highs forward of Christmas?

On Wednesday, 18th of December, the US Fed made one other 0.25% rate of interest minimize, however its 2025 hawkish projection triggered Bitcoin’s [BTC] decline to $100K.

Throughout the identical buying and selling session, Ethereum [ETH] dropped 6.8% whereas Ripple [XRP] dumped 10%. All the foremost digital property eased at short-term assist ranges as analysts remained optimistic about risk-on property.

So, will the large three bounce again or slide decrease? Let’s discover charts for insights.

Bitcoin defends $100K: Will ETH, XRP rebound?

Supply: BTC/USDT, TradingView

Because the twelfth of December, BTC bulls have defended $100K. The current FOMC assembly sell-off eased on the psychological stage. This confirmed it as a assist.

Apparently, the 100-day EMA (exponential transferring common), which stopped previous BTC dumps since October, aligned with the channel lows. This made the $98K-$100K a robust short-term assist for BTC.

The mid-range of $104K and higher stage of $108K-$109K might be possible if the assist holds.

On the flipside, a breach beneath the assist may escalate additional carnage and embolden bears. In such a case, $90K and $85K may change into reachable for bears.

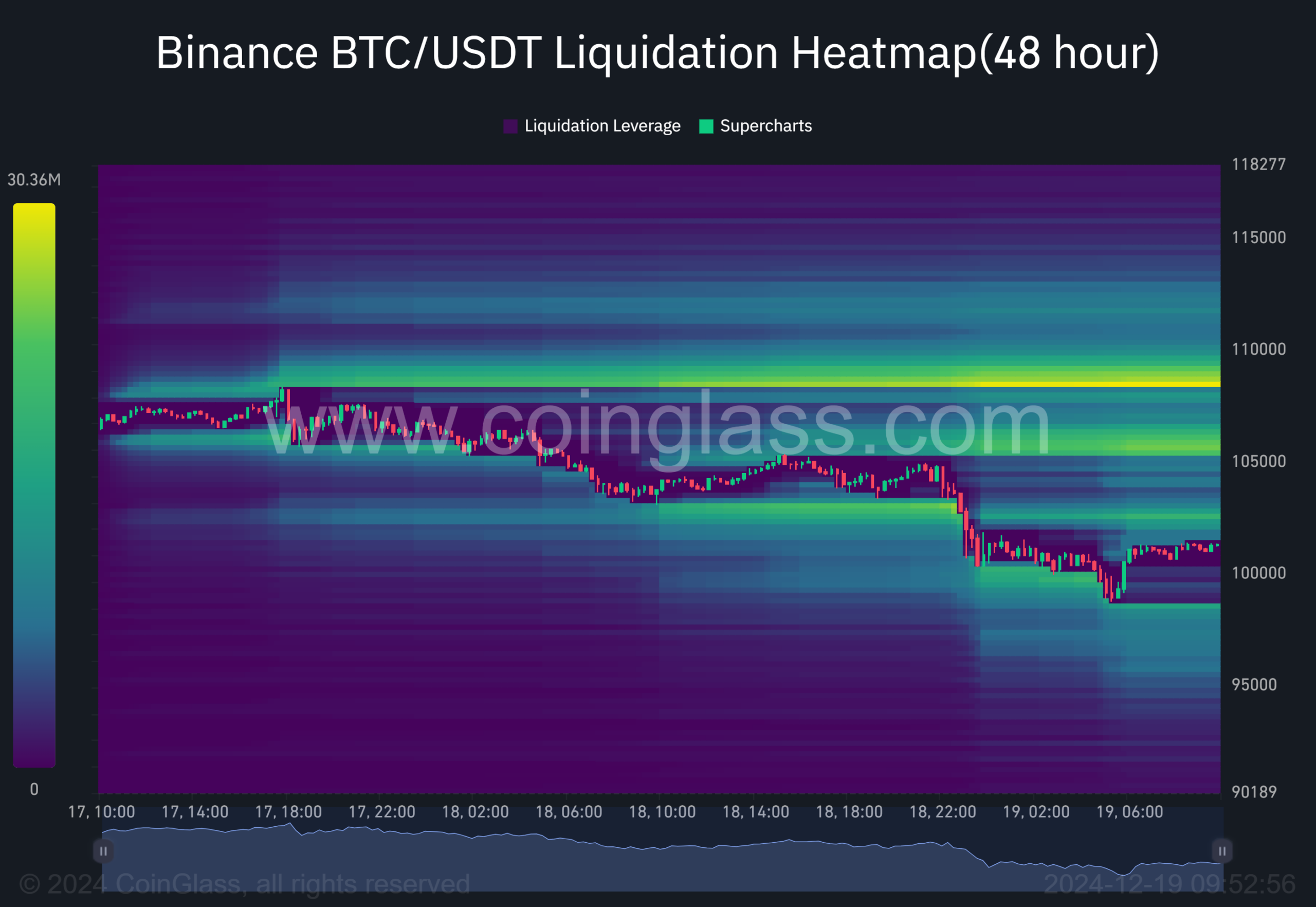

That mentioned, the current decline was additionally pushed by a liquidity hunt, which was presently concentrated at $102.5K, $105K and $108K ranges (shiny yellow strains).

Supply: Coinglass

The upside liquidity made a BTC rebound the most probably except low buying and selling quantity throughout the Christmas vacation triggered extra sell-offs.

How will ETH and XRP react to the above BTC’s worth situations?

ETH, XRP worth prediction

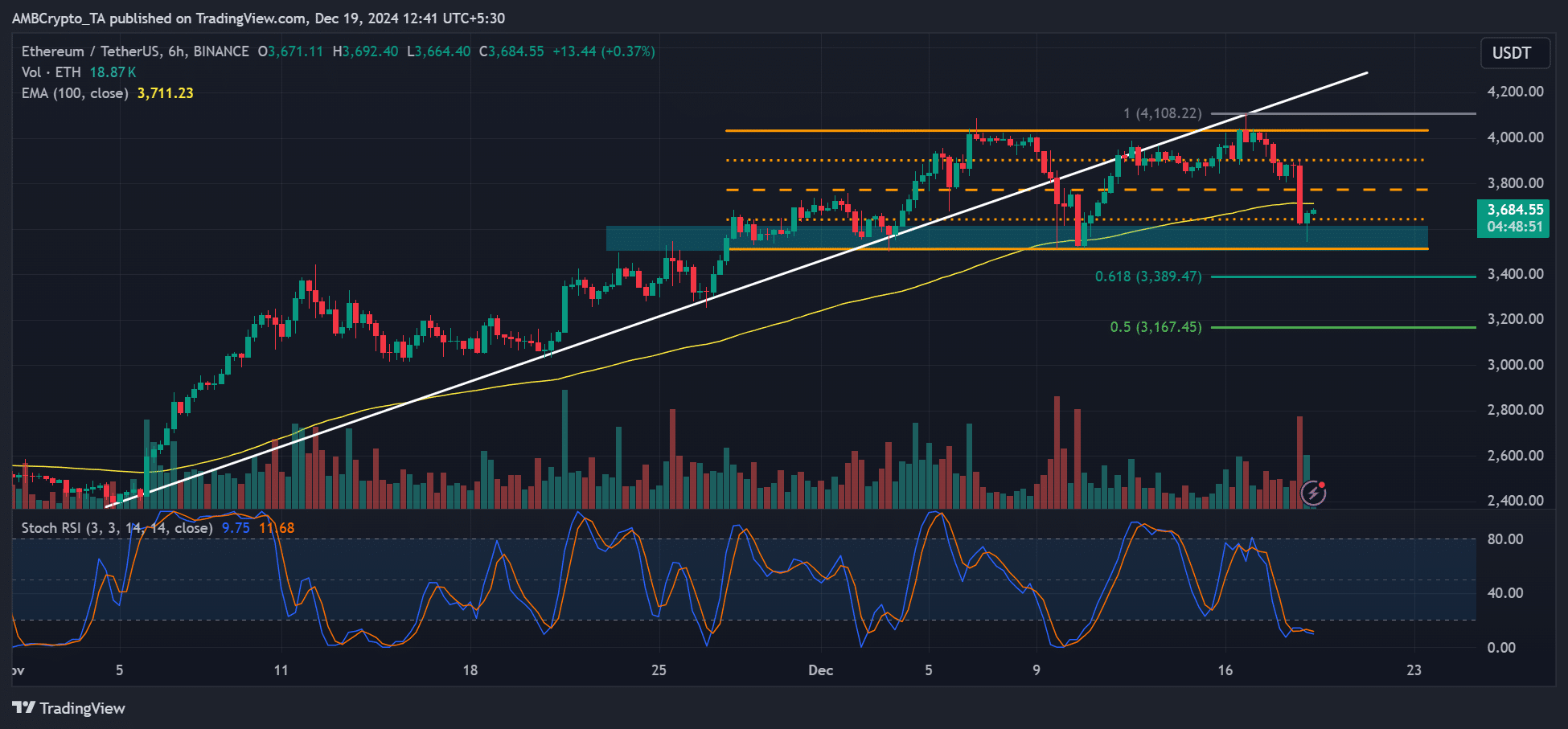

For ETH, the king altcoin has consolidated between $3.5K and $4K because the starting of December. Like BTC, it dropped from $4.1K however bounced on the $3.5K range-lows as of this writing.

Supply: ETH/USDT, TradingView

A transfer greater to $3.7K and $4K might be possible if the range-low holds. A decisive transfer above the trendline assist (white), may affirm a reclaim of the uptrend that started in November.

That mentioned, if the channel’s assist cracked, ETH bears may drag the altcoin to $3.3K or $3.1K.

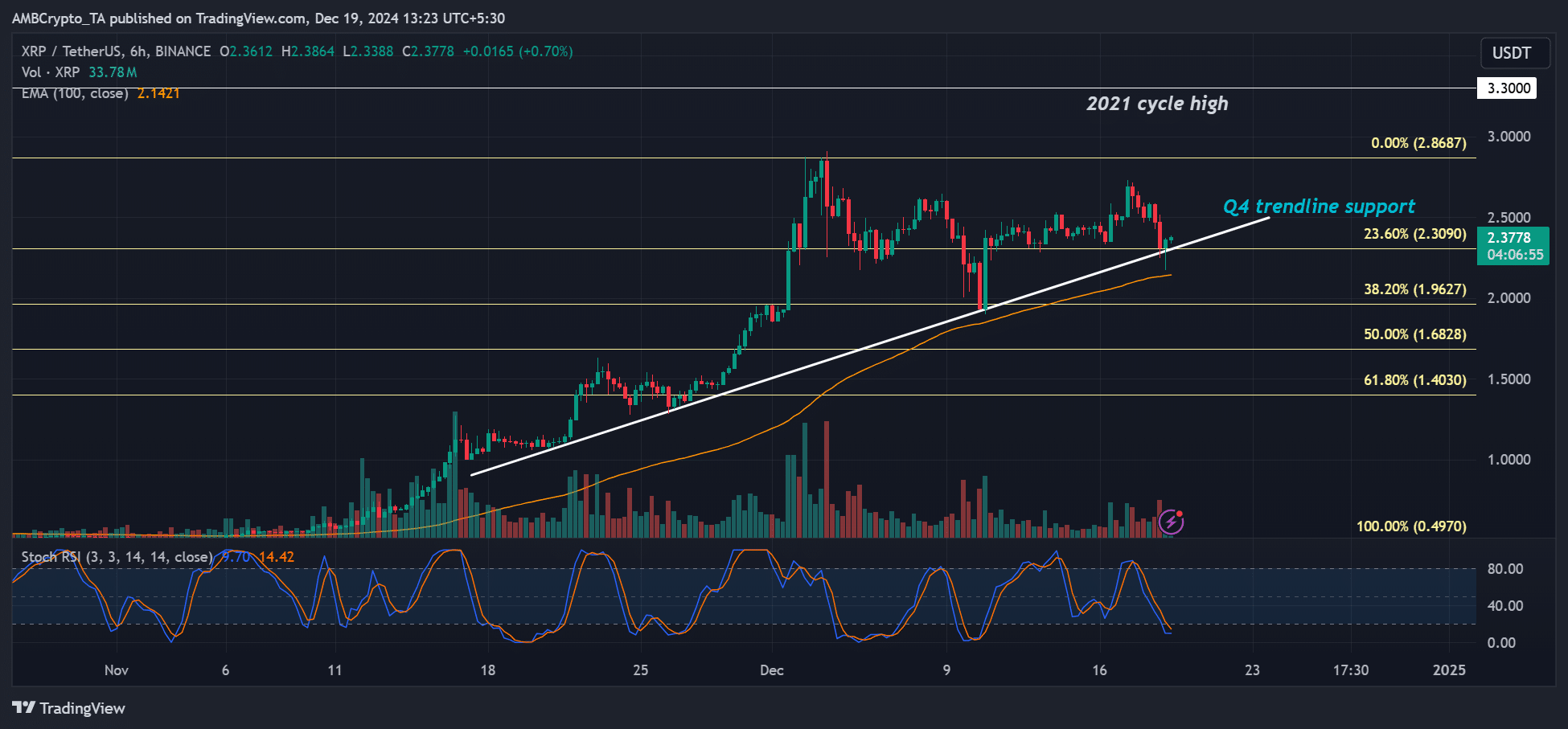

Apparently, XRP’s chart appeared stable amongst the large 3. Regardless of the ten% drop, XRP held above its This autumn trendline assist and might be the important thing stage to observe for the remainder of 2024.

Supply: XRP/USDT, TradingView

Bulls may eye a $2.8 stage or push greater to the 2021 cycle excessive of $3.3 utilizing the assist as a springboard. The bullish leaning was supported by the current stablecoin RLUSD launch and ETF expectations in 2025.

Learn Bitcoin [BTC] Worth Prediction 2024-2025

Nonetheless, a crack beneath it may empower quick sellers to push XRP decrease to $2 or $1.6.

In conclusion, the highest cryptocurrencies, BTC, ETH, and XRP defended key ranges, suggesting a possible market development reversal to the upside. However will a possible low buying and selling quantity throughout the Christmas interval have an effect on the restoration?