- Bitcoin retained momentum, regardless of dropping beneath $70,000

- Insights utilizing the MVRV indicator hinted at a potential surge

After a number of makes an attempt to push past $70,000, Bitcoin has as soon as once more slipped beneath this resistance degree. This highlighted the potential challenges in sustaining upward momentum on the charts.

On the time of writing, the cryptocurrency was buying and selling at $68,581, following a minor hike of 0.3% over the past 24 hours. What this implies is that extra market energy could also be required to solidify a long-term transfer above $70,000.

On the again of the crypto’s current value actions, CryptoQuant analyst CoinLupin shared insights into Bitcoin’s MVRV (Market Worth to Realized Worth) cycle. In accordance with the analyst,

“As we approach key November events, the MVRV ratio offers a traditional analytic approach to assess Bitcoin’s value amidst broader market factors.”

The MVRV ratio, with a worth of round 2 at press time, confirmed that Bitcoin’s market worth stood at twice its on-chain worth estimate. As a substitute of focusing solely on the MVRV’s present worth, CoinLupin emphasised the development by utilizing instruments just like the 365-day Bollinger Band for MVRV and the four-year common to raised perceive Bitcoin’s cycles.

Supply; CryptoQuant

On the time of writing, the MVRV ratio had moved above this annual common – An indication that whereas Bitcoin’s development continues to move north, there may be nonetheless potential for the next cycle peak.

Lengthy-Time period value indicators and future targets

In accordance with the analyst, the press time MVRV degree steered a sustained upward trajectory, however one that’s but to succeed in historic peak ranges. This sometimes falls between 3 and three.6 on the MVRV scale.

Assuming a steady Realized Worth, the analyst estimated that BTC would require a 43-77% hike to doubtlessly hit value targets between $95,000 and $120,000.

He additionally famous that rising market curiosity and shopping for momentum might push the Realized Worth increased – An indication that future peaks could exceed these ranges based mostly on prior cycles.

Past the MVRV, CoinLupin highlighted that Bitcoin has risen significantly over the previous 12 months. Nevertheless, it has solely not too long ago approached the MVRV indicator’s common degree, sustaining its constructive momentum.

Inspecting key Bitcoin metrics and market curiosity

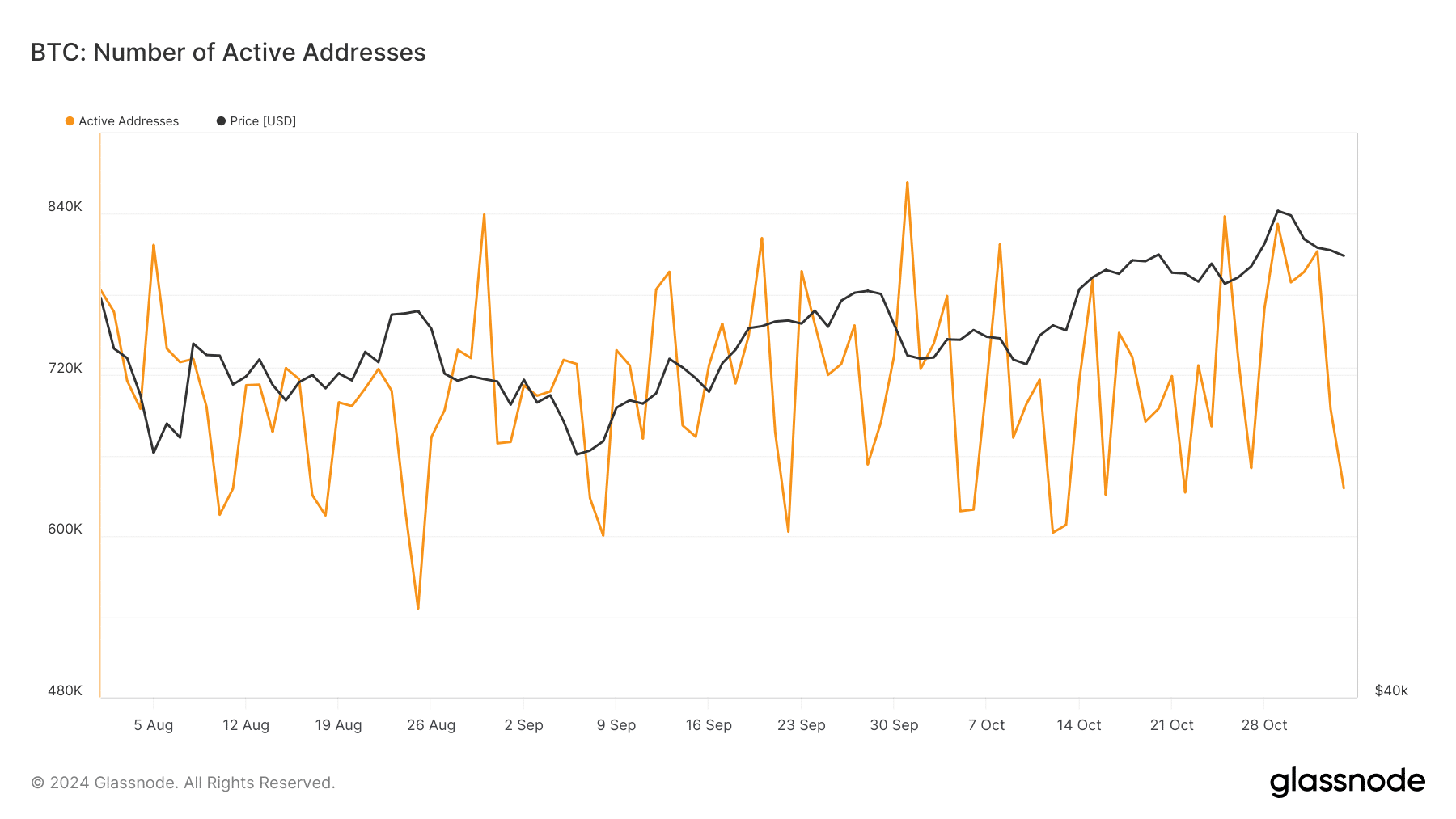

Bitcoin’s ongoing efficiency might be additional understood by a better take a look at its on-chain metrics. For instance – Retail curiosity, represented by lively handle information from Glassnode, revealed that this metric has been comparatively steady since August.

Supply: Glassnode

Regardless of Bitcoin’s current value strikes, the variety of lively addresses has remained inside a spread. It has fluctuated between 870,000 and 546,000 lively addresses over current months.

This regular exercise might point out that whereas there may be curiosity in BTC, important new retail engagement could also be restricted. The shortage of robust directional motion in lively addresses could indicate that whereas present customers stay engaged, a significant inflow of recent individuals has not but materialized. This may very well be essential for BTC to ascertain a extra strong upward trajectory.

Moreover, analyzing whale transactions—a key indicator of bigger holders’ actions—offers one other perspective on Bitcoin’s potential.

Knowledge from IntoTheBlock revealed that Bitcoin’s whale transactions not too long ago peaked at 24,070 on 29 October, earlier than declining to 13,300 transactions on 03 November.

Supply: IntoTheBlock

Such a drop in large-scale transactions alludes to a brief discount in whale exercise, one which could affect Bitcoin’s short-term momentum. A fall in whale transactions might sign that bigger holders are momentarily pausing their shopping for or promoting actions. This, in flip, could result in the cooling off of Bitcoin’s value motion.

If whale exercise climbs once more, it might present renewed assist for Bitcoin’s value. This can doubtlessly assist the asset go previous key resistance ranges.