- Lengthy-term BTC holders have continued to money in.

- This has contributed to BTC’s battle to interrupt its psychological resistance.

Bitcoin’s [BTC] long-term holders have had an enormous sell-off prior to now 30 days, marking the biggest since April. This comes as Bitcoin hovers close to $93,000, sparking questions on whether or not these strikes sign profit-taking or forewarn a possible market correction.

With key indicators just like the Concern & Greed Index and HODL Waves exhibiting noteworthy tendencies, this sell-off may have implications for Bitcoin’s near-term trajectory.

Lengthy-term holders shed Bitcoin amid value surge

The offloading by long-term holders coincides with Bitcoin’s parabolic rise to $93,000 earlier this month, fueling hypothesis concerning the motivations behind such a large sell-off.

Evaluation of the Lengthy Time period Holders Internet place Change chart on CryptoQuant confirmed that it was destructive. Over 728,000 BTC has been bought prior to now 30 days, marking the biggest sell-off since April.

Supply: CryptoQuant

In April, an analogous sell-off by long-term holders triggered a short-term value correction, elevating questions on whether or not historical past may repeat itself. With Bitcoin nonetheless holding above $90,000, the market’s resilience is being examined.

Bitcoin Concern & Greed Index hits excessive ranges

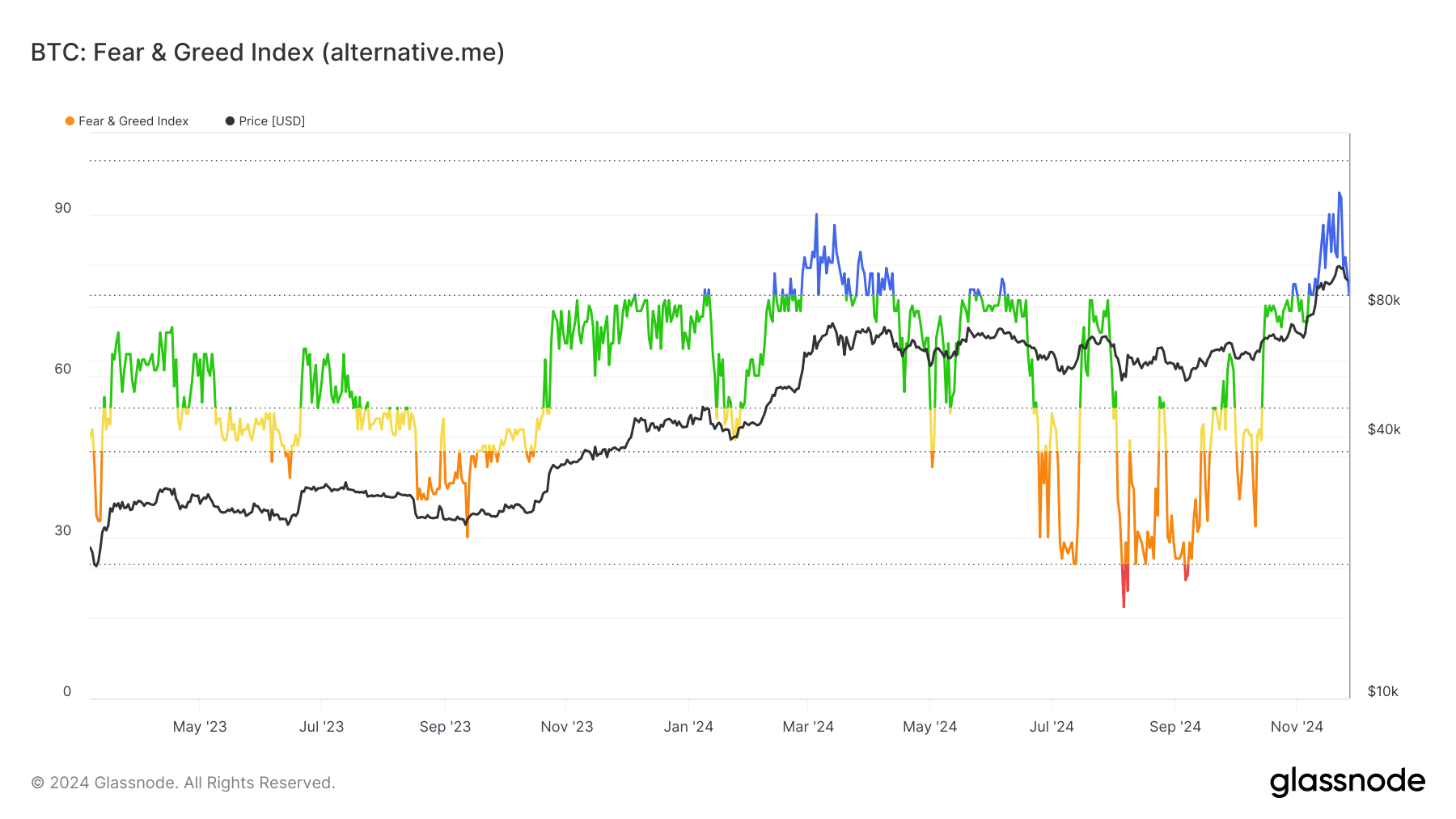

One other issue including to the narrative is the Bitcoin Concern & Greed Index, which at the moment reveals a studying of round 75, reflecting “extreme greed” available in the market. Such sentiment typically precedes corrections, as overconfidence amongst buyers can result in unsustainable value motion.

The index, mixed with the sell-off from long-term holders, suggests warning could also be warranted within the quick time period.

Supply: Glassnode

Youthful cash dominate as HODL Waves shift

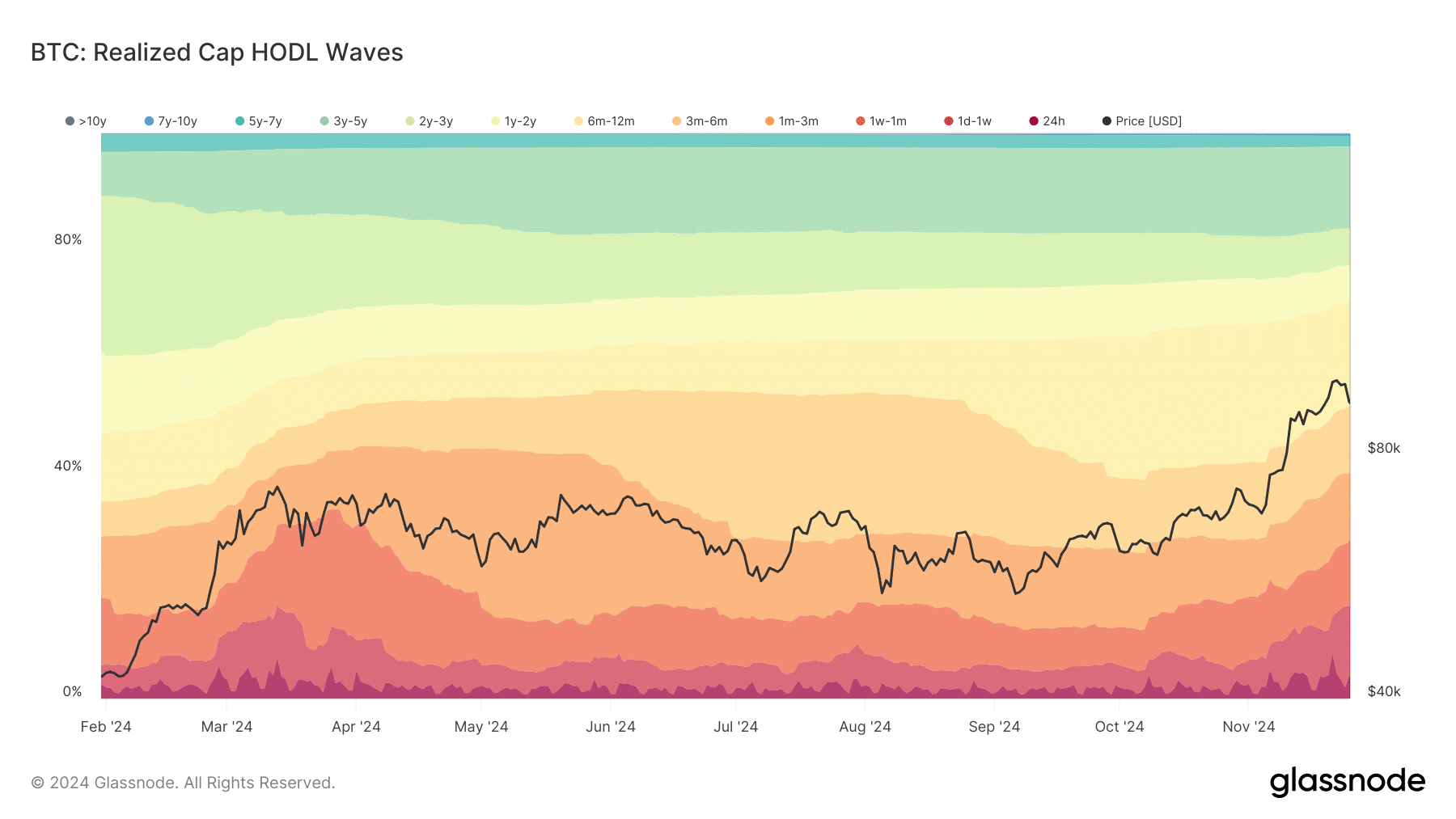

Information from Glassnode’s Realized Cap HODL Waves signifies a big shift in Bitcoin possession, with youthful cash—these held for lower than six months—making up a bigger share of the market. This implies new entrants or merchants are absorbing the promoting strain from long-term holders, stabilizing Bitcoin’s value for now.

Nevertheless, the query stays whether or not these newer market contributors may have the identical conviction if volatility spikes.

Supply: Glassnode

Outlook: warning or optimism?

Whereas Bitcoin’s current sell-off by long-term holders is notable, it doesn’t essentially sign a bearish pattern. The market has proven resilience in holding key ranges, with $90,000 appearing as crucial assist.

Nevertheless, the confluence of maximum greed available in the market and heavy profit-taking raises the chance of elevated volatility.

The RSI (Relative Power Index) for Bitcoin now stands at 61.44, reflecting that the asset is approaching overbought ranges. Traditionally, these metrics are inclined to align with profit-taking conduct, particularly when costs breach important psychological thresholds.

Learn Bitcoin (BTC) Worth Prediction 2024-25

As Bitcoin edges nearer to $100,000—a psychological resistance stage—buyers ought to maintain a detailed watch on the conduct of each long-term holders and newer contributors.

Whether or not this can be a mere consolidation section or a prelude to a correction stays to be seen. For now, the Bitcoin market is strolling a nice line between bullish momentum and cautious retracement.