- Bitcoin at $80K means greater stakes, setting the stage for large market volatility.

- Now, greater than ever, it’s essential for whales to behave.

As anticipation builds over Trump’s subsequent coverage transfer concerning the crypto market, Bitcoin [BTC] is experiencing a large surge of euphoria, driving it near $80K.

Though the market hasn’t hit an overextended part but, its high-risk nature might deter some buyers.

Famend investor Robert Kiyosaki has weighed in, emphasizing the necessity to keep away from wishful considering and concentrate on sound investing ideas, whatever the present worth.

On the flip aspect, one other well-known analyst has expressed warning as Bitcoin approaches a historic vary.

With these excessive situations, AMBCrypto has analyzed the present market tendencies and concluded {that a} hidden catalyst is critical to maintain Bitcoin from dealing with a possible pullback.

The market is primed for volatility

Within the final presidential election, it took two months of inconsistent worth motion to push Bitcoin to a $40K worth for the primary time, with noticeable pullbacks alongside the best way.

Nonetheless, this time, whereas the surge has been extra in line with inexperienced candlesticks over the previous 5 days, there’s way more at stake, contemplating the present worth Bitcoin holds.

So, with the value nearing $80K, the stakes are greater, and any pullback might set off important market reactions.

One issue fueling this uncertainty is the excessive leverage ratio in perpetual trades, as highlighted by one other AMBCrypto report, making BTC susceptible to sudden swings.

Supply : HyblockCapital

Presently, a lot of the volatility is pushed by exercise on main buying and selling platforms like Binance and OKX.

The share of merchants taking lengthy positions has considerably declined, whereas quick positions are seeing a powerful resurgence – creating situations ripe for a possible long-squeeze.

This setup resembles the late October interval when BTC surged to $72K, solely to fall again to $67K inside every week, as seen within the chart above.

Moreover, through the election buildup, a surge of buyers went lengthy on Bitcoin, sparking record-breaking quick liquidations of round $371 million.

Nonetheless, these lengthy positions may very well be in danger if FOMO fades, shopping for curiosity weakens, and the market overheats – particularly because the RSI hovers in overbought territory. Due to this fact,

Bitcoin wants a catalyst to soak up the stress

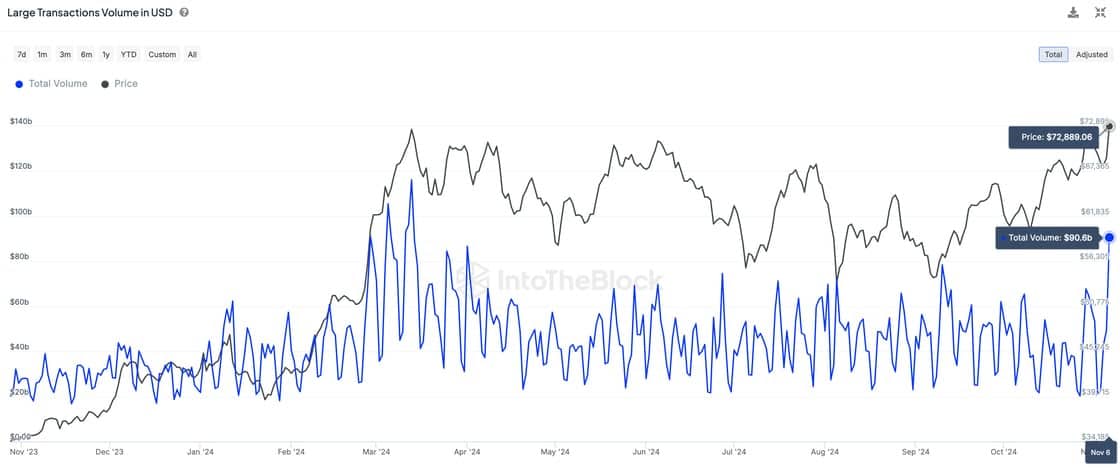

Following the election, massive Bitcoin transactions surged, reaching a peak of $90 billion, signaling a pointy uptick in whale exercise. Their perspective on the present worth as the appropriate entry level is extra essential than ever.

Supply : IntoTheBlock

AMBCrypto’s chart evaluation reveals that the present accumulation by whales mirrors the March peak when BTC hit its ATH of $73K.

Nonetheless, that peak was adopted by a pullback, partly pushed by swings within the by-product markets, as mentioned earlier.

Due to this fact, for Bitcoin to remain above $80K, constant help from massive HODLers is important. That is one thing to observe carefully within the coming days.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

General, Bitcoin stays bullish, with a possible short-term surge above $80K.

However with rising volatility and rising quick positions, whales’ regular accumulation is essential to absorbing the stress and sustaining a risk-free market sentiment – particularly with the stakes so excessive.