- Ethereum, Bitcoin ETF tendencies have been optimistic all by the previous week.

- BTC has dropped barely from its ATH of $100,000, whereas ETH additionally fell under its $4,000 value stage.

The Bitcoin [BTC] and Ethereum [ETH] ETFs had an eventful week, with each reaching important milestones as their costs rallied.

Whereas Bitcoin ETFs reached an all-time excessive in internet property, Ethereum ETFs set a brand new report for weekly inflows, signaling heightened institutional curiosity within the crypto market.

Bitcoin ETF hits new all-time excessive

The Bitcoin ETF market skilled exceptional development final week, coinciding with Bitcoin’s value surge to a brand new all-time excessive.

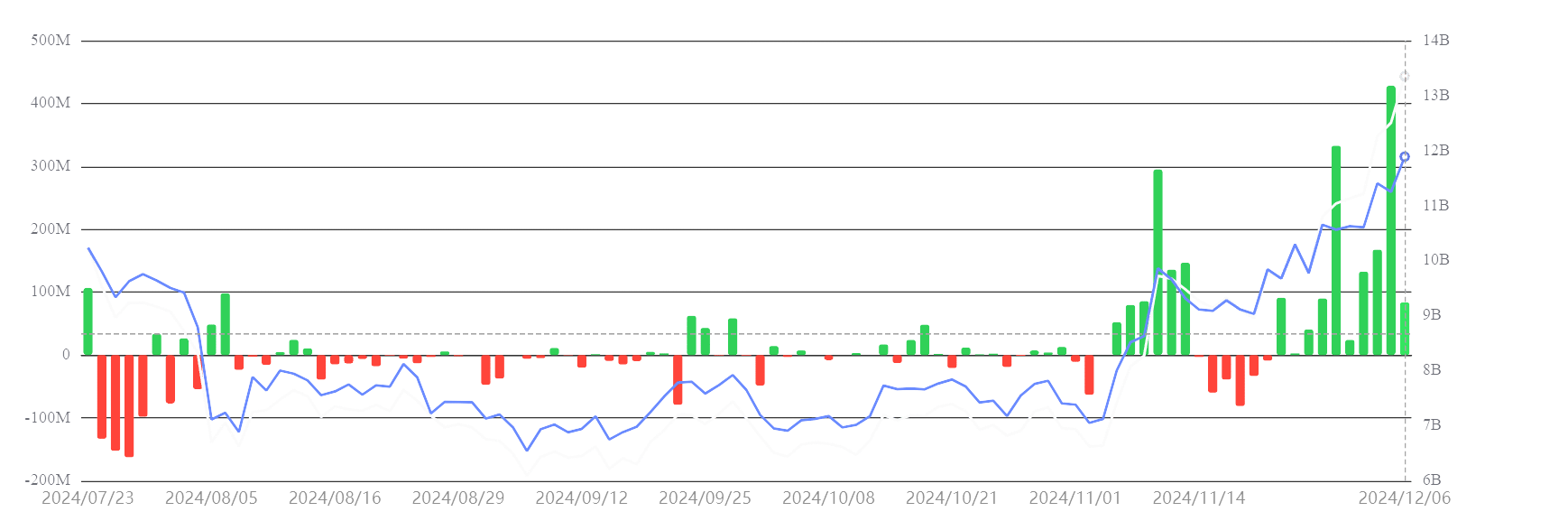

Knowledge from SosoValue revealed that Bitcoin ETFs held a report internet asset of $112.74 billion at press time, accounting for five.62% of Bitcoin’s complete market capitalization.

Supply: SosoValue

Internet inflows for the previous week totaled $2.73 billion, with optimistic flows recorded on all days. BlackRock’s IBIT, the world’s largest BTC ETF, attracted the lion’s share of those inflows, receiving over $2.6 billion.

This reinforces BlackRock’s dominant place within the ETF area and highlights the rising institutional urge for food for BTC publicity.

Ethereum ETF breaks weekly internet influx information

Ethereum ETFs mirrored Bitcoin’s success, reaching a milestone of their very own.

Weekly internet inflows hit $836.69 million, the best in Ethereum ETF historical past, pushing the entire property beneath administration to a report $13.6 billion.

For the primary time since their approval, Ethereum ETFs recorded two consecutive weeks of optimistic internet inflows, a major shift in investor sentiment.

Supply: SosoValue

On the fifth of December, Ethereum ETFs set one other report, registering $428.44 million in every day internet inflows, the best ever for the asset class.

These inflows exhibit a rising confidence in Ethereum’s potential as a long-term funding, pushed by its increasing utility in DeFi and good contracts.

Bitcoin value consolidates after historic rally

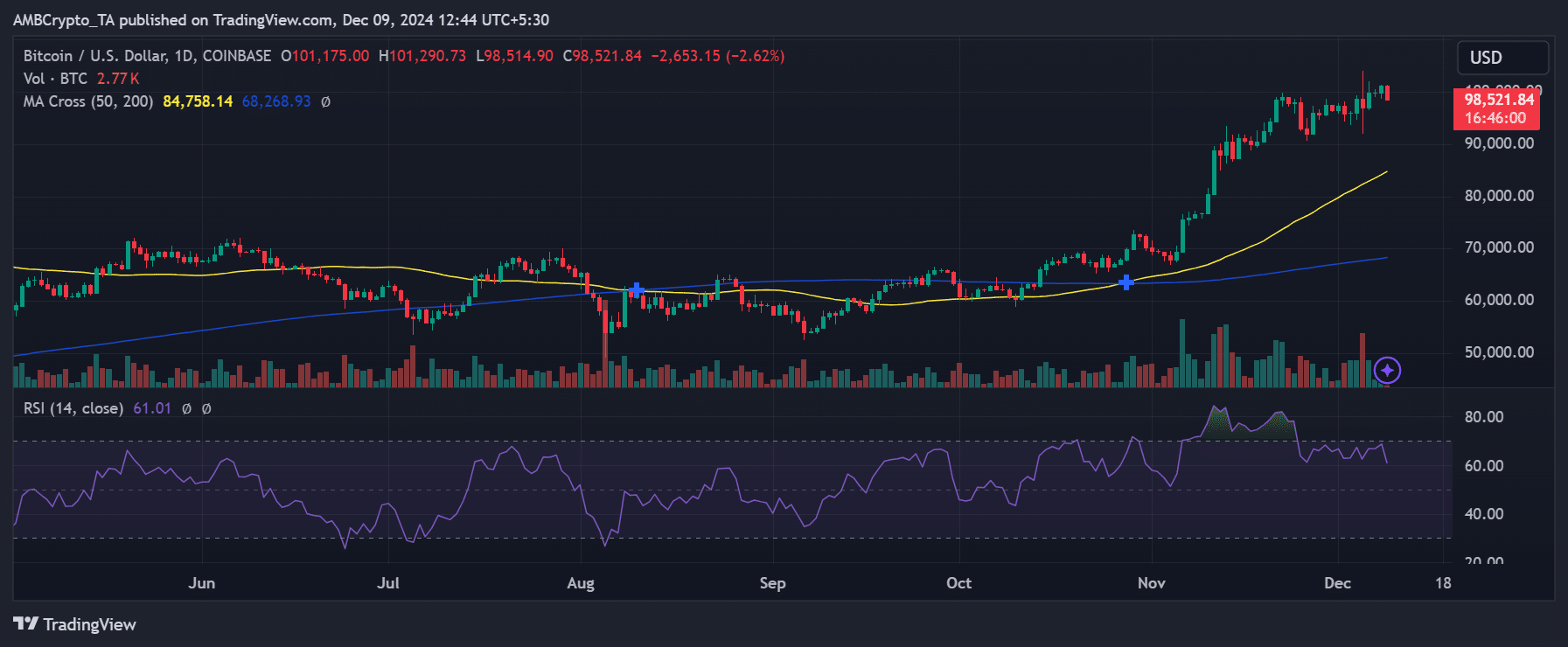

Bitcoin’s value was $98,521 at press time, reflecting a wholesome consolidation part after its sharp rally previous the $100,000 mark.

The 50-day shifting common has crossed above the 200-day shifting common, forming a golden cross—a robust bullish indicator.

With an RSI of 61, Bitcoin maintains room for additional upward motion whereas remaining in a secure buying and selling vary.

Supply: TradingView

With their record-breaking $112.74 billion in internet property, Bitcoin ETFs underscore the asset’s continued dominance in institutional portfolios.

Buyers nonetheless view Bitcoin as a dependable retailer of worth, at the same time as Ethereum positive factors consideration for its development potential.

Ethereum’s value momentum aligns with ETF development

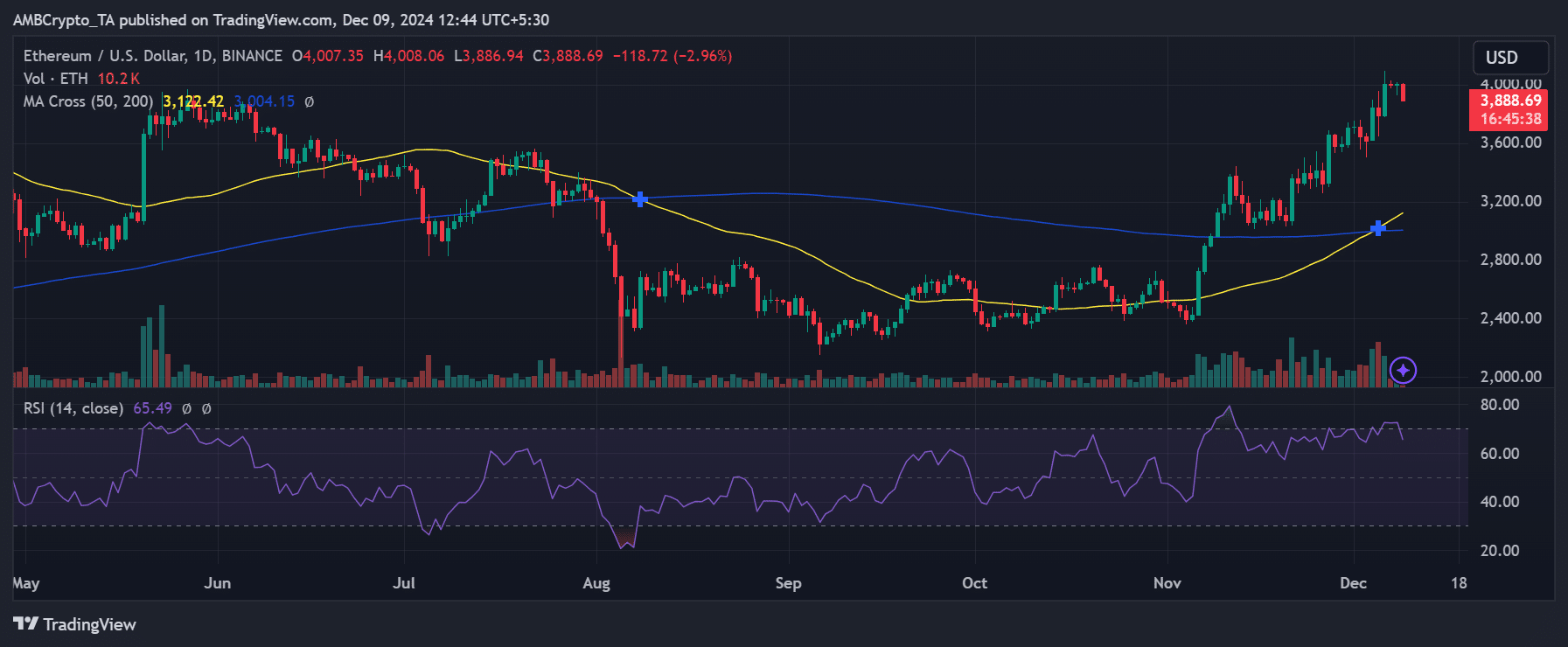

Ethereum’s value, at $3,888, has seen a slight pullback after not too long ago crossing the $4,000 mark. Nonetheless, its bullish technical indicators remained intact.

The golden cross between the 50-day and 200-day shifting averages pointed to additional upside potential. In the meantime, an RSI of 65 prompt Ethereum was nearing overbought ranges however nonetheless has room for development.

Supply: TradingView

The report inflows into Ethereum ETFs aligned with this value momentum, reflecting institutional confidence in Ethereum’s long-term prospects.

These inflows might catalyze sustained value appreciation, additional solidifying Ethereum’s place because the main various to Bitcoin.

Bitcoin and Ethereum ETFs are breaking information, pushed by rising institutional demand and powerful value momentum.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Whereas Bitcoin retains its dominance as a retailer of worth, Ethereum’s explosive weekly inflows spotlight its rising position as a dynamic development asset.

These developments mark a pivotal second for the cryptocurrency ETF market, underscoring the growing integration of digital property into conventional monetary portfolios.