- Ethereum ETFs noticed $332.9 million in inflows, surpassing Bitcoin’s ETF efficiency on the twenty ninth of November.

- Ethereum’s value reached a 5-month excessive, outperforming Bitcoin in weekly and month-to-month efficiency.

After a interval of challenges, Spot Ethereum [ETH] exchange-traded funds (ETFs) within the U.S. skilled a surge in every day inflows throughout its newest buying and selling day — the twenty ninth of November.

This notable uptick signifies rising curiosity in ETH, highlighting its resurgence as a possible catch-up commerce after considerably lagging behind Bitcoin [BTC] in efficiency this 12 months.

Ethereum ETF replace

On the twenty ninth of November, the 9 Ethereum-based exchange-traded merchandise noticed spectacular web inflows totaling $332.9 million, as per knowledge from Farside Traders.

Amongst these, BlackRock’s iShares Ethereum Belief (ETHA) and Constancy Ethereum Fund (FETH) led the cost, bringing in $250 million and $79 million, respectively.

Grayscale’s Ethereum fund additionally noticed modest inflows of $3.4 million, whereas different merchandise skilled no extra capital.

This marked the fifth consecutive day of constructive inflows, capping off the second-strongest week for the group with $455 million in complete inflows, regardless of the shortened buying and selling week as a consequence of Thanksgiving.

In actual fact, on that very day, Ether ETFs surpassed their spot Bitcoin counterparts, which noticed $320 million in inflows however confronted web outflows for the week as per Farside Traders.

Remarking on the identical, crypto dealer Edward Morra famous,

Supply: Edward Morra/X

What’s the explanation behind this?

The surge in Ethereum ETF inflows follows the election of Donald Trump because the forty seventh President of the US.

Together with this momentum, open curiosity for ETF futures on the Chicago Mercantile Trade (CME), which targets institutional buyers, has reached all-time highs close to $3 billion, in keeping with CoinGlass.

Supply: CoinGlass

This progress displays a constructive shift in sentiment towards Ethereum as a number one asset within the cryptocurrency area.

ETH and BTC current value developments

Whereas Bitcoin remained in consolidation under the $100,000 mark all through the week, Ethereum demonstrated notable power, outperforming its bigger counterpart.

That being stated, ETH’s value reached a 5-month excessive, surpassing $3,700 on the thirtieth of November, and outperformed Bitcoin each weekly and month-to-month, although it nonetheless lags behind on a year-on-year foundation.

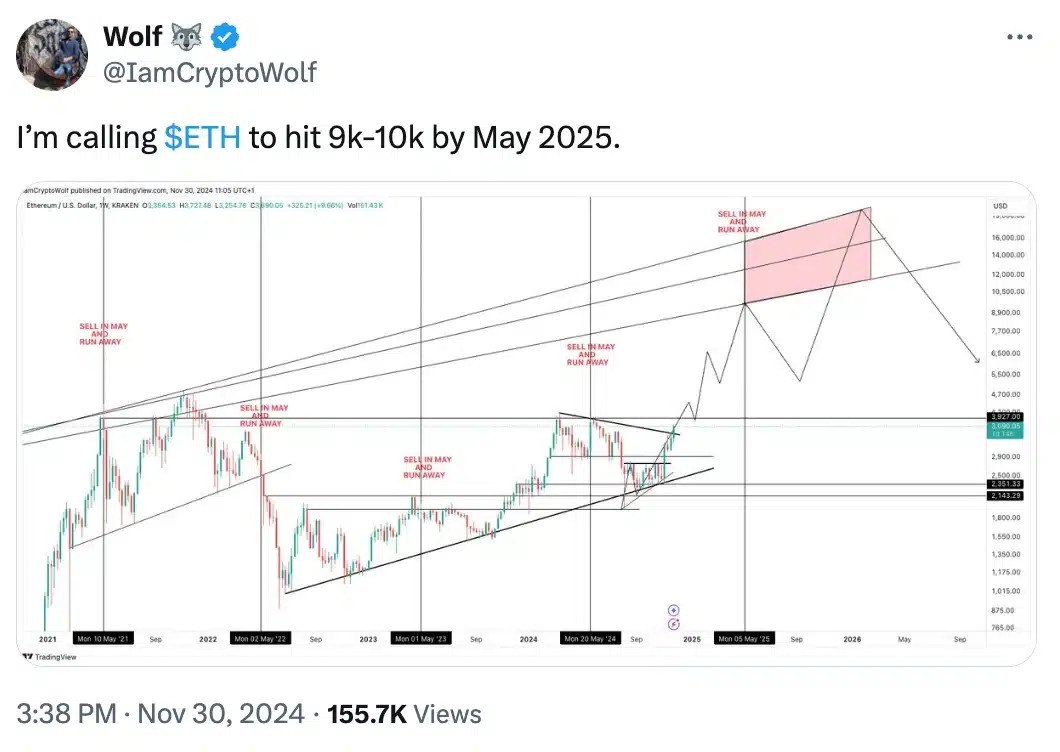

Regardless of this, analyst Woolf took to X (previously Twitter) and famous,

Supply: Wolf/X

As of the newest replace, Ethereum was priced at $3,582.05, reflecting a 3% decline over the previous 24 hours.

In the meantime, Bitcoin stood at $94,936.36, marking a 2.02% drop in the identical interval, in keeping with CoinMarketCap.

Subsequently, regardless of current fluctuations, each cryptocurrencies proceed to draw consideration, with market dynamics able to form and switch bullish within the coming weeks.