- A promote sign appeared on BTC’s each day chart, hinting at a correction.

- Bitcoin was testing key help, and the NVT ratio indicated that BTC was undervalued.

After efficiently crossing the $91k mark, Bitcoin [BTC] confronted a correction, pushing the king coin down underneath $90k once more. Actually, the newest information already flagged the potential for a correction taking place. Does this imply BTC was poised for extra worth drops?

Bitcoin’s bull rally halts

Over the previous few weeks, Bitcoin has smashed a number of resistance ranges. This sparked pleasure locally about BTC subsequent touching $100k.

Nonetheless, quickly after reaching $91k, a promote sign appeared. Ali, a well-liked crypto analyst, not too long ago posted a tweet revealing that Bitcoin’s TD sequential flashed a promote sign.

BTC’s rally did halt after the sign appeared, as its worth declined by over 3% up to now 24 hours. On the time of writing, BTC was buying and selling underneath $90k at $87,524.10.

Aside from this, AMBCrypto additionally reported earlier that the crypto market was in an “extreme greed” section. This was much like the March surge when Bitcoin hit $73k earlier than crashing to $67k once more.

At press time too, the concern and greed index had a worth of 80, suggesting an analogous grasping sentiment out there.

However buyers’ ought to stay affected person. The Bitcoin Rainbow Chart identified that the king coin’s worth was within the “HODL” place, that means that it’d simply be proper for buyers to proceed holding their BTC.

Supply: Blockchaincenter

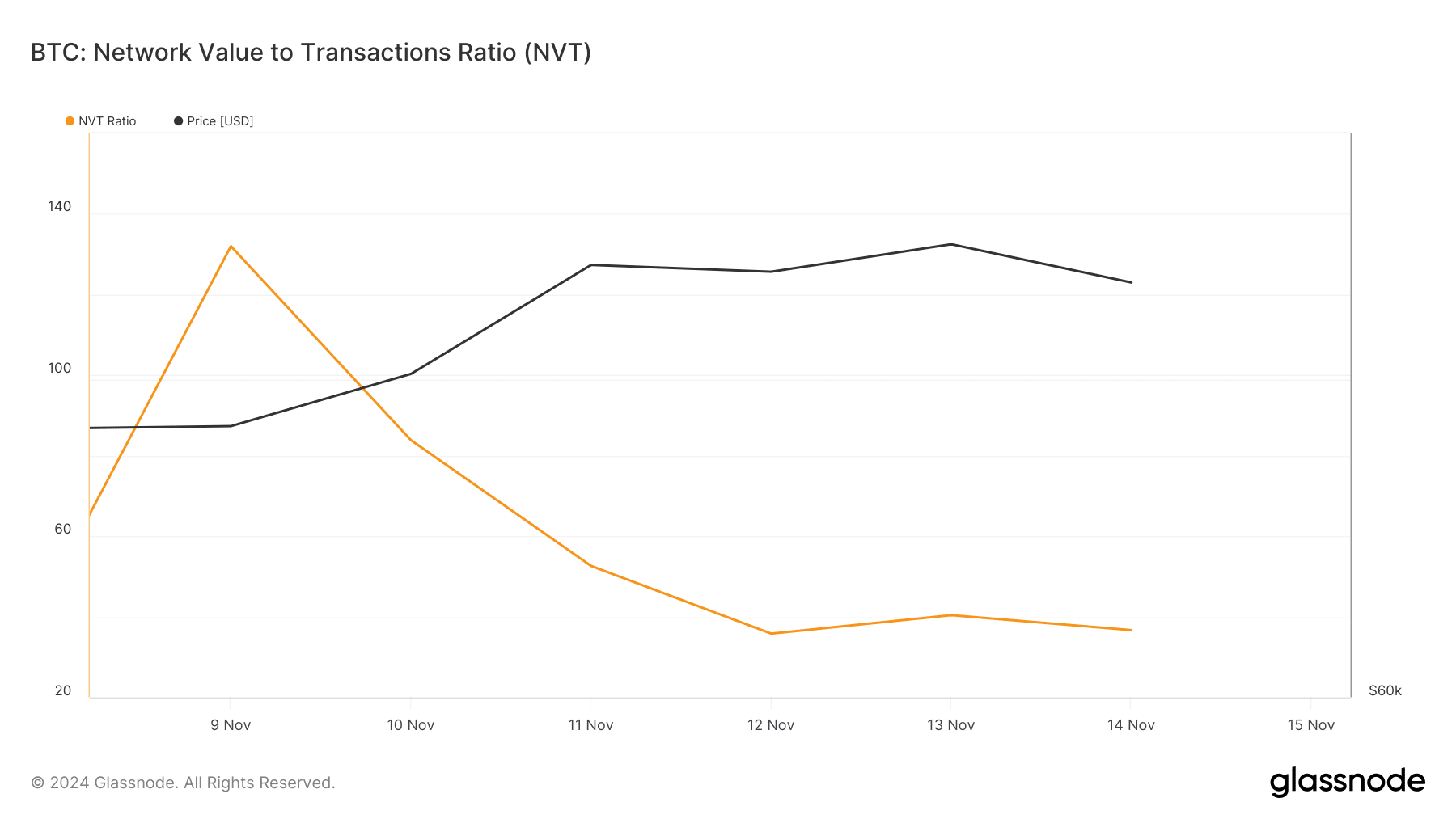

Glassnode’s information revealed that regardless of the final main worth pump, Bitcoin’s NVT ratio registered a large dip final week. At any time when the metric drops, it signifies that an asset is undervalued, hinting at a worth rise within the coming days.

One other excellent news for BTC was its declining trade reserve up to now 24 hours. This indicated that buyers didn’t panic promote, which may stop a steep worth drop within the close to time period.

Supply: Glassnode

Checking BTC’s nearest help

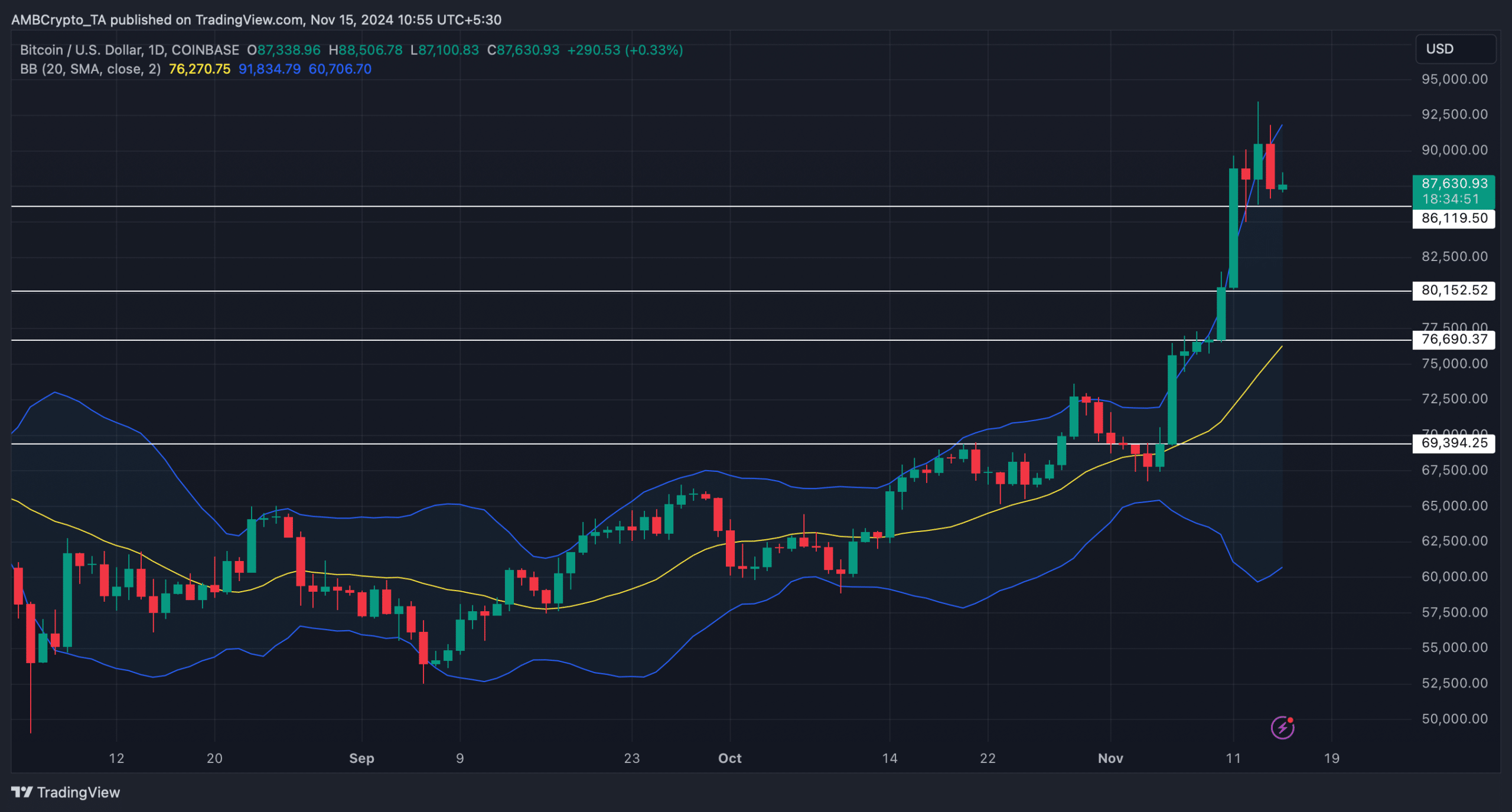

Checking Bitcoin’s each day chart is usually an excellent choice to search for rapid help and resistance zones when costs stay risky.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

BTC’s worth had touched the higher restrict of the Bollinger Bands, and on the time of writing, it was testing its help close to $86k. A profitable check of the help may kickstart yet one more bull rally.

Nonetheless, if Bitcoin fails to take action and slips underneath the help, it may drop to the vary of $76k-$80k. An additional worth plummet from that vary may as soon as once more push BTC down to close the $70k mark.

Supply: TradingView