- The cryptocurrency market capitalization has ballooned to $2.7 trillion after a $500 billion hike in underneath one week.

- Retail FOMO, US politics, and short-sellers may very well be driving the rally.

The cryptocurrency market is experiencing one among its greatest months this 12 months. Bitcoin [BTC] has made successive new highs within the final seven days, and it lately ripped previous $81,000. Ethereum [ETH] additionally flipped $3,100 for the primary time in three months.

The features have been widespread as the whole market capitalization has pushed previous the $2.7 trillion mark. In only one week, complete crypto market capitalization has surged by greater than $500 billion.

A number of elements had been driving this bull run and if the optimistic sentiment continues, it might result in extra features.

Supply: Tradingview

Concern of lacking out (FOMO)

Cryptocurrency merchants, particularly short-term holders, are identified to be reactive. Not like long-term holders who typically concentrate on fundamentals, short-term holders react to cost volatility and hype.

This habits was seen within the Concern and Greed Index, which had a price of 76 at press time, a sign that the market was in “extreme greed”. On the tenth of November, this index surged to 78, its highest stage in a 12 months.

Information from Google Traits additionally reveals that the phrase “Bitcoin” was gaining curiosity with a search rating of fifty/100. This was a notable hike from 18/100 barely a month in the past.

When retail curiosity is excessive, it drives shopping for exercise, which in flip results in value features. Nonetheless, FOMO is normally short-lived, and as soon as patrons are exhausted, crypto costs might appropriate or consolidate.

Hypothesis of a pro-crypto Senate chief

After the Republican Occasion received the fifth of November US elections, the main target has now turned to the Senate management. Hypothesis was rife that Florida Senator, Rick Scott, will take the place of Senate majority chief after he was endorsed by Tesla CEO, Elon Musk.

Scott is a pro-crypto senator provided that earlier this 12 months, he was amongst those that voted for the SAB 121 decision permitting banks to custody digital belongings.

In February 2024, Scott additionally supported the CBDC Anti-Surveillance State Act proposed by pro-crypto Senator Ted Cruz. Scott opposed CBDCs saying that they enabled authorities surveillance. If Scott wins the vote, it might pave the way in which for pro-crypto payments. This might drive extra features throughout the market.

Brief liquidations

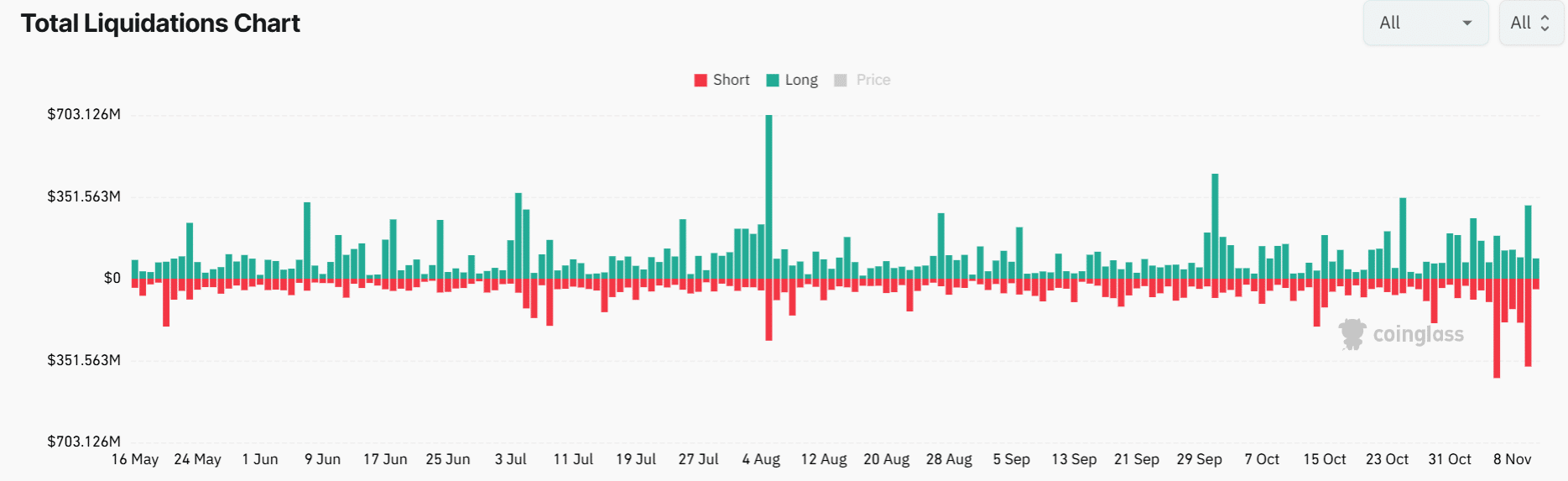

The latest volatility throughout the crypto market has led to a surge in liquidations. Information from Coinglass confirmed that previously week, brief liquidations have spiked and continued to rise as within the final 24 hours, $283 million value of shorts had been liquidated.

Supply: Coinglass

When brief sellers are liquidated, they’re pressured to purchase to shut their positions. This pressured shopping for tends to speed up the uptrend. Regardless of greater than $650 million in each lengthy and brief positions being liquidated up to now 24 hours, open curiosity continued to climb, which confirmed an total bullish sentiment.

In reality, Bitcoin’s open curiosity has continued to make new highs and stood at $49 billion at press time. When open curiosity is rising, it signifies that the bullish sentiment is rising.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nonetheless, CryptoQuant CEO, Ki Younger Ju, acknowledged that the futures market prompt that Bitcoin was “overheated.” Due to this fact, he anticipated that costs might appropriate and consolidate earlier than the bull run extends.

Nonetheless, if the present bullish momentum continues till the top of the 12 months, it might result in a bear market in 2025.