- Almost $3 billion in BTC and ETH choices expire, with merchants bracing for main volatility and key value motion.

- Market makers reposition amid vacation buying and selling lull as $98K BTC and $3,700 ETH ranges dominate consideration.

Bitcoin [BTC] and Ethereum [ETH] choices contracts price $3 billion had been set to run out on the thirteenth of December. These expirations typically result in elevated market exercise, with merchants intently watching potential value actions.

At press time, Bitcoin was priced at $100,073, whereas Ethereum was buying and selling at $3,881.12, in response to Coingecko knowledge.

Bitcoin choices price $2.1 billion close to expiry

Bitcoin has $2.1 billion in choices contracts expiring. The put-call ratio stands at 0.83, indicating extra name choices (bullish bets) than places (bearish bets).

The max ache level—the worth stage the place most choices will expire nugatory—is $98,000.

Supply: X

With Bitcoin’s market cap at $1.98 trillion and a circulating provide of 20 million cash, merchants are monitoring its subsequent strikes.

The 24-hour buying and selling quantity for BTC has reached $94.48 billion, suggesting heightened exercise because the expiration approaches.

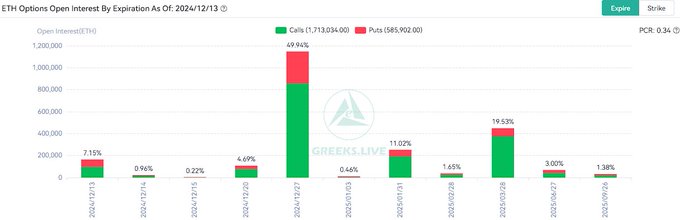

Ethereum choices see $640M expire

Ethereum has $640 million in choices expiring, with a put-call ratio of 0.68, exhibiting even stronger bullish sentiment than Bitcoin. The max ache level for ETH is $3,700, a vital stage that merchants are watching intently.

Supply: X

Ethereum’s buying and selling quantity over the previous 24 hours stands at $44.47 billion, with a market cap of $467.65 billion and a circulating provide of 120 million ETH.

Although ETH has seen a slight 0.63% value decline within the final 24 hours, its week-to-week efficiency stays flat, reflecting a wait-and-see angle amongst merchants.

Market makers reposition as liquidity declines

In response to Greeks.dwell, market makers are shifting their positions throughout this era of expirations, which coincides with decreased buying and selling volumes throughout the vacation season.

Analysts have famous rising Implied Volatility (IV), indicating that markets are making ready for sharper value actions. “Lower liquidity during the holidays often magnifies market volatility,” mentioned analysts at Greeks.dwell.

Additionally they highlighted the rising correlation between crypto costs and U.S. inventory markets, suggesting that equities’ value swings could affect cryptocurrency actions.

Financial knowledge provides complexity

The expiration of those choices comes after every week of financial developments within the U.S. November’s inflation fee elevated to 2.7%, with core CPI at 0.3%, signaling ongoing inflationary challenges.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Whereas a Federal Reserve fee reduce is anticipated, considerations stay about whether or not inflation will delay easing.

These components, mixed with the expiration of billions in crypto choices, may create heightened market exercise.