- Promoting stress on Bitcoin was rising.

- A value correction can push BTC right down to $95.8k once more.

After crossing a historic $100k mark, Bitcoin [BTC] witnessed a pullback and dropped close to the $98k vary. Slowly, the king coin was once more approaching the triple digit mark.

Nonetheless, BTC has to face a couple of obstacles going ahead, which might set off a value correction.

Bitcoin inches in the direction of $100k once more, however…

Bitcoin value consolidated within the final 24 hours as its value moved marginally. On the time of writing, the king was buying and selling at $99.6k with a market capitalization of over $1.97 trillion.

Nonetheless, this sluggish method to $100k won’t be a profitable try as a key metric was rising.

IntoTheBlock, a knowledge analytics platform, not too long ago posted a tweet spotlight BTC’s MVRV ratio. As per the tweet, Bitcoin’s MVRV was shifting nearer to historic peak ranges.

Typically, when MVRV rises, it’s typically adopted by value corrections.

Traditionally, BTC witnessed related pullbacks in 2018, 2021, 2022, and 2024. If historical past repeats, then BTC buyers ought to put together themselves to witness a value correction quickly.

Supply: X

Is a value correction inevitable?

Not solely did the MVRV ratio flag a pink sign, a couple of different on-chain metrics additionally painted an identical image. For example, BTC dominance has been declining of late.

The ratio dropped from 53.7% to 51% final week — an indication of a brand new altcoin season.

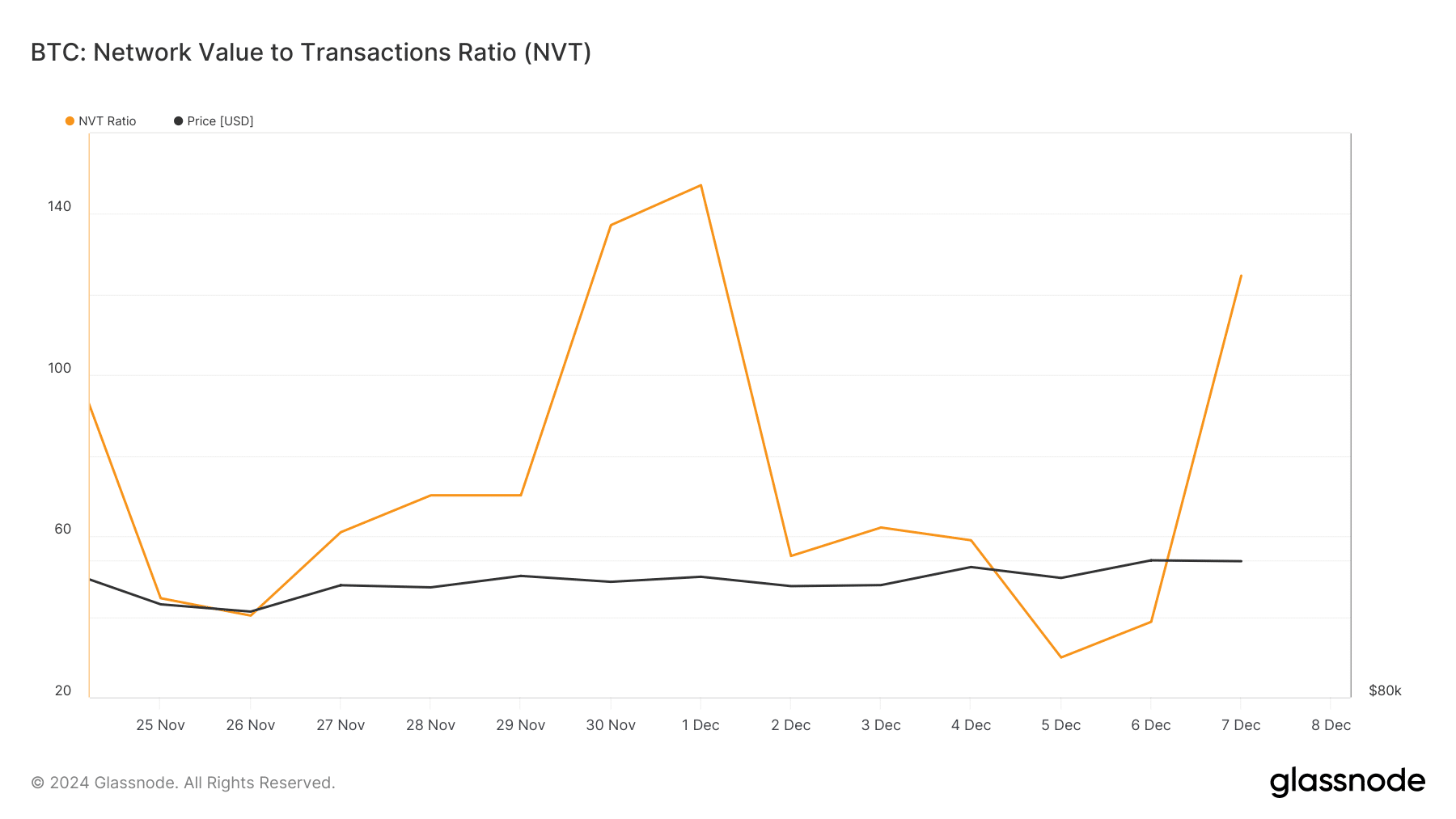

Glassnode’s information revealed that Bitcoin’s NVT ratio registered a pointy uptick. At any time when the metric rises, it signifies that an asset is overvalued, hinting at a value correction going ahead.

Supply: Glassnode

CryptoQuant’s information additionally identified a couple of bearish metrics. BTC’s web deposit on exchanges had been excessive in comparison with the previous seven days’ common. It is a clear signal of rising promoting stress on the king coin.

Moreover, the aSORP turned pink, that means that extra buyers are promoting at a revenue. In the course of a bull market, it might point out a market high.

Other than that, AMBCrypto reported earlier that miners had been exhibiting much less confidence in BTC as they had been promoting their holdings.

To be exact, over the previous 48 hours, BTC miners have offered off an unbelievable 85,503 BTC, bringing miner balances right down to about 1.95 million BTC — the bottom stage in months.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

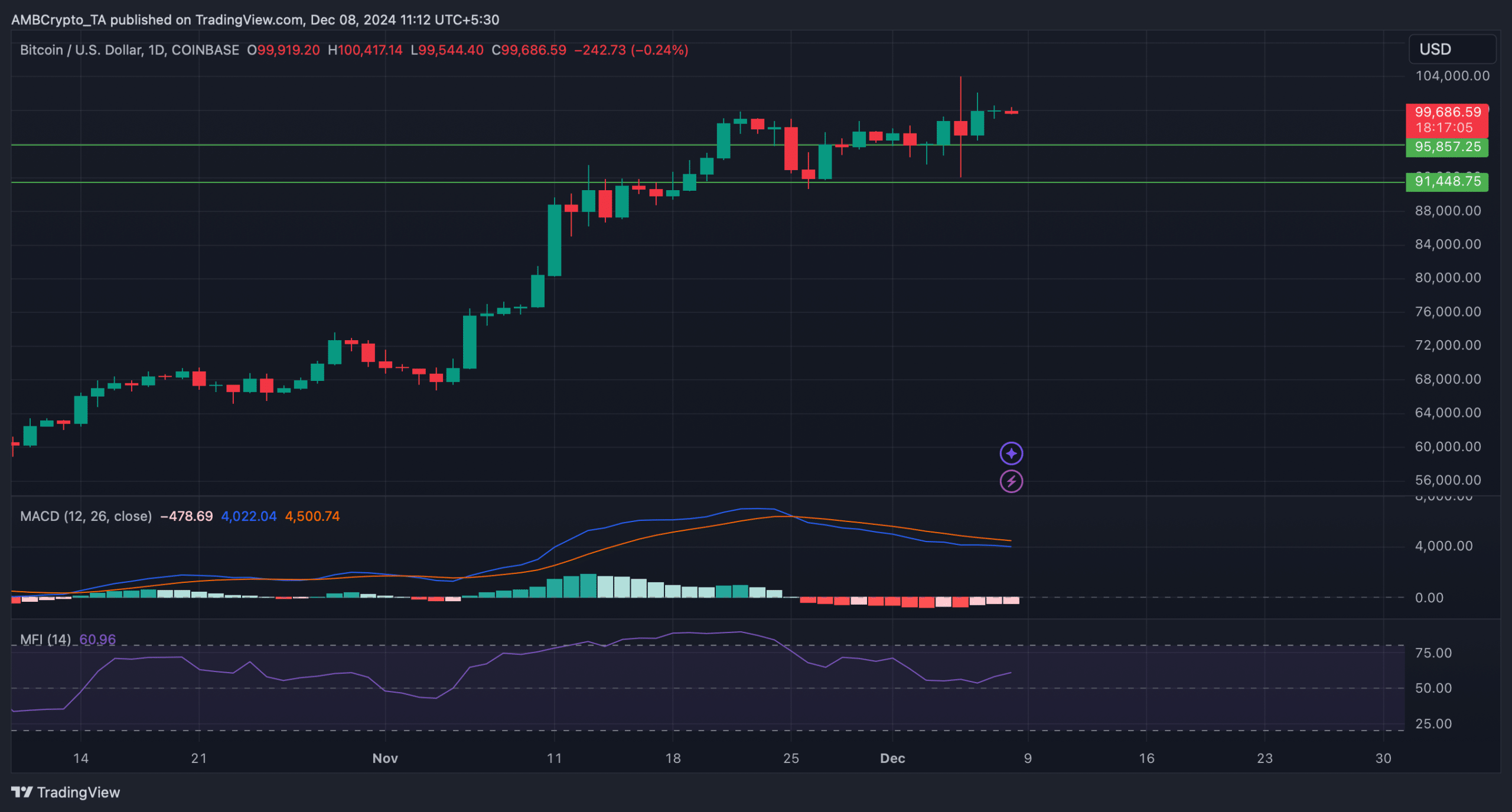

The technical indicator MACD displayed a bearish benefit available in the market. Within the occasion of a value correction, BTC may quickly drop to its assist close to $95.8k. A slip below that might push BTC right down to $91k once more.

Nonetheless, the Cash Circulate Index (MFI) registered an uptick, hinting at a continued value rise. This may push BTC above $100k once more within the coming days.

Supply: TradingView