- Bitcoin has dropped 5.6% from its $99,645 all-time excessive, with retail merchants but to affix the rally.

- Change inflows and Open Curiosity revealed insights into market sentiment.

After a powerful rally that pushed Bitcoin [BTC] to an all-time excessive of $99,645 final week, the asset has now entered a correction section.

This marks a 5.6% drop from its peak, with Bitcoin buying and selling at $93,602 at press time, a 4.3% decline previously 24 hours.

The correction comes as Bitcoin inches nearer to the psychologically vital six-digit worth stage of $100,000. Regardless of the pullback, market analysts proceed to investigate key metrics for indicators of what lies forward.

Retail dealer present development

A CryptoQuant analyst, Woominkyu, has highlighted a key statement — retail merchants have but to play a big position in Bitcoin’s worth motion.

In line with the analyst, the Korea Premium Index, which displays retail participation, remained beneath -0.5 on the time of writing. Thus, retail exercise has not been a significant driver of the current worth surge.

Supply: CryptoQuant

Traditionally, the Korea Premium Index has typically proven vital spikes earlier than Bitcoin reaches a worth peak. Woominkyu emphasised the significance of monitoring this indicator intently to determine potential worth tops.

The subdued retail involvement means that Bitcoin’s present rally is essentially being pushed by institutional participation or different components, leaving room for added momentum as soon as retail merchants reenter the market.

Change Outflows, Open Curiosity provide insights

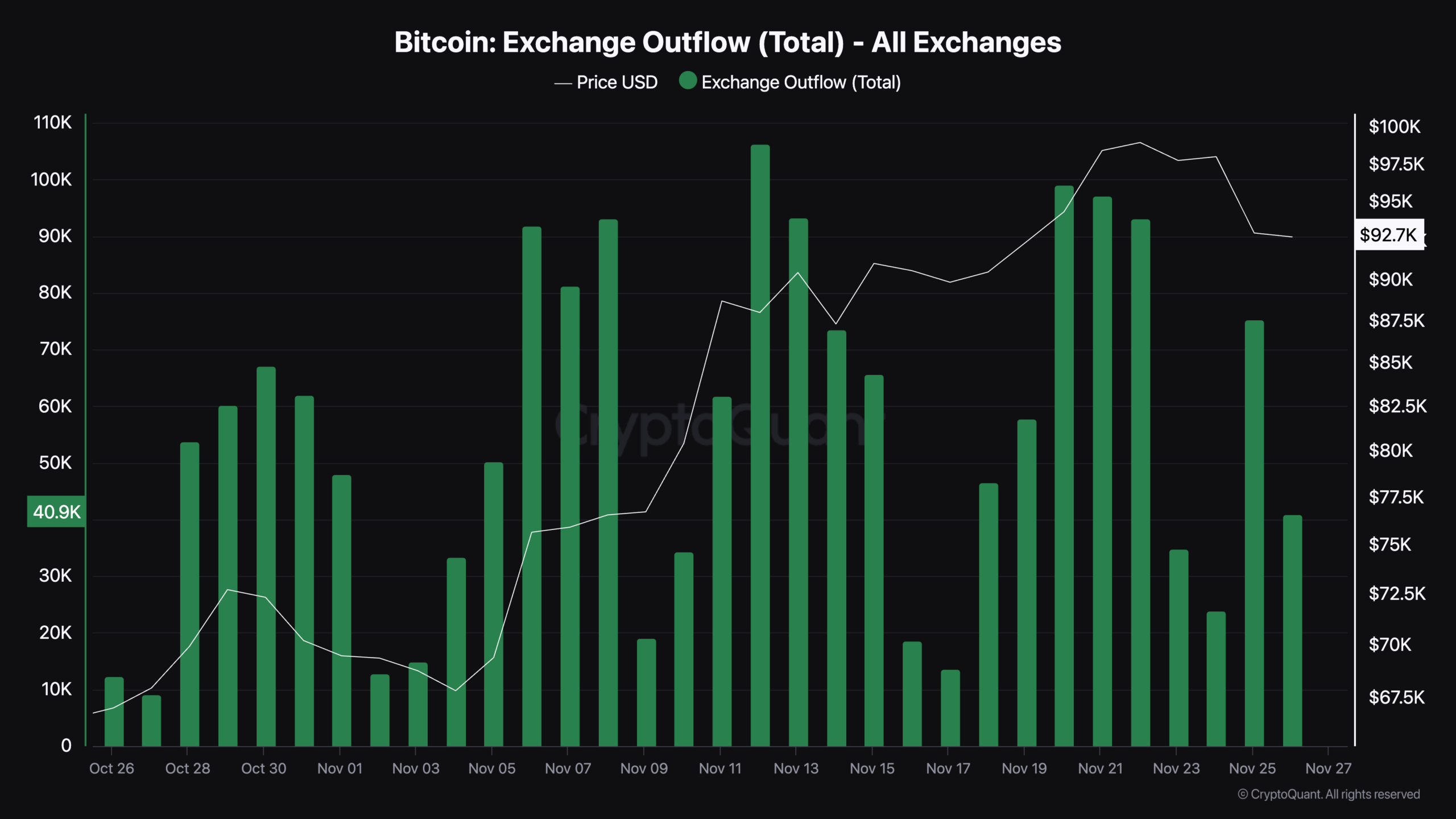

Past retail exercise, inspecting Bitcoin’s trade outflows and Open Curiosity gives a deeper understanding of market dynamics. Information from CryptoQuant reveals a notable development in trade outflows.

Supply: CryptoQuant

Not too long ago, the metric recorded a big spike, with greater than 75,000 BTC outflowing from exchanges on the twenty fifth of November.

Though this determine has since declined to round 31,000 BTC at press time, the quantity was nonetheless noteworthy, particularly contemplating the day is simply beginning.

This development of Bitcoin shifting off exchanges signifies that buyers could also be choosing self-custody, signaling long-term holding intentions quite than short-term promoting stress.

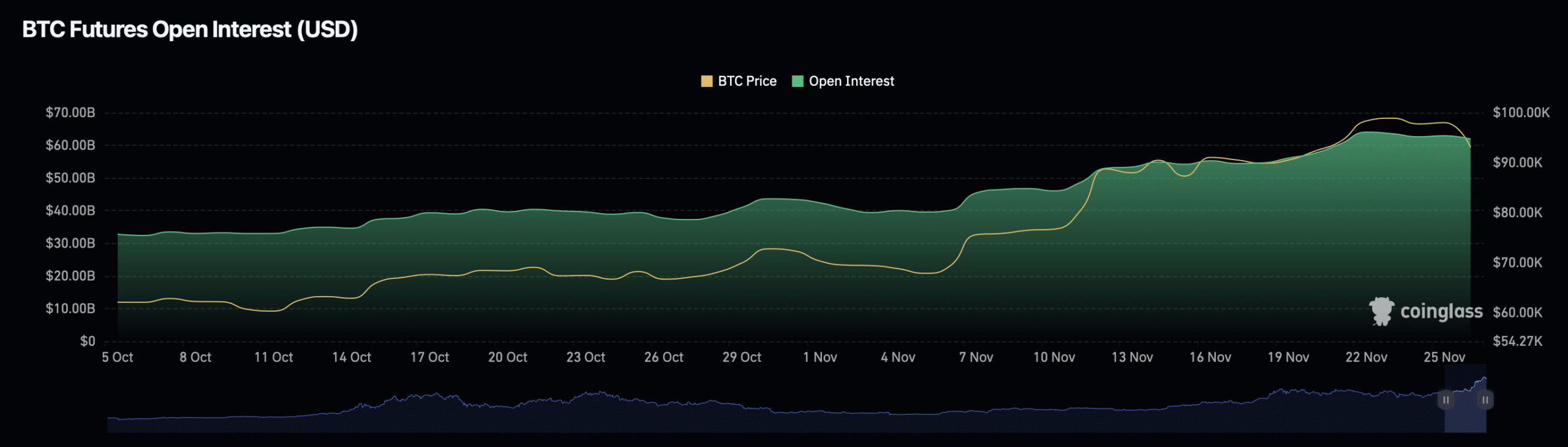

Then again, Bitcoin’s open curiosity metrics paint a blended image.

In line with Coinglass, Bitcoin’s Open Curiosity worth has decreased by 4.55% to $60.37 billion, signaling a possible cooling in leveraged positions.

Nevertheless, the Open Curiosity surged by a powerful 62.58%, reaching $132.86 billion.

Supply: Coinglass

This disparity signifies that whereas the whole worth of contracts has declined, there is a rise within the variety of lively positions available in the market.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This rise in quantity may recommend heightened market exercise, with merchants opening positions in anticipation of additional worth actions.

Nevertheless, the decline within the total worth of those positions may suggest warning amongst bigger buyers.