- Quantity of huge transactions by whales and buyers surged by 7.85%, indicating a bullish outlook

- At press time, 55% of prime BTC merchants had been holding lengthy positions, whereas 45% held brief positions

Bitcoin (BTC), the world’s largest cryptocurrency by market cap, is poised for an upside rally after recording an 8% worth decline in current days.

Following a breakout from the descending channel sample on 28 October, BTC soared by greater than 8%. Nevertheless, the most-recent decline seems to be a worth correction – A constructive signal for the upcoming rally.

Bitcoin worth evaluation and key ranges

In accordance with AMBCrypto’s technical evaluation, the cryptocurrency appeared to be going through resistance from a declining trendline on the four-hour timeframe. If Bitcoin does register an upside rally, there’s a excessive likelihood that the asset may breach this aforementioned hurdle.

Supply: TradingView

If BTC breaches this trendline and closes a four-hour candle above $70,000, there’s a sturdy risk the asset may soar considerably. Probably to hit a brand new all-time excessive within the coming days.

Nevertheless, this bullish thesis will solely work if Bitcoin maintains assist above the $67,500-level. In any other case, it might fail.

On the time of writing, BTC appeared to be buying and selling above its 200 Exponential Shifting Common (EMA) on each the four-hour and every day timeframes, indicating an uptrend.

BTC’s bullish on-chain metrics

Taking a look at this bullish outlook, it appeared that whales and buyers have elevated their participation. In accordance with the on-chain analytics agency IntoTheBlock, BTC’s giant transaction quantity surged by 7.85% over the previous 24 hours. This might assist drive the asset’s worth greater.

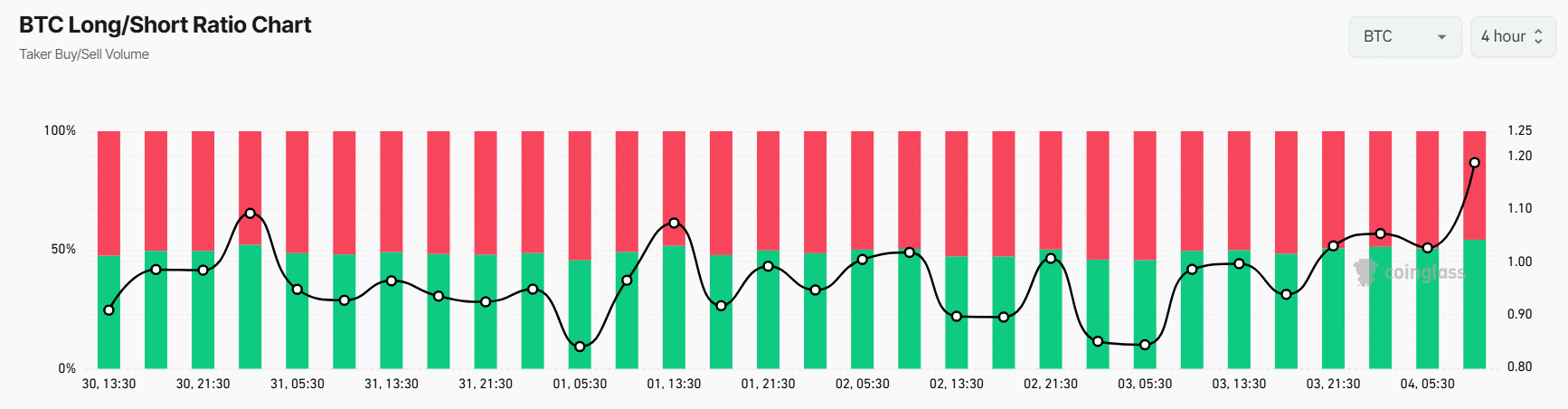

Moreover, BTC’s Lengthy/Quick ratio had a price of 1.20, underlining sturdy bullish sentiment amongst merchants. In the meantime, its Open Curiosity rose by 2.9% during the last 24 hours, indicating rising curiosity and the formation of latest positions from merchants.

Supply: Coinglass

Primarily based on an evaluation of Coinglass information, 55% of prime merchants held lengthy positions, whereas 45% held brief positions.

Worth efficiency

At press time, Bitcoin was valued at $69,100, after appreciating by practically 1.1% during the last 24 hours. Throughout the identical interval, its buying and selling quantity skyrocketed by 45%, indicating heightened participation from merchants and buyers.