- Bitcoin reserves on spot exchanges have dropped to their lowest degree since 2017

- Rising institutional demand amid the falling provide might set off a prize squeeze

Bitcoin (BTC), at press time, was buying and selling at $101,718 on the charts following positive aspects of 1.6% in 24 hours. As anticipated, the king coin continues to be essentially the most dominant crypto available in the market, with a market capitalization of >$2 trillion.

Alongside these latest positive aspects although, demand for BTC has surged too. This has created a market imbalance attributable to falling provide. If these developments persist, Bitcoin is perhaps going through a possible provide squeeze, one that would push its worth larger.

Bitcoin spot alternate reserves hit a 7-year low

Knowledge from CryptoQuant highlighted the drop in Bitcoin’s provide after spot alternate reserves fell to their lowest degree since mid-2018. Actually, the Bitcoin held on spot exchanges now stands at 1,055,716 BTC.

Supply: CryptoQuant

These reserves have recorded a steep drop over the previous month amid Bitcoin’s rally previous $100,000 to new all-time highs.

In line with 10X Analysis, Coinbase, which has the very best Bitcoin reserves, recorded 72,000 BTC in outflows within the final 30 days. These outflows comprised practically 10% of the alternate’s Bitcoin steadiness.

29,000 BTC was additionally withdrawn from Binance throughout the similar interval, whereas Kraken’s outflows accounted for greater than 7% of its complete Bitcoin holdings.

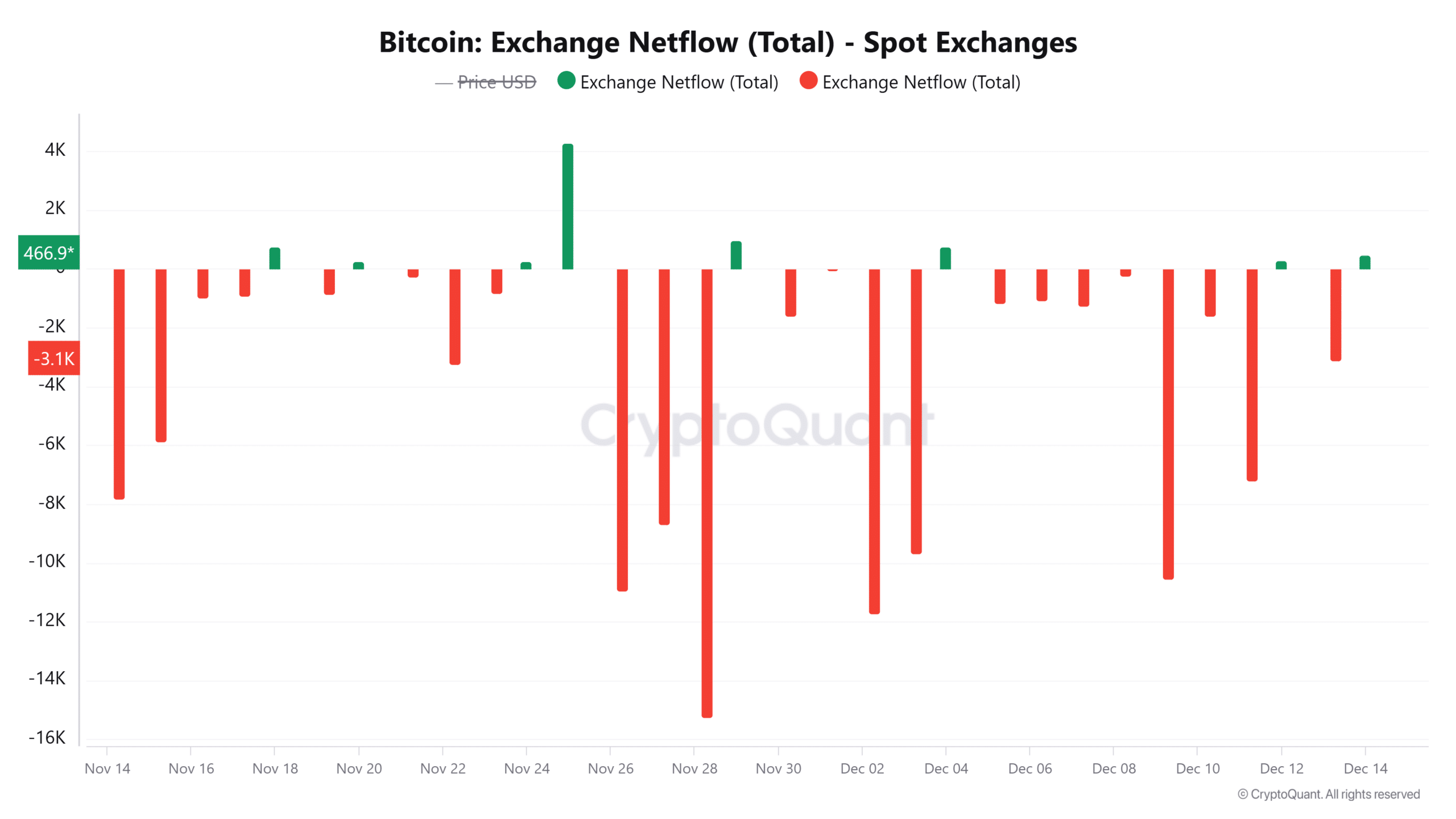

The alternate netflow information for the final 30 days additionally revealed that Bitcoin has recorded 22 days of unfavourable netflows from spot exchanges. That is additional proof of a state of affairs the place merchants haven’t been eager on promoting.

Supply: CryptoQuant

Moreover, this information urged that the majority merchants are selecting to carry Bitcoin regardless of its latest positive aspects – An indication of their long-term bullish outlook.

Rising institutional demand

The unwillingness to promote has been met with a spike in institutional demand, as seen within the inflows to identify Bitcoin exchange-traded funds (ETFs).

In line with SoSoValue information, the entire inflows to identify Bitcoin ETFs within the final three weeks have surpassed $5 billion. These property are inching nearer to holding 6% of Bitcoin’s complete market capitalization.

Inflows to those ETFs have additionally been optimistic for the final 12 consecutive days.

If these inflows persist, it might set off an extra provide squeeze on Bitcoin that would push the value larger.

Binary CDD exhibits….

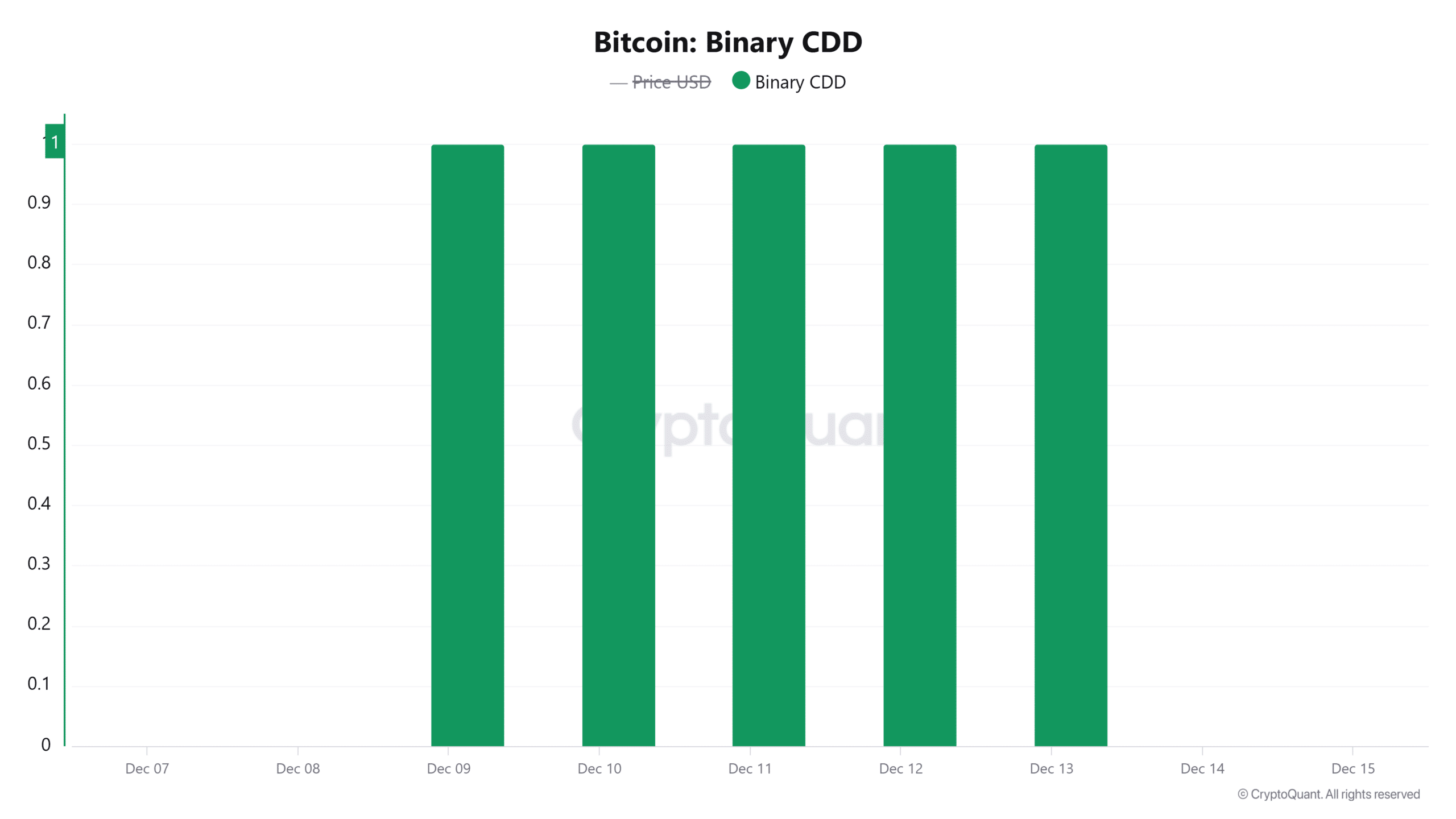

Lengthy-term Bitcoin holders are recognized to promote every time the market hits a neighborhood prime. As AMBCrypto reported, this cohort began promoting Bitcoin earlier this month, inflicting the rally to stall.

The Binary Coin Days Destroyed (CDD) has been at 1 over the past 5 days. This implied that long-term holders should be taking earnings.

Supply: CryptoQuant

If this cohort is promoting, it might result in Bitcoin avoiding a possible provide squeeze if the cash being bought are sufficient to soak up the buy-side strain.