Picture supply: Getty Photographs

After a buying and selling replace revealed a 20% drop in Q3 income, ITV (LSE: ITV) shares fell 15% earlier this week. Is {that a} trigger for concern — or does the 8% dividend yield nonetheless make the shares engaging?

I’m taking a more in-depth look.

In a buying and selling replace launched Thursday (7 November), the broadcaster reported various monetary outcomes for the primary 9 months of 2024. Its ITV Studios arm noticed a 20% drop in income, impacted by the US writers’ and actors’ strike.

Group income was down 8% at £2.74bn in opposition to £2.97bn in 2023, with a decline in ITV Studios income offsetting development in whole promoting income (TAR).

Nevertheless, the broadcaster says it’s nonetheless on observe to realize document income by year-end. Chief govt Carolyn McCall stated: “Our cost-saving programme is progressing effectively and right this moment we’re asserting additional price financial savings along with the beforehand introduced £40 million of incremental price financial savings by restructuring, improved effectivity and simplifying methods of working.“

In contrast, its ITVX streaming platform displayed stable development, with streaming hours rising 14% and digital promoting income growing 15%. To additional improve profitability, the corporate has additionally outlined a further £20m in price financial savings.

Enterprise developments

ITV Studios not too long ago acquired a majority stake in distinguished UK drama producer Eagle Eye and secured the choice to adapt Philippa Gregory’s novel Wideacre for tv. Each developments ought to be good for enterprise.

It additionally lined up a variety of latest dramas for ITVX. Examples embody the thriller Enjoying Good, with James Norton, plus the present crime drama Joan, and real-life thriller Till I Kill You.

Lengthy-time favourites like Dancing on Ice, Superstar Huge Brother and Deal or No Deal proceed to enchantment to broad audiences throughout its most important ITV1 channel and ITVX

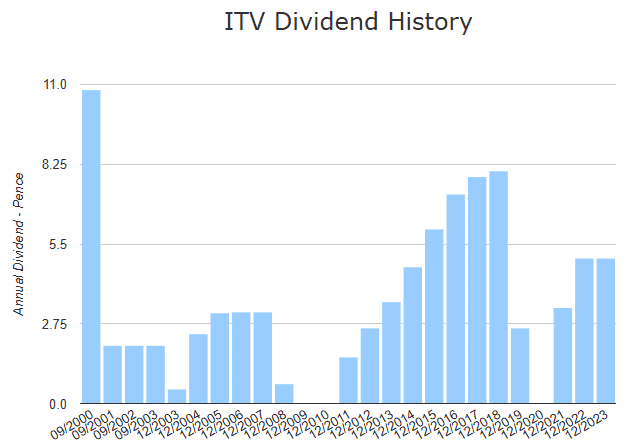

Dividend observe document

One in all my most important issues relating to ITV when it comes to dividends is a sketchy cost observe document. When the financial system is nice — like between 2011 and 2018 — dividends are dependable. However when it’s not, the broadcaster is fast to make cuts and reductions.

Following the 2008 disaster, dividends have been lower fully for 2 years and in 2020 they have been lower once more. Whereas this doesn’t negate the respectable returns delivered in different years, it’s not precisely dependable when it comes to passive earnings.

Dividend cuts can scare off traders and harm the share worth, which might result in losses.

To keep away from cuts, it should efficiently seize streaming audiences and generate enough income from digital content material. This might be difficult, because it faces fierce competitors from main gamers like Netflix, Amazon Prime and Disney+.

My verdict

The autumn in income’s a priority however I feel a number of elements make ITV nonetheless seem engaging. Not least of which is a low ahead price-to-earnings (P/E) ratio of seven.6. It additionally has an honest internet revenue margin of 12.11% and a low debt-to-equity ratio of 39.5%.

Although my present shares are a bit down right this moment, I plan to reap the benefits of this chance and purchase extra whereas they’re low cost!