- A recap of how Ethereum has been lagging behind in comparison with a few of its high rivals.

- Why Bitcoin dominance might be the important thing to ETH unlocking explosive progress.

Ethereum [ETH] turned the topic of criticism lately, with many accusing the king of altcoins of underperforming. However issues might change quickly — one primary catalyst might be Bitcoin’s [BTC] dominance.

Ethereum gained roughly $100.61 billion in its market cap from its lowest level to date this month. In distinction, Bitcoin gained over $480 billion in market cap throughout the identical interval.

Maybe the largest measure of its underperformance was the truth that Ethereum has not achieved new ATHs.

As has been the case with a few of its high rivals. For instance, its TVL peaked at $66.77 billion on the twelfth of November. Nevertheless, this was nonetheless decrease than its June TVL peak at $72.72 billion.

Supply: DeFiLlama

Transaction information additionally painted an analogous image. Ethereum’s on-chain transactions peaked at 1.29 million transactions on the twelfth of November. This was the very best single day transactions it achieved final week.

Nevertheless, the quantity was nonetheless decrease than its peak day by day transaction rely in October, which peaked at 1.32 million transactions on the 18th of October.

One other main space the place individuals thought it has been lagging behind was the worth motion. Observe that ETH really delivered a bullish efficiency to date in November.

It rallied by 44.61% from its lowest to its highest value within the final two weeks. Nevertheless, Bitcoin has been in value discovery, whereas ETH was nonetheless miles away from its historic ATH.

Ethereum might redeem itself if…

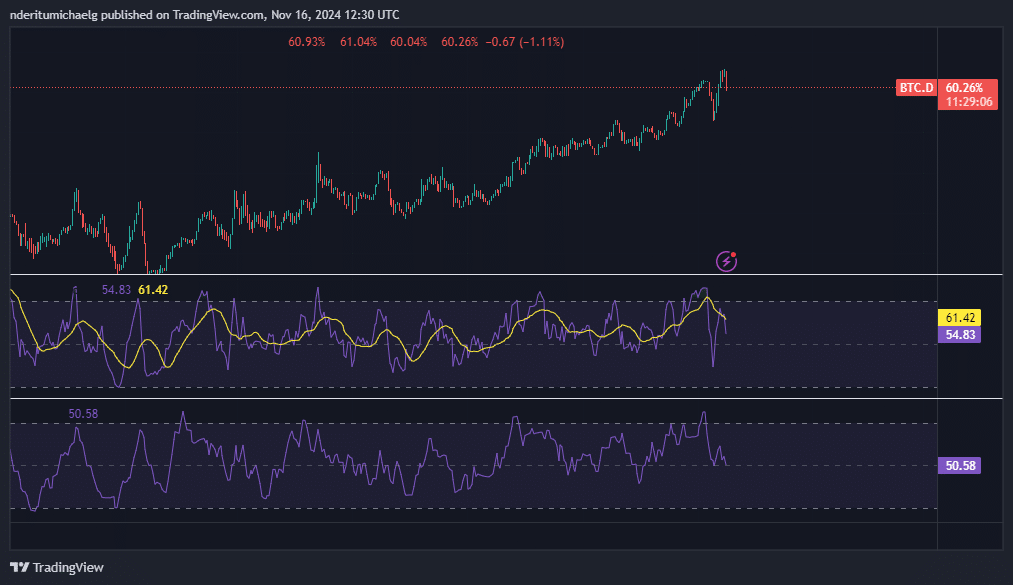

Bitcoin dominance has been on the rise for months, thus indicating that many of the liquidity coming into crypto went into BTC. Nevertheless, this may occasionally quickly change if Bitcoin dominance begins declining.

Supply: TradingView

Bitcoin dominance was already wanting prefer it was prepared for some draw back on the time of writing. This was courtesy of some draw back within the final 24 hours and a bearish divergence sample with the RSI.

Additionally, its cash move indicator confirmed that liquidity flows might already be in favor of altcoins.

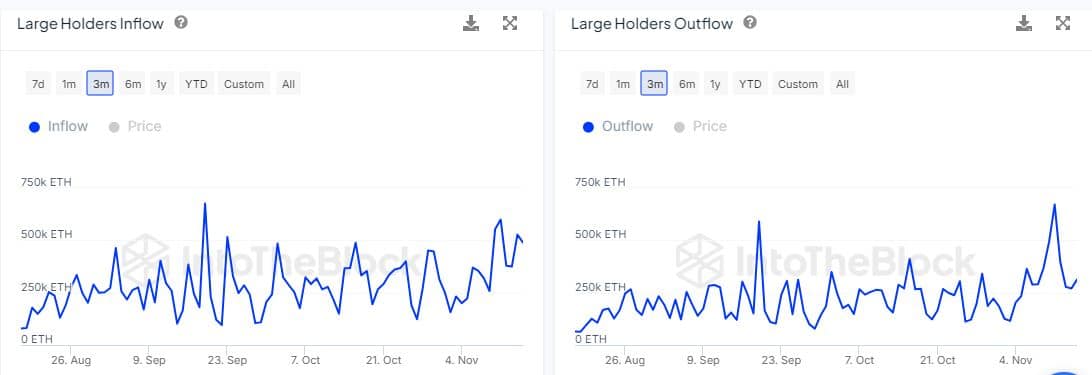

The liquidity move into Ethereum might already be going down. The hole between massive holder inflows and outflows has been widening.

Supply: IntoTheBlock

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Massive holder inflows have been notably increased at over 488,000 ETH as of the fifteenth of November. Nevertheless, massive holder outflows have been notably increased at 312,430 ETH throughout the identical buying and selling session.

This might point out that ETH is increase extra momentum as BTC dominance begins declining.