- Bitcoin ETF inflows have hit a weekly low, because the market simmers with each “anticipation” and “uncertainty”.

- A mixture of inner dynamics and exterior elements leaves Bitcoin’s subsequent goal unclear.

The previous 40 days have been “highly volatile,” really testing the persistence of Bitcoin [BTC] stakeholders. The highs propelled BTC to its ATH of $104K, however the lows dragged it again to round $94K, leaving traders on edge.

And the actual problem? It’s simply starting. Simply two days in the past, BlackRock’s (IBIT) help sparked almost $300 million in web ETF inflows, sending Bitcoin surging 4% in in the future. This institutional push helped BTC shut above the $100K mark.

However right here’s the catch—the rally feels fragile. BlackRock’s inflows have since dwindled to web zero, signaling the top of a week-long surge streak. Even total ETF inflows have halved.

In the meantime, whispers of a possible 25 bps price minimize by the Fed are protecting hopes alive, however Bitcoin’s greatest asset stays institutional backing.

So, as early traders money out as millionaires, all eyes are on the institutional heavyweights. Will they be those to push BTC towards the formidable $200K goal, or will their fading help set off a brand new wave of doubt?

Bitcoin’s newest surge would possibly simply be a ‘Cautious’ optimism

Early traders appear to be cashing out on the pivotal $100K resistance degree, signaling a retreat from greed and a pullback in danger urge for food.

But, the latest surge that catapulted Bitcoin above $101K—after weeks of fierce back-and-forth between the $94K and $100K value band—has sparked contemporary optimism.

In line with AMBCrypto, this optimism stays considerably cautious, pushed extra by “anticipation” than the precise “execution” of a Fed price minimize.

Whereas the U.S. job market reveals promise with a decline within the unemployment price, inflation has made a noticeable comeback. The CPI has risen to 2.7% on a yearly foundation, with a slight 0.3% improve in only one month.

With these combined alerts, all eyes are actually on the upcoming FOMC assembly scheduled for subsequent week. Will the Fed take a extra conservative stance in response to the uptick in inflation, probably choosing greater rates of interest? Or will it lean extra liberal, contemplating a price minimize to help the financial system?

Regardless, the short-term influence on Bitcoin’s value is already evident.

Supply : CryptoQuant

U.S. traders have eagerly seized the chance to purchase BTC, significantly by way of their Coinbase cohorts, after a interval of distribution that dominated a lot of the second week of December.

Whereas this uptick is undeniably bullish, it might show to be a short lived blip except Bitcoin’s fundamentals, together with sturdy Bitcoin ETF inflows, spark sustained curiosity from each retail and institutional traders.

Declining Bitcoin ETFs sign indicators of uncertainty

Since launching in January, Bitcoin ETFs have develop into a well-liked approach for retail traders to entry Bitcoin’s volatility, with sturdy help from establishments.

After the “Trump pump” sparked pleasure, Bitcoin ETFs reached a report $1.3 billion in inflows, with BlackRock contributing $1.2 billion.

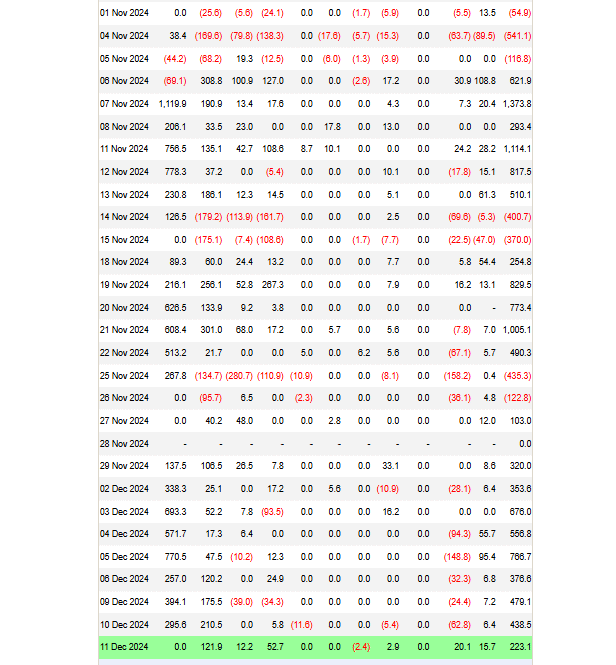

Supply : FarsideInvestors

Nonetheless, latest traits counsel a shift. BlackRock’s inflows have plateaued, ending a streak of consecutive positive factors.

Whereas this doesn’t sign a full bearish outlook for Bitcoin, it does spotlight a dip in enthusiasm for Bitcoin ETFs, with total inflows hitting a weekly low.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This reinforces AMBCrypto’s view of a extra ‘cautious’ optimism out there – sufficient to doubtlessly set $100K as a backside for Bitcoin, however not fairly sufficient to drive it towards a brand new all-time excessive.

Thus, the market is in a fragile stability, the place hope stays, however the highway to contemporary highs appears unsure.