Picture supply: Getty Photos

The market didn’t like a buying and selling replace from medical gadgets producer Smith & Nephew (LSE: SN) launched this morning (31 October). As I write on Thursday afternoon, Smith & Nephew shares are down 12% from the closing worth yesterday. That makes it the most important faller of any FTSE 100 share in morning buying and selling.

Does this supply me a doable shopping for alternative as a long-term investor?

Disappointing replace

In its third-quarter buying and selling replace, the corporate reported 4% development in comparison with the identical interval final 12 months.

That may sound good and definitely not a cause for Smith & Nephew shares to fall. But it surely upset buyers.

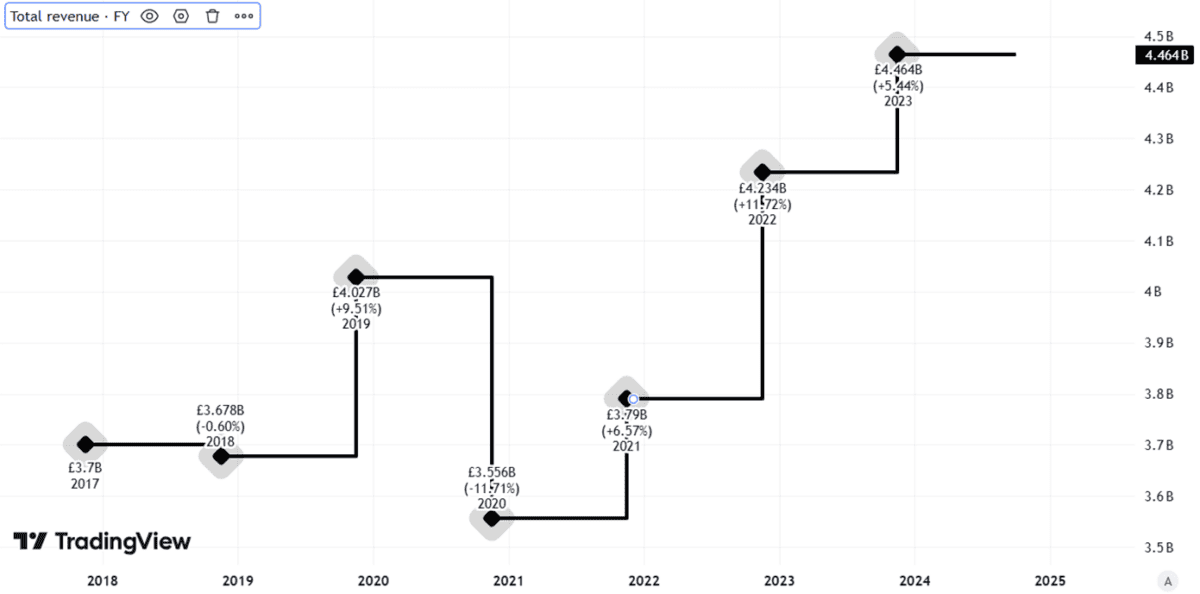

The corporate mentioned that, “China was impacted by worse than expected headwinds across our surgical businesses”. It additionally lowered its full-year underlying income development expectation to round 4.5%, versus 5-6% beforehand.

Created utilizing TradingView

Once more, that may not sound like an enormous change.

However keep in mind that we’re already over three-quarters of the best way by means of the 12 months, so altering full-year expectations at this level suggests there could also be sharply weaker efficiency nonetheless to return within the present quarter.

Will issues get higher or worse?

I’m not persuaded administration has actually bought a deal with on the way to get the enterprise on monitor to hit its formidable development objectives.

Within the assertion, the corporate mentioned, “Whereas the revised outlook displays the headwinds throughout our surgical companies in China, we stay satisfied that our transformation to a better development firm… is on the fitting course“.

In my expertise, pinning a gross sales warning on a single a part of the enterprise usually foreshadows extra widespread challenges. Within the quarter, for instance, the orthopaedics income grew 2.4%. That strikes me as completely respectable, however it’s not the kind of development I’d get enthusiastic about if I needed to put money into a “higher growth company”.

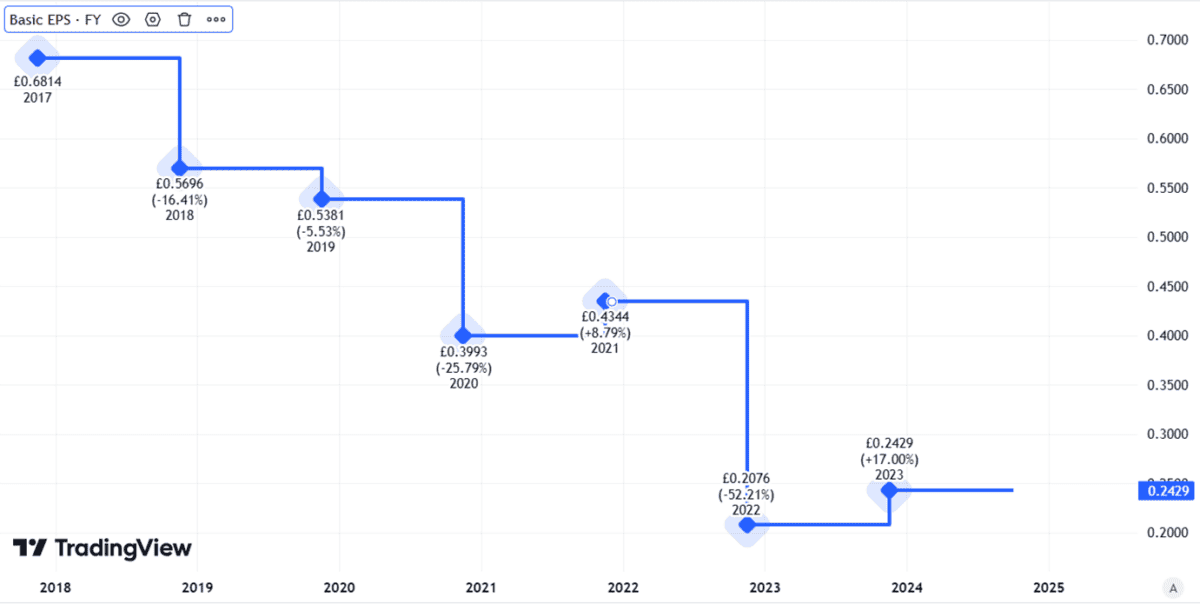

Smith & Nephew’s price-to-earnings ratio of 17 doesn’t appear low-cost to me. If the corporate points additional unhealthy information or underperforms expectations within the fourth quarter or subsequent 12 months, I feel it may benefit a decrease valuation. Earnings per share have declined markedly in recent times.

Created utilizing TradingView

The enterprise does have strengths: a big, resilient goal buyer market, a longtime base of patrons, and proprietary know-how.

Even simply bringing earnings per share again to the place they stood a couple of years in the past may assist justify a better worth for Smith & Nephew shares.

No rush to purchase

However, because the buying and selling assertion underlined, there may be work to be achieved.

My concern is that there’s extra of it to be achieved that administration might at present realise. Having set itself lofty development objectives in recent times, I stay unconvinced as as to if the enterprise can ship them.

I’m thus in no rush to purchase the shares and can as an alternative wait to see how the enterprise performs in coming months and past.